Property Taxes Ohio County Wv

Search Layers Basemap Tools Clear Help Imagery. Ohio County Assessor 1500 Chapline Street Wheeling WV 26003 304-234-3626 Home Online Filing Contact Us Search Property Records GIS Map Important Dates Forms Estimate Taxes General Info FAQ Levy Rates Links.

Tucker County West Virginia Wikipedia

Tucker County West Virginia Wikipedia

The Tax Commissioner must issue a ruling by the end of February of the calendar tax year.

Property taxes ohio county wv. The Ohio County Assessors office is pleased to make assessment data available online and free of charge. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Counties in West Virginia collect an average of 049 of a propertys assesed fair market value as property tax per year.

When a Ohio County WV tax lien is issued for unpaid past due balances Ohio County WV creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. For example some Recorders offices have marriage and birth records available online. Property Tax Bills Property tax bills commonly called tickets are issued on or after July 15 of the property tax year by county sheriffs for all property except public utility operating property.

Click Here for Tax Search. Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. Please allow 2-3 business days for online payments to be processed by your countys tax office.

Online Tax Payment --- Select a County --- Barbour Berkeley Boone Braxton Brooke Cabell Calhoun Clay Doddridge Fayette Gilmer Grant Greenbrier Hampshire Hancock Hardy Harrison Jackson Jefferson Kanawha Lewis Lincoln Logan Marion Marshall Mason McDowell Mercer Mineral Mingo Monongalia Monroe Morgan Nicholas Ohio Pendleton Pleasants Pocahontas. Located in West Virginias Northern Panhandle Ohio County is a progressive thriving community of business industry families and individuals. A new interactive GIS portal is coming soon.

330 287-5454 Office Hours. Tax information is provided by the Ohio County Assessors Office. Ohio County Tax Office.

Pay Personal Property Taxes Online. Interested in a tax lien in Ohio County WV. The Ohio County Assessors Office located in Wheeling West Virginia determines the value of all taxable property in Ohio County WV.

The median property tax in West Virginia is 46400 per year for a home worth the median value of 9450000. Click here for Property. Tax Maps Tax maps are currently down for maintenance.

West Virginia Department of Transportation. Wooster Ohio 44691 Bus. Processing times may vary for each County.

West Virginia Property Viewer. This is accomplished by redemption of property and by offering the parcels at public auction. The Ohio County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Ohio County and may establish the amount of tax due on that property based on the fair market value appraisal.

Ohio County Assessors Office Services. M-F 800am - 430pm. Click Here for Tax Search.

Renew My Vehicle Registration. Koch Wayne County Treasurer 428 West Liberty St. As of February 15 Ohio County WV shows 15 tax liens.

Click here for Property Search. No warranties expressed or implied are provided for the data herein its use or interpretation. The Ohio County Commission is comprised of three elected commissioners and five independently elected county officials that work together to oversee the fiscal affairs record keeping annual budget levying of real estate taxes enforcement of state code and emergency response procedures for the residents of Ohio County.

Ohio County Tax Office. Ohio County Sheriffs Tax Office 1500 Chapline St. The Public Records Online Directory is a Portal to official state web sites and those Tax Assessors and Recorders offices that have developed web sites for the retrieval of available public records over the Internet.

Tax information is provided by the Ohio County Assessors Office. The County Collections Divisions primary function is to return tax-delinquent lands to private ownership so the revenues derived can be allocated to the appropriate counties in West Virginia. How does a tax lien sale work.

Also a kiosk is now available at the. Box 188 Wheeling WV 26003 304 234-3688. Public utility property tax bills are issued by the State Auditor in June of the property tax year.

The office makes every effort to produce the most accurate information possible.

Mason County West Virginia Wikipedia

Mason County West Virginia Wikipedia

Logan Wv West Virginia History West Virginia Wyoming County

Logan Wv West Virginia History West Virginia Wyoming County

I Found The Coolest Site To Use For Land Records In West Virginia West Virginia Dna Research Mason County

I Found The Coolest Site To Use For Land Records In West Virginia West Virginia Dna Research Mason County

