What Does Home Insurance Premium Mean

Every homeowners insurance policy has a liability limit which. That means everything from clothes to electronics to portable appliances are insured against covered damages or theft.

Interesting Facts During Home Purchase Insurance Home Fun Facts Home Insurance Facts

Interesting Facts During Home Purchase Insurance Home Fun Facts Home Insurance Facts

The premium in an insurance policy is the cost that the policy holder pays to obtain the guaranteed benefits offered by the insurer.

What does home insurance premium mean. The basic job of a homeowners policy is to protect your home and possessions from certain perils such as wind hail fire damage and theft. There are a number of factors that impact your premium namely your level of coverage deductible amount home characteristics and credit score. When it comes to the FHA borrowers must pay a mortgage insurance premium or MIP on the home loan.

Your homeowners insurance premium is the amount of money you pay every year to keep your insurance policy active. Insurance premiums will vary depending on the type of coverage you are seeking. A premium is the amount you pay an insurer for insurance cover.

They obtain a mortgage to buy the home but because they dont have a 20 down payment the lender requires them to obtain mortgage insurance. It reflects what the insurer believes is the likelihood you will make a claim. In a nutshell an insurance premium is the payment or installment you agree to pay a company in order to have insurance.

Most people pay their premium on a monthly basis but others choose to pay the. A reinsurance premium is an amount of money that an insurance company pays to a reinsurance company to receive a specific amount of reinsurance coverage over a specified period of time. The higher the deductible on an insurance contract the lower the monthly or annual premium on a homeowners insurance policy.

To bear these risks insurance companies charge an amount called premiums. Important definitions for homeowners. You enter into a contract with an insurance company that guarantees payment in case of damage or loss and for this you agree to pay them a certain smaller amount of money.

A qualified mortgage insurance premium is a payment to insure a homeowners mortgage payments. Personal property insurance or personal property coverage is a component of your homeowners insurance policy that reimburses you if your personal belongings are burglarized or damaged by a covered peril. It also includes an insurers business costs and may also reflect the benefits of any discounts or bonuses the insurer may offer to you.

Premiums are determined by various factors related to the product and the individual group or business being insured. Depending on the insurer and the amount of risk involved in the loan the average monthly fee is based on an annual rate. An insurance premium is the amount of money an individual or business must pay for an insurance policy.

Monthly mortgage insurance fees or premiums are based on the loan amount. Mortgage insurance is paid if you as a borrower were to make a down payment of less than 20 percent on your home loan. It is paid by you but is used to protect the lender from losses if you were to default on the loan.

The insurance premium is the amount that the insured person pays regularly to pay for his own risks. Advice from insurance experts. An insurance premium is the amount you pay to your insurer regularly to keep a policy in force.

Lets say John and Jane Doe buy a house. Your insurance history where you live and other factors are used as part of the calculation to determine the insurance premium price. You may be able to pay premiums monthly quarterly every six months or annually depending on your insurance company and your specific policy.

In insurance contracts risk is transferred from the insured to the insurance company. Understand the basics of homeowners insurance. Health insurance life insurance auto insurance disability insurance homeowners.

The insurance premium is the amount of money paid to the insurance company for the insurance policy you are purchasing. Insurance companies purchase reinsurance to hedge their risks. Your homeowners insurance premium is the amount you pay to keep your home insurance policy active.

An insurance premium is a monthly or annual payment made to an insurance company that keeps your policy active. Insurance premiums are paid for policies that cover healthcare auto home and life. How Does a Qualified Mortgage Insurance Premium Work.

Common Health Insurance Terms Health Insurance Infographic Health Insurance Life Insurance Policy

Common Health Insurance Terms Health Insurance Infographic Health Insurance Life Insurance Policy

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Cov Homeowners Guide Home Insurance Homeowner

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Cov Homeowners Guide Home Insurance Homeowner

Infographic The Difference Between Home Insurance And Home Warranties Your Home Should Have Both Home Insurance Home Warranty Home Insurance Quotes

Infographic The Difference Between Home Insurance And Home Warranties Your Home Should Have Both Home Insurance Home Warranty Home Insurance Quotes

