Capital Gains Tax Uk Property Disposals Service Hmrc

HMRC Capital Gains Tax Payment for Property Disposals We have previously advised you that from 6 April 2020 UK residents must report and pay any Capital Gains Tax CGT due on gains on the disposal of a UK residential property to HMRC within 30 days of completion of the disposal. The relevant legislation can be found in schedule 2 of Finance Act 2019.

Https Accountantsbrighton Wordpress Com 2015 01 08 Every Tax Payer Be It A Sole Trader Brighton Accountant London Capital Gains Tax Tax Advisor Business Tax

Https Accountantsbrighton Wordpress Com 2015 01 08 Every Tax Payer Be It A Sole Trader Brighton Accountant London Capital Gains Tax Tax Advisor Business Tax

ICAEWs Tax Faculty highlights HMRCs new service for reporting and payment of capital gains tax CGT on disposals of UK residential property.

Capital gains tax uk property disposals service hmrc. CGT 30-day reporting requirement. The report must be made online via the UK Property Reporting Service. From April 2020 HMRC is changing the rules related to the submissions of information and payment of Capital Gains Tax CGT due on the disposals of a UK residential property other than a principle.

Any individual who is required to file a UK land return must complete and submit it to HMRC within 30 days of the disposal of the UK residential property. HMRC have produced a helpsheet to guide you if you think you may be temporarily non-UK resident. ICAEWs Tax Faculty provides guidance on the digital service for reporting disposals to HMRC.

Few UK residential property transactions are proceeding right now but where the date of disposal for capital gains tax CGT usually date of exchange on a sale but date of the transfer for a gift is on or after 6 April 2020 and CGT is due this must be reported to HMRC using a new online portal. The date that you get the keys. Detailed guidance on how to work our your tax if you sell UK land or property as a non-resident can be found on GOVUK.

However for such disposals or for non-residential UK disposals HMRC offers a real time capital gains tax service which allows individuals to pay the CGT on such disposals early if preferred. Since April 2020 any UK resident disposing of a UK residential property who has CGT to pay has to calculate report and pay the tax within 30 days of completion. The tax due must be reported and paid to HMRC within 30 days of completion of the disposal.

For all other capital gains nothing has changed. HMRC provides a service via GOVUK allowing you to send questions about capital gains tax if you are not resident in the UK. Instead companies simply declare the disposal in their accounts and UK corporation tax return in the usual way and pay any tax due as normal.

If you want to help HMRC trial the new report-and-pay service for CGT on property disposals theyre looking for people who want to test the service and offer feedback. Report and pay Capital Gains Tax on UK property. From April 2020 HMRC is changing the rules related to the submissions of information and payment of Capital Gains Tax CGT due on the disposals of a UK residential property other than a principle private residence.

Service availability and issues Updated 8. The test will take place online and youll need to be someone who is a linked to a trust that is considering disposing of a UK property on or after 6th April 2020. In practise the disposal date is the date of completion ie.

From 6 April 2020 UK residents who make a chargeable gain on the sale of UK residential property will need to disclose the sale and pay any Capital Gains Tax CGT to HMRC within 30 days of completion. More time for 30-day reporting of CGT. .

Here we answer some frequently asked questions. You must report and pay any tax due on UK residential property using a Capital Gains Tax on UK property account within 30 days of selling it. Penalties for late reports apply from 1 August 2020.

Service availability and issues. As above if you are already required to submit a self-assessment tax return the gain would also need to be reported on the tax return in the usual way. A new requirement for UK residents to report and pay capital gains tax CGT on disposals of UK residential property within 30 days was introduced in April 2020.

Non-residents have had an obligation since 2015. New rules mean that UK residents with capital gains tax to pay on the sale of UK residential property have to report and pay this to HMRC within 30 days. C Shutterstock iQoncept.

From 6 April 2020 a UK resident disposing of a residential property in the UK making a gain which is liable to CGT will have 30 calendar days from the date of completion to tell HMRC and pay any CGT owed. Report and pay Capital Gains Tax on UK property. You may have to pay interest and a penalty if you do.

UK companies do not have to declare the gain to HMRC through the Capital Gains Tax Service within 30 days of the sale or pay any tax that is due. 30-day reporting of CGT on disposals of UK residential property 7 April 2020. HMRC has produced a fact sheet on the CGT 30-days reporting and payment obligations for UK residents disposing of residential property and for non-UK residents disposing of UK land from 6 April 2020.

The changes for UK residents only apply to disposals of UK residential property. Self Assessment SA reporting continues in parallel to the 30 day rule. They will be able to do this using a new online service.

Gains on residential property disposals must now be declared on HMRCs online CGT disposal return and the tax paid using the Capital Gains Tax UK property disposal service within 30 days of completion.

