Property Yield Vs Interest Rate

So if a property had an NOI of 80000 and we thought it should trade at an 8 cap rate then we could estimate its value at. A nominal yield is the coupon rate on a bond.

Amazing How Much House You Can Afford With Today S Historically Low Interest Rates If You V Mortgage Interest Rates Real Estate Infographic Real Estate Advice

Amazing How Much House You Can Afford With Today S Historically Low Interest Rates If You V Mortgage Interest Rates Real Estate Infographic Real Estate Advice

Gross yield does not consider expenseswhat it costs you to keep that property up and running including the interest you might be paying on loans and mortgages.

Property yield vs interest rate. Net rental yield 232. The Treasury Yield Curve. It gives them less to spend on the price of the home.

Interest Rates Go Up. While you own the bond the prevailing interest rate rises to 7 and then falls to 3. Property A has a value of 2000 with net operating income NOI of 100 in year one and a cap rate of 5.

Yield is also the. The nominal yield is the interest rate to par value that the bond issuer promises to pay bond purchasers. Yield is always higher than an interest.

As an equation this is expressed as Property Yield Net Property IncomeProperty Value X 100. Price and interest rates Lets say you buy a corporate bond with a coupon rate of 5. Interest rates are largely expressed in terms of percentage.

After all when you buy an investment property with the aim of collecting rental income dont you want to see how your rate of return rental yield stacks up against your cost of capital mortgage interest rate. Yield always includes the amount of interest gained. Secondly cap rates or yields are closer in economic terms to real interest rates than to nominal ones.

Similar to the discounted cash flow analysis conducted on equity and bond investments the income approach takes the net cash flow. THE RELATIONSHIP BETWEEN PROPERTY YIELDS AND INTEREST RATES. Treasury notes rise it means banks can raise the interest rates on new mortgages.

For a 700000 property with a. Interest is calculated independent of yield. Yield refers to the earnings from an investment over a specific period.

The prevailing interest rate is the same as the bonds coupon rate. Interest rates can drive property prices in a variety of ways. Yields generally tend to be higher in less expensive areas.

To understand this consider the following three points. The cap rate allows us to value a property based on a single years NOI. Contrary to common belief however our analysis only shows a modest correlation between property yields and interest rates.

Net rental yield Annual rental income - annual expenses total property cost x 100. Who wants a 526 yield when. Net rental yield 26000 - 4000 950000 x 100.

But they go on to add that. So back to the original question whats the difference between the cap rate versus the discount rate. Homebuyers will have to pay more each month for the same loan.

Usually when interest rates rise housing prices eventually fall. Consider a new corporate bond that becomes available on the market in a given year with a coupon or interest rate of 4 called Bond A. Yield can be expressed as percentage and as amounts of currency as well.

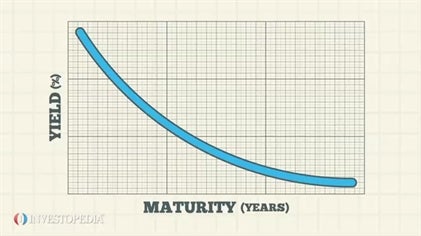

In the United States the Treasury yield curve or term structure is the first mover of all domestic interest rates and an influential factor in setting global rates. Youve probably heard this before if a propertys rental yield sufficiently exceeds the interest rate then it is likely a good investment. SOME THOUGHTS Cautiousness over propertys vulnerability in a period of rising interest rates stems from the perceived risk of rising property yields.

Cap Rate vs Discount Rate. A good Property Yield percentage is a good indicator of the REITs ability to generate income in relation the value of property that it holds. As interest rates on US.

Keeping an eye on the property market can help you understand the implications of a rise or fall in prices on your rental yield. Prevailing interest rates rise during the next 12 months and one year later the same company issues a new bond called Bond B but this one has a yield of 45. In other words the cap rate is a real rate of interest and therefore directly related to the rate of interest provided by banks less expected inflation.

On the surface this seems to make sense. It includes the investor earning such as interest and dividends received by holding particular investments. This rate is fixed.

