Gross Property Plant And Equipment Formula

Gross PPE will go down whenever we sell these assets. Owns machinery with a gross value of 10 million.

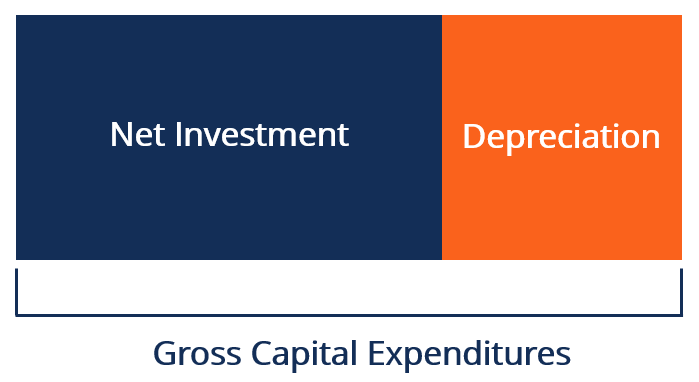

Net Investment Overview How To Calculate Analysis

Net Investment Overview How To Calculate Analysis

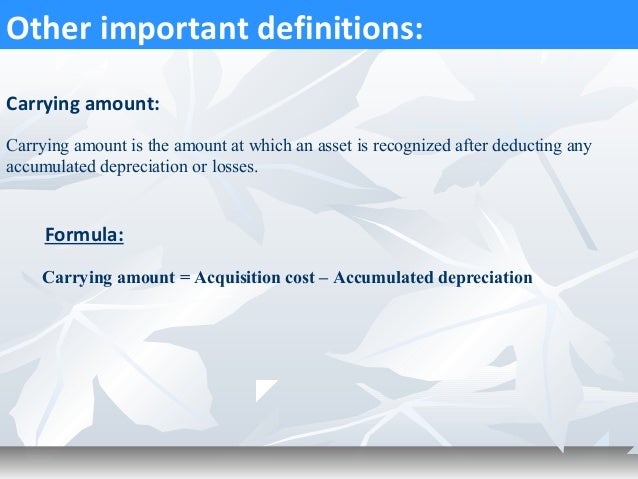

It is undepreciated amount thats going to reduce from gross PPE.

Gross property plant and equipment formula. These statements are key to both financial modeling and accounting of a business and is used to generate revenues and profits. The formula for this is pretty simple once we have gathered all of our numbers. At the time you apply for an Illinois title with the Secretary of State for a vehicle you purchased leased or acquired by gift or transfer you are required to submit either payment of tax or proof that no tax is due before your vehicle can be titled.

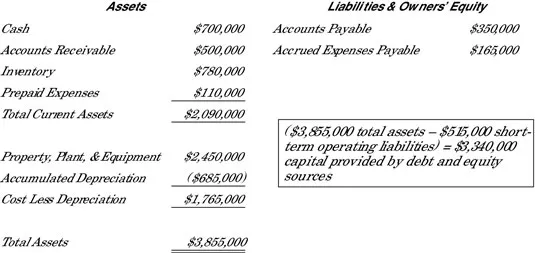

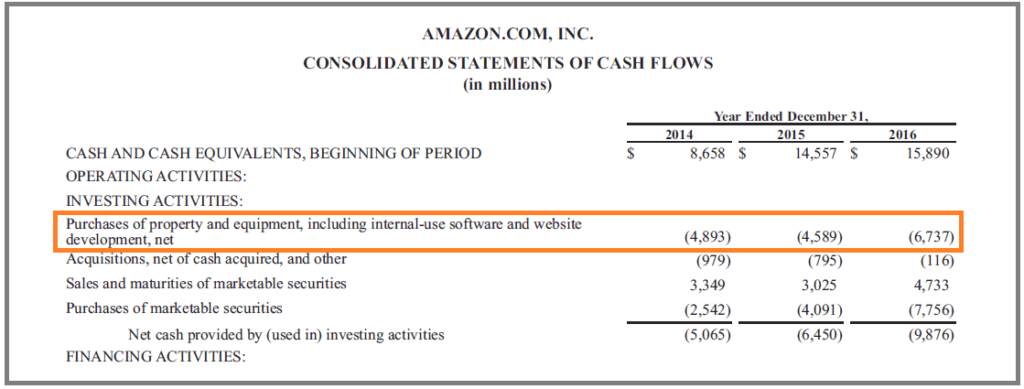

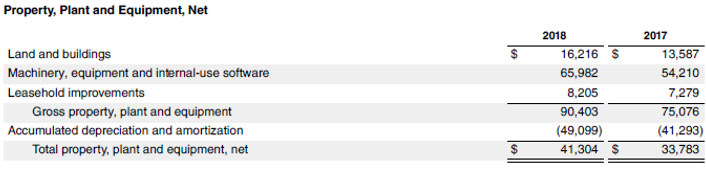

