Can A Judgement Against Me Affect My Spouse In Texas

A spouse can still have separate property in Texas and a separate bank account. Reviewed by Attorney Andrea Wimmer.

If My Spouse Owes Back Taxes Am I Liable It Depends Debt Com

If My Spouse Owes Back Taxes Am I Liable It Depends Debt Com

Consequently a judgment creditor of your spouse may be able to file a lien against real property that you jointly own with your spouse.

Can a judgement against me affect my spouse in texas. If the judgment against you did not include your spouse his wages cannot be garnished to pay the judgment. The lien could attach to only your spouses interest in the property The lien might not attach to the real property at all. However it is important to note that your interest in community property only extends to assets acquired while you and your spouse were married.

A judgment is a court order declaring that you do owe the debt and must repay it. If you ignore the lawsuit the court will enter an automatic judgment against you known as a default judgment. If both your name and your spouses name are listed on the loan the creditor can pursue collection of past-due amounts from your spouse.

If you cant pay on a debt a creditor person or company you owe might sue you to collect it. In Texas property in the possession of either spouse is presumed to be community property Tex. That lien could attach to the entire property.

0 found this answer helpful 0 lawyers agree. This also means that you and your spouse share liability on debts whether or not you signed for that debt or were included as a judgment debtor. Code 3003 a and therefore available to be executed upon to satisfy a judgment.

Personal property that can be seized in a judgment is the type of property that does not meet one of the numerous exemptions available under the Texas Constitution Texas Property Code 41001 Texas Property Code 42002 Texas Property Code 420021 the Texas Homestead Law and other applicable laws. A specific item of property might be exempt under some other rule of law such as the general personal property exemption statute. The tax implications of your spouses foreclosure may affect you if you file married filing jointly.

Property held as tenants by the entireties is generally protected from a claim against just one spouse. See section 14411 below. How can a judgment against me affect my spouse.

If you are sued and cant pay the creditor can get a judgment in court against you for the money you owe plus interest. It means their wage can be garnished provided that the debt collector managed to get a court judgment. And no without proof that you in fact have a valid marital claim to your spouses property it is unlikely that a claim under a lien could be sustained against it.

Therefore judgment creditors cannot access funds your spouse earned or owned prior to your marriage so long as. If you refuse to pay a debt or make no attempt to resolve your past-due balance your creditor may file a lawsuit to obtain a civil judgment against both you and your spouse. That said there are other issues to consider.

If you have your own separate bank account and a judgment is taken against your spouse that creditor can also garnish your separate account to pay for your spouses debt. I would consult a local attorney if you are concerned to get a full picture of what post-judgment collection activities look like. Current wages those wages that have not yet been paid cannot be taken to pay a judgment in Texas except to pay court ordered child support spousal maintenance federally guaranteed student loans in default or federal income taxes owed.

A long list of exempt property in Texas includes the homestead which is a house and up to ten 10 acres of land in an urban area or a house and up to one hundred 100 acres of land for a single person and two hundred 200 acres for a family in a rural area under Texas Property Code 41002. How all of this can affect your spouse if you are married largely depends on whether you reside in a common law or community property state and the judgment-debtor laws of your state. People who obtain money judgments are called judgment creditors and they can collect against the debtor the person against whom the judgment is docketed at any time provided the judgment is still enforceable.

Tenancy by entirety can protect your home from personal or business creditors who win judgments against you as a judgment cannot be placed against one spouse unless both are held jointly responsible. The mortgage lender issues a 1099-C Cancellation of Debt form to your spouse for the remaining. Of course even if you file an answer to the lawsuit you can still lose the case.

1 the assets are heled in a separate account in your spouses name only and 2 you or your spouse do not comingle or mixcombine these assets with community or your own separate property. And as said by my colleagues try to avoid the judgment by defending the suit. If the judgment is against both spouses for joint liability all community property and both spouses separate property can be reached.

Personal property up to 50000 for a single person and 100000 for a. Unfortunately for you the answer to both questions is YES. The lien could attach to the entire property even if you did not owe that debt.

However you cant be put in jail for failing to pay your creditors though child support is an exception. Written by the Upsolve Team. The creditor would need a judgment against both spouses.

Depending on your state and how you own the property there are several possibilities if a creditor gets a judgment against your spouse only. If you live in one of the community property states listed below your spouse will also be liable for repaying the debt youve made since youve been married. A judgment creditor of your spouse can garnish your joint accounts and.

This also means that you and your spouse share liability on debts whether or not you signed for that debt or were included as a judgment debtor. Before a person or a company to whom you owe money can win a judgment against you they must first file a lawsuit in court.

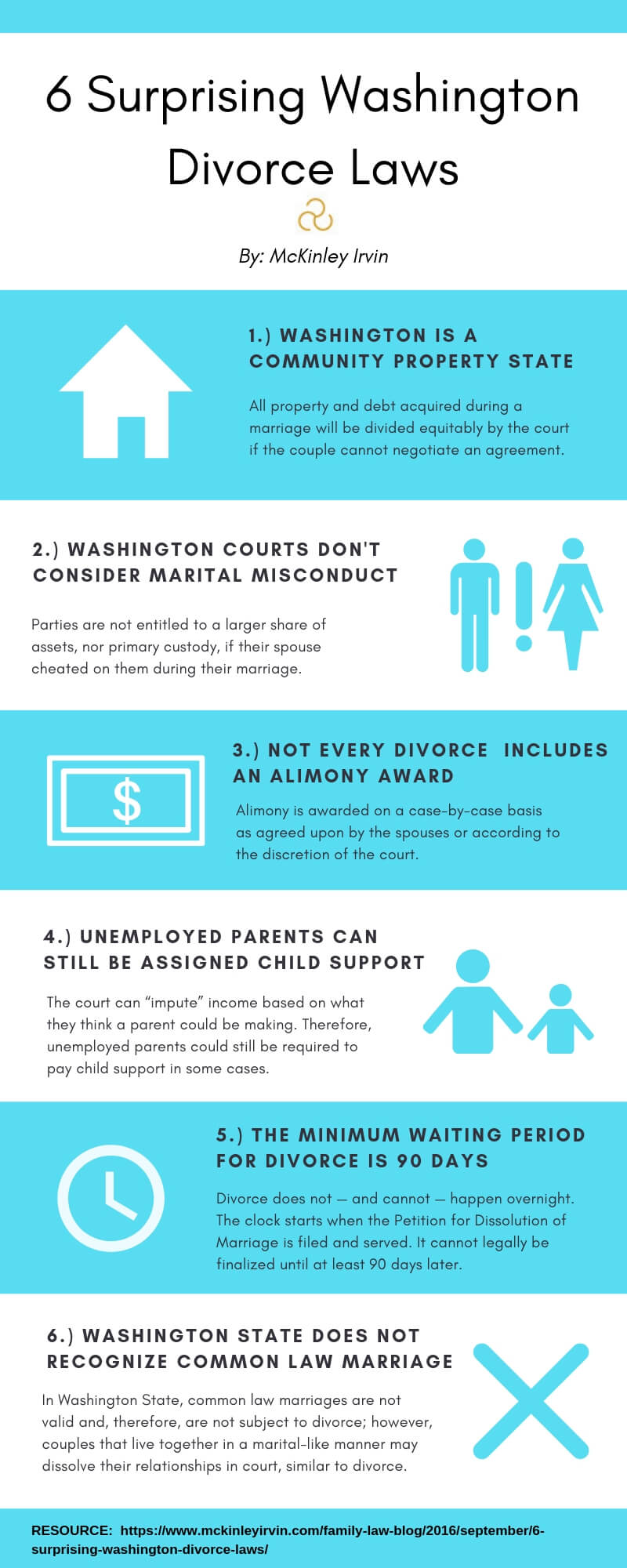

6 Surprising Washington Divorce Laws

6 Surprising Washington Divorce Laws

Can I Sue My Spouse S Lover Epstein Associates

Can I Sue My Spouse S Lover Epstein Associates

Am I Responsible For My Spouse S Student Loan Debt Student Loan Planner

Am I Responsible For My Spouse S Student Loan Debt Student Loan Planner

What If My Ex Will Not Sign The Final Decree In My Texas Divorce

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/bankruptcy-with-spouse-0160532018d5451e941225642a3127ff.jpg) Can I File Bankruptcy Without My Spouse

Can I File Bankruptcy Without My Spouse

Should I Put My Spouse On The Deed To My House Stock Leader

Should I Put My Spouse On The Deed To My House Stock Leader

Could My Spouse Be Liable For My Business Debts

Could My Spouse Be Liable For My Business Debts

The Judge Ruled Against Me In My Family Law Case Now What

What Happens If My Ex Spouse Refuses To Sign The Final Decree Of Divorce Revisited

Can I Ask My Spouse To Pay Attorney Fees In A Divorce Ramos Law Group Pllc

Can I Ask My Spouse To Pay Attorney Fees In A Divorce Ramos Law Group Pllc

Can My Spouse Leave Me Out Of His Will Raleigh Family Law

Can My Spouse Leave Me Out Of His Will Raleigh Family Law

Michigan Divorce Laws Faq Divorce In Michigan Cordell Cordell

Michigan Divorce Laws Faq Divorce In Michigan Cordell Cordell

I Only Gave It To My Spouse In Case I Got Sued Defense Flops Once Again In Soley Case

I Only Gave It To My Spouse In Case I Got Sued Defense Flops Once Again In Soley Case

How To Get A Divorce If My Spouse Won T Sign The Papers Quora

Can My Spouse Be Garnished For My Debt House Of Debt

Can My Spouse Be Garnished For My Debt House Of Debt

Will Bankruptcy Affect My Spouse S Debts And Credit National Bankruptcy Forum

Will Bankruptcy Affect My Spouse S Debts And Credit National Bankruptcy Forum

What If My Spouse Won T Sign Divorce Papers In California Furman Zavatsky

What If My Spouse Won T Sign Divorce Papers In California Furman Zavatsky

Filing Bankruptcy While Married Filing Bankruptcy Without Spouse

Filing Bankruptcy While Married Filing Bankruptcy Without Spouse

Can I Be Forced To Pay My Spouse S Divorce Attorney In California Divorce Attorney San Diego Renkin Associates

Can I Be Forced To Pay My Spouse S Divorce Attorney In California Divorce Attorney San Diego Renkin Associates