Real estate typically provides a higher real rate of interest than do banks because of the risks and costs associated with owning real estate. Youre left with a rate of return or net yield when you subtract these expenses. Property Yield will give you an indication of the earning power of the portfolio of properties a REIT holds.

Gross rental yield is your annual rent income divided by your propertys value while the net rental yield takes into account the total property expenses including stamp duty legal fees loan fees building inspections repairs and maintenance management fees insurance costs and other rates and charges. Interest is always lower than yield. If current interest rates were to rise where newly issued bonds were offering a yield of 10 then the zero-coupon bond yielding 526 would be much less attractive.

Understanding The Relationship Between Interest Rates And Bond Prices

Understanding The Relationship Between Interest Rates And Bond Prices

What Is Interest Rate Risk Mint2save What Is Interest Rate Interest Rates Finance Blog

What Is Interest Rate Risk Mint2save What Is Interest Rate Interest Rates Finance Blog

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png) Duration And Convexity To Measure Bond Risk

Duration And Convexity To Measure Bond Risk

Pin By S Webster On Economy Markets And Miscellaneous Points Of Interest Bond Portfolio Finance

Pin By S Webster On Economy Markets And Miscellaneous Points Of Interest Bond Portfolio Finance

In Australia There Are Two Main Types Of Property Ownership Arrangements Joint Tenants And Tenants In Common We Compare Th Tenants Joint Investment Property

In Australia There Are Two Main Types Of Property Ownership Arrangements Joint Tenants And Tenants In Common We Compare Th Tenants Joint Investment Property

Annual Percentage Yield Apy Is A Financial Definition You Need To Know You Can Make Your Money Work For You Debt Relief Programs Debt Relief Smart Finances

Annual Percentage Yield Apy Is A Financial Definition You Need To Know You Can Make Your Money Work For You Debt Relief Programs Debt Relief Smart Finances

:max_bytes(150000):strip_icc()/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png) Corporate Bonds An Introduction To Credit Risk

Corporate Bonds An Introduction To Credit Risk

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments A Interest Rates Financial Wealth Developed Economy

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments A Interest Rates Financial Wealth Developed Economy

The Difference Your Interest Rate Makes Infographic Mortgage Interest Rates Real Estate Infographic Real Estate Advice

The Difference Your Interest Rate Makes Infographic Mortgage Interest Rates Real Estate Infographic Real Estate Advice

Https Www Creconsult Net Wp Content Uploads 2019 10 Capture Jpg Will Cap Rates Chase Interest Rates L Commercial Real Estate Interest Rates Low Interest Rate

Https Www Creconsult Net Wp Content Uploads 2019 10 Capture Jpg Will Cap Rates Chase Interest Rates L Commercial Real Estate Interest Rates Low Interest Rate

:max_bytes(150000):strip_icc()/GettyImages-481269242-bc3864796b5043c8a4f082b02118584b.jpg) Yield Vs Interest Rate What S The Difference

Yield Vs Interest Rate What S The Difference

/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png) Corporate Bonds An Introduction To Credit Risk

Corporate Bonds An Introduction To Credit Risk

When You Want The Best Mortgage Rate For Your Situation Let S Connect And Figure Out The Right Strategy Mortgage Rates Mortgage Loans Mortgage

When You Want The Best Mortgage Rate For Your Situation Let S Connect And Figure Out The Right Strategy Mortgage Rates Mortgage Loans Mortgage

The Decline In Long Term Interest Rates Needle Felted Owl Felt Owl Corporate Business Card Design

The Decline In Long Term Interest Rates Needle Felted Owl Felt Owl Corporate Business Card Design

7 Key Differences Between Residential And Commercial Properties Commercial Property Property Residential

7 Key Differences Between Residential And Commercial Properties Commercial Property Property Residential

Term Structure Of Interest Rates Theories Bbalectures Business Articles Term Long T

Term Structure Of Interest Rates Theories Bbalectures Business Articles Term Long T

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)