List Of Magisterial Districts In West Virginia Wikipedia

List Of Magisterial Districts In West Virginia Wikipedia

1905 Foot Bridge Gassaway Wv Baltimore Ohio Postcard West Virginia History West Virginia Appalachian People

1905 Foot Bridge Gassaway Wv Baltimore Ohio Postcard West Virginia History West Virginia Appalachian People

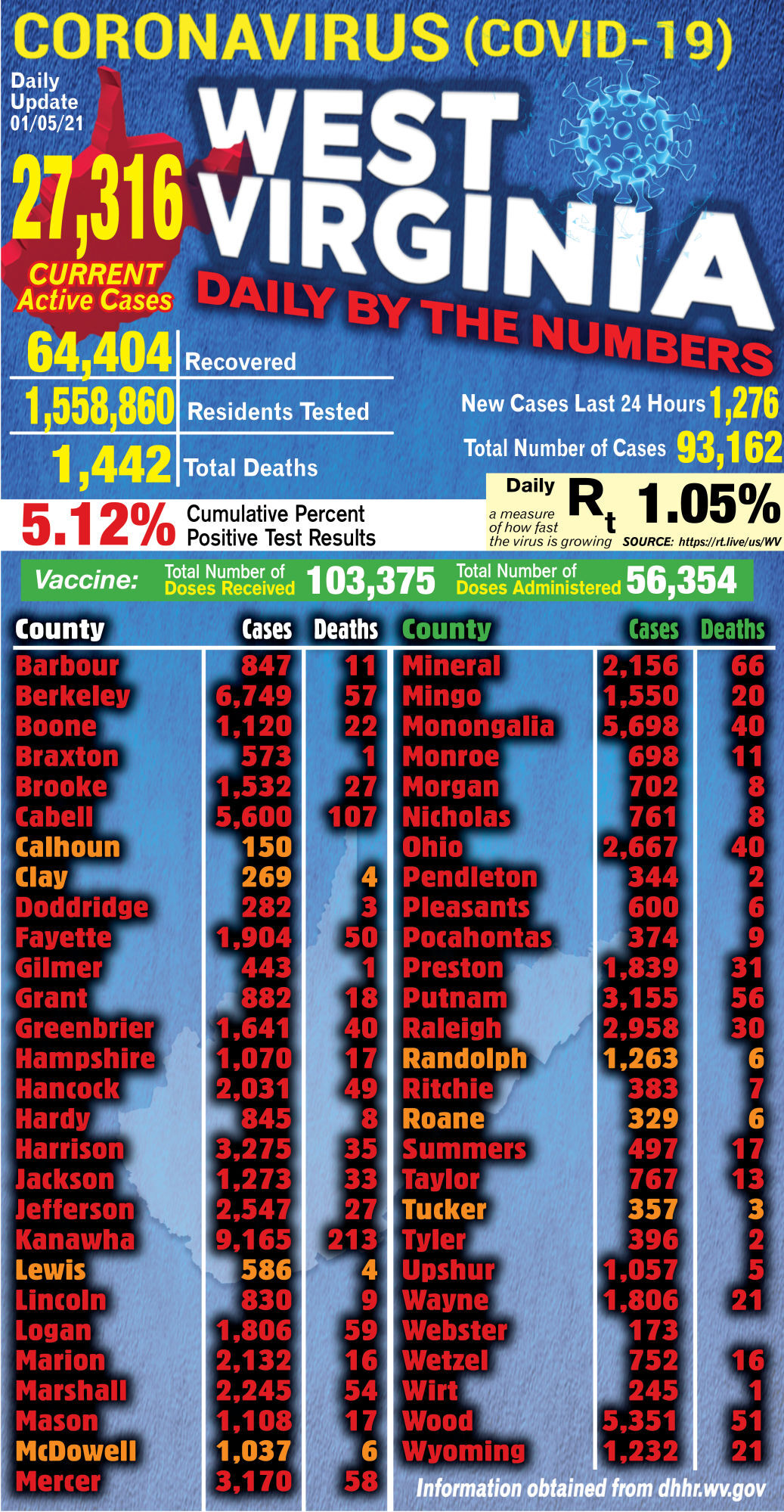

46 New Deaths West Virginia S Covid 19 Deaths Per Capita Now Worse Than Kentucky Virginia 12 Other States Mountain State Ohio Have About Same Rate Wv News Wvnews Com

46 New Deaths West Virginia S Covid 19 Deaths Per Capita Now Worse Than Kentucky Virginia 12 Other States Mountain State Ohio Have About Same Rate Wv News Wvnews Com

Ohio County Sheriff Tax Office

Ohio County Sheriff Tax Office

Preble County Church Plays Role In Underground Railroad Preble County Church Underground Railroad

Preble County Church Plays Role In Underground Railroad Preble County Church Underground Railroad

Pin By Rebecca Bauer On Waterfalls Within A Day S Drive Buckeye Ohio Youngstown

Pin By Rebecca Bauer On Waterfalls Within A Day S Drive Buckeye Ohio Youngstown

92 00 Acres In Greenbrier County West Virginia In 2020 Property Smoot House

92 00 Acres In Greenbrier County West Virginia In 2020 Property Smoot House

1031 Tax Free Exchange Gustancho Com Property Management Wealth Management Exchange

1031 Tax Free Exchange Gustancho Com Property Management Wealth Management Exchange

See At Least One Covered Bridge Covered Bridges Country Roads Take Me Home West Virginia

See At Least One Covered Bridge Covered Bridges Country Roads Take Me Home West Virginia

Frederick County Virginia Early Map Virginia Map Virginia Harpers Ferry

Frederick County Virginia Early Map Virginia Map Virginia Harpers Ferry

Instagram Photo By Paul Missy Ashmore May 2 2016 At 11 39pm Utc Estate Homes Instagram Posts Photo

Instagram Photo By Paul Missy Ashmore May 2 2016 At 11 39pm Utc Estate Homes Instagram Posts Photo

Old Williamstown Bridge Ohio History Marietta Ohio Parkersburg

Old Williamstown Bridge Ohio History Marietta Ohio Parkersburg