Property Allowable Costs To Reduce Income Tax Optimise

Property Allowable Costs To Reduce Income Tax Optimise

Do I Need To Pay Capital Gains Tax If I Gift Property Taxscouts

Do I Need To Pay Capital Gains Tax If I Gift Property Taxscouts

A Guide To Capital Gains Tax On Uk Property For Us Expats

A Guide To Capital Gains Tax On Uk Property For Us Expats

30 Day Residential Property Capital Gains Tax Cgt Payment And Reporting Rules

30 Day Residential Property Capital Gains Tax Cgt Payment And Reporting Rules

Selling Your Home Low Incomes Tax Reform Group

Selling Your Home Low Incomes Tax Reform Group

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

Report And Pay Capital Gains Tax On Uk Property Non Residents Who Cannot Set Up A Government Gateway Account Chartered Institute Of Taxation

Report And Pay Capital Gains Tax On Uk Property Non Residents Who Cannot Set Up A Government Gateway Account Chartered Institute Of Taxation

Changes To Capital Gains Tax Payments Effective From April 2020

Changes To Capital Gains Tax Payments Effective From April 2020

Selling Uk Land Or Property Here S What You Need To Know About Capital Gains Tax Starfish Accounting

Selling Uk Land Or Property Here S What You Need To Know About Capital Gains Tax Starfish Accounting

How To Use The Ppr Exemption To Legitimately Avoid Property Capital Gains Tax By Amer Siddiq

How To Use The Ppr Exemption To Legitimately Avoid Property Capital Gains Tax By Amer Siddiq

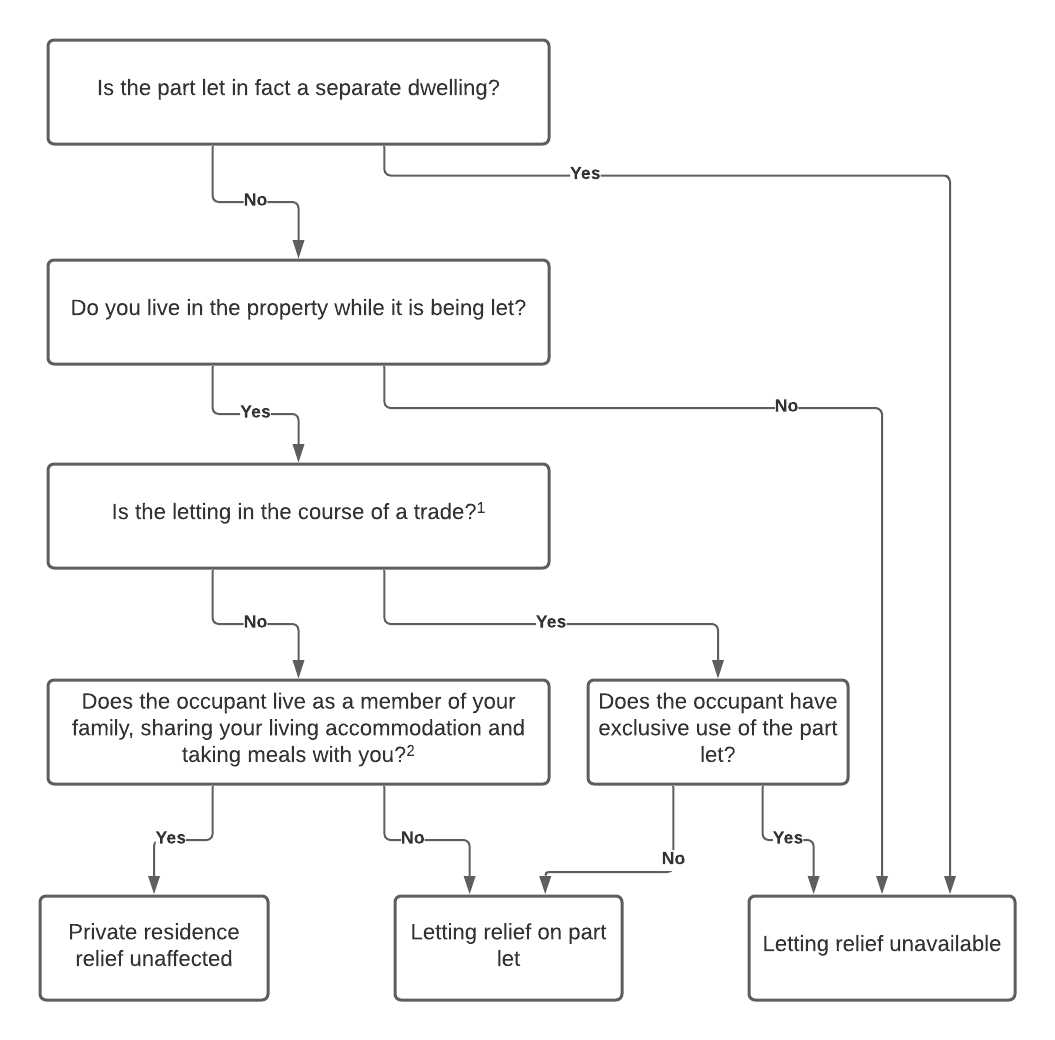

Private Residence Relief Capital Gains Tax Bdo

Private Residence Relief Capital Gains Tax Bdo

Capital Gains Tax For Expats Experts For Expats

Capital Gains Tax For Expats Experts For Expats

Online Accountant Reading Accounting Online Growing Your Business

Online Accountant Reading Accounting Online Growing Your Business

Prepare For Capital Gains Tax Changes Tinsdills Solicitors

Prepare For Capital Gains Tax Changes Tinsdills Solicitors

Self Assessment Service In Windsor Self Assessment Accounting Assessment

Self Assessment Service In Windsor Self Assessment Accounting Assessment

Guide To Capital Gains Tax Times Money Mentor

Guide To Capital Gains Tax Times Money Mentor

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group