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Home Insurance

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Home Insurance

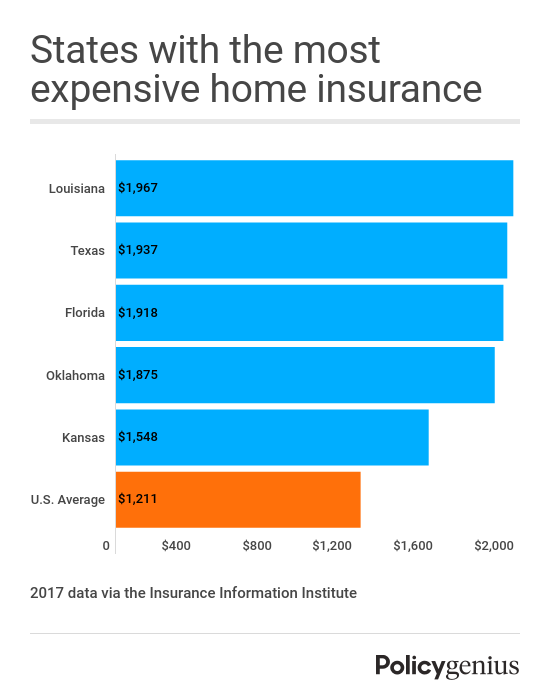

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

Life Insurance Facts Lifeinsurancetips Life Insurance Facts Homeowners Insurance Life Insurance Policy

Life Insurance Facts Lifeinsurancetips Life Insurance Facts Homeowners Insurance Life Insurance Policy

If You Re Going To Be A Landlord It S A Good Idea To Learn About Landlord Insurance Here Is Some Inf Landlord Insurance Being A Landlord Commercial Insurance

If You Re Going To Be A Landlord It S A Good Idea To Learn About Landlord Insurance Here Is Some Inf Landlord Insurance Being A Landlord Commercial Insurance

How Much Is Renters Insurance Compared To What The Average American Spends On Shoes Soda Phones Home Insurance Quotes Renters Insurance Homeowners Insurance

How Much Is Renters Insurance Compared To What The Average American Spends On Shoes Soda Phones Home Insurance Quotes Renters Insurance Homeowners Insurance

5 Different Types Of Insurance Policies Coverage You Need Mint Homeowners Insurance Coverage Insurance Benefits Car Insurance

5 Different Types Of Insurance Policies Coverage You Need Mint Homeowners Insurance Coverage Insurance Benefits Car Insurance

Here Are The Five Most Important Things To Know As You Compare Prices And Coverage Homeinsurance Home Insurance Quotes Home Insurance Renters Insurance

Here Are The Five Most Important Things To Know As You Compare Prices And Coverage Homeinsurance Home Insurance Quotes Home Insurance Renters Insurance

Average Cost Of Homeowners Insurance 2019 Valuepenguin Homeowners Insurance Home Insurance Home Insurance Quotes

Average Cost Of Homeowners Insurance 2019 Valuepenguin Homeowners Insurance Home Insurance Home Insurance Quotes

Understanding Your Home Insurance Declarations Page Policygenius

Understanding Your Home Insurance Declarations Page Policygenius

10 Things You Should Know Before Embarking On E Renters Home Insurance E Renters Home Insu Renters Insurance Renters Insurance Quotes Home And Auto Insurance

10 Things You Should Know Before Embarking On E Renters Home Insurance E Renters Home Insu Renters Insurance Renters Insurance Quotes Home And Auto Insurance

What Does Homeowners Insurance Cover Home Insurance Quotes Homeowners Insurance Homeowner

What Does Homeowners Insurance Cover Home Insurance Quotes Homeowners Insurance Homeowner

Homeowners Insurance Guide Home Insurance All About Insurance Homeowners Insurance

Homeowners Insurance Guide Home Insurance All About Insurance Homeowners Insurance

Need Home Insurance Buy Home Insurance Policy To Cover Your Precious House Its Cont Life Insurance Facts Homeowners Insurance Coverage Life Insurance Policy

Need Home Insurance Buy Home Insurance Policy To Cover Your Precious House Its Cont Life Insurance Facts Homeowners Insurance Coverage Life Insurance Policy

60 Elegant Home Insurance Quotes Over 55 Home Insurance Quotes Home Insurance Insurance Quotes

60 Elegant Home Insurance Quotes Over 55 Home Insurance Quotes Home Insurance Insurance Quotes

Thinking Of Renting Here Are A Few Tips Renting Rentersinsurance Apartment Condo Insurance T Renters Insurance Landlord Insurance Homeowners Insurance

Thinking Of Renting Here Are A Few Tips Renting Rentersinsurance Apartment Condo Insurance T Renters Insurance Landlord Insurance Homeowners Insurance

What Is A Personal Umbrella Policy And When Do You Need It Allstate Umbrella Insurance Insurance Marketing Insurance License

What Is A Personal Umbrella Policy And When Do You Need It Allstate Umbrella Insurance Insurance Marketing Insurance License