Capital Gains Tax Personal Possessions

If you have 50000 in long-term gains from the sale of one stock but 20000 in long-term losses from the sale of another then you may only be taxed on 30000 worth of long-term capital gains. This applies to any gain minus any expenses of selling the real estate.

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

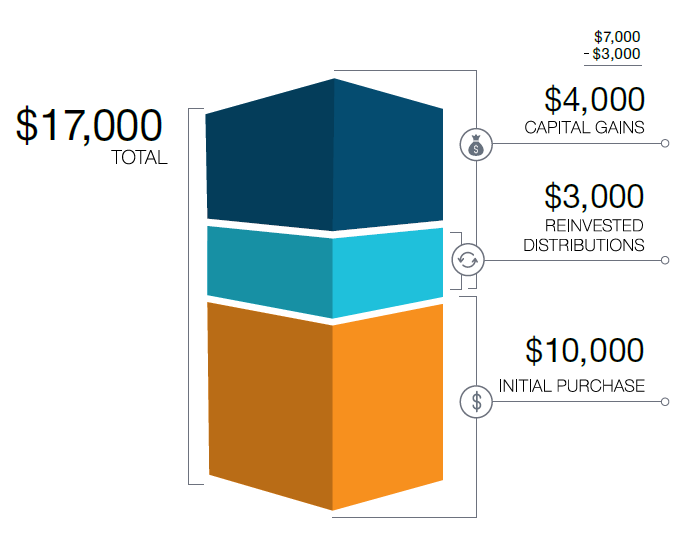

Capital gains taxes are the taxes you pay on profits from most investments including stocks bonds or mutual funds.

Capital gains tax personal possessions. That means you pay the same tax rates you pay on federal income tax. A capital asset includes inherited property or property someone owns for personal use or as an investment. The personal residence exemption One of the most common exemptions from capital gains tax involves personal residences.

Here are 10 facts that taxpayers should know about capital gains and losses. For example you purchase an antique. What is an asset.

Capital losses from investmentsbut not from the sale of personal property can be used to offset capital gains. When a person sells a capital asset the sale normally results in a capital gain or loss. When you sell an investment for more than you paid for it youll have to pay.

Long-term capital gains are gains on assets you hold for more than one year. Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed.

For investors this can be a stock or a bond but if you make a profit on selling a car that is also a capital gain. Long-term capital gains taxes apply to profits from selling something youve held for a year or more. To determine the amount of the gain you may exclude from income or for additional information on the tax rules that apply when you sell your home refer to Publication 523.

Property Tax in Delaware. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. Remember short-term capital gains from.

Capital gains tax is the tax imposed by the IRS on the sale of certain assets. You then subsequently sell the antique and pay. Lawmakers also agreed however on a new.

Thats offset however by a large capital gains tax exemption that lets most homeowners avoid tax on up to 250000 for single filers and 500000 for joint filers. You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital Assets. Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals.

Understanding Capital Gains Tax on a Real Estate Investment Property Real estate properties generate income for investors but taxes play a factor in returns. Just remember that you only report the sale of personal items where there is a capital gain Capital loss is not allowed on the sale of personal items. However for items that were held as investments you would be able to include both the capital gains or loss on such investment items.

Short-term capital gains are gains you make from selling assets that you hold for one year or less. Any gain from the sale of real estate in Delaware by an individual that lives in a different state is taxed at 675 percent. As part of its 1921 tax relief legislation the Republican majority on Capitol Hill agreed to significant rate reductions for the individual income tax.

By Ellen Chang Contributor Jan. It is paid by the person making the disposal. Delaware property taxes are among the lowest in the entire United States.

Capital Gains Tax On Personal Possessions Explained Capital Gains Tax is a tax on the profit made when selling or disposing of an asset that has increased in value. This is true even if theres no net capital gain subject to tax. You must first determine if you meet the holding period.

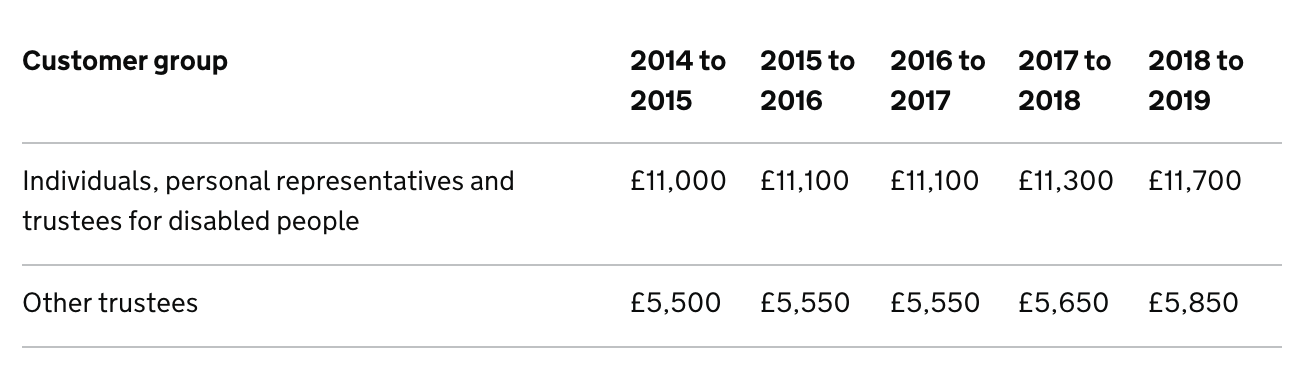

If you meet the requirements youre allowed to make up to 250000 for. Capital Gains Tax CGT is a tax charged on the capital gain profit made on the disposal of any asset. Possessions that are part of a set What you pay it on You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of a personal possession for 6000 or more.

If you can exclude all of the gain you dont need to report the sale on your tax return unless you received a Form 1099-S Proceeds From Real Estate Transactions. Theyre taxed like regular income. The gainprofit the difference between the price you paid for the asset and the price you sold it for is considered taxable income.

Sale Of Under Construction Property How To Calculate Capital Gains

Sale Of Under Construction Property How To Calculate Capital Gains

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

5 Things You Need To Know About Capital Gains Tax The Official Blog Of Taxslayer

5 Things You Need To Know About Capital Gains Tax The Official Blog Of Taxslayer

Sale Of Primary Residence Capital Gains Tax

Sale Of Primary Residence Capital Gains Tax

How Capital Gains Taxes Work In Utah Salt Lake City Ut

How Capital Gains Taxes Work In Utah Salt Lake City Ut

Ten Ways To Reduce Your Capital Gains Tax Liability Brewin Dolphin

Ten Ways To Reduce Your Capital Gains Tax Liability Brewin Dolphin

Tax Efficient Investing In Gold

Tax Efficient Investing In Gold

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Fafsa

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Fafsa

Squatting Your Way To Home Ownership Partners In Fire Home Ownership Personal Finance Bloggers Finance Bloggers

Squatting Your Way To Home Ownership Partners In Fire Home Ownership Personal Finance Bloggers Finance Bloggers

Understanding Capital Gains And Taxes On Mutual Funds T Rowe Price

Understanding Capital Gains And Taxes On Mutual Funds T Rowe Price

Investing In Gold Rules And Myth Gold Investments Investing Gold

Investing In Gold Rules And Myth Gold Investments Investing Gold

How Do Capital Gains Taxes Work On Real Estate Millionacres

How Do Capital Gains Taxes Work On Real Estate Millionacres

Owning Gold And Precious Metals Doesn T Have To Be Taxing

Owning Gold And Precious Metals Doesn T Have To Be Taxing

In Focus What Capital Gains Tax Mean For Property Owners Your Mortgage Australia

In Focus What Capital Gains Tax Mean For Property Owners Your Mortgage Australia

Does An Irrevocable Trust Pay Capital Gains Taxes Cincinnati Estate Planning

Does An Irrevocable Trust Pay Capital Gains Taxes Cincinnati Estate Planning

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium

How Much Is Capital Gains Tax Times Money Mentor

How Much Is Capital Gains Tax Times Money Mentor

:max_bytes(150000):strip_icc()/GettyImages-547124491-1--5756b2055f9b5892e8a8fd30.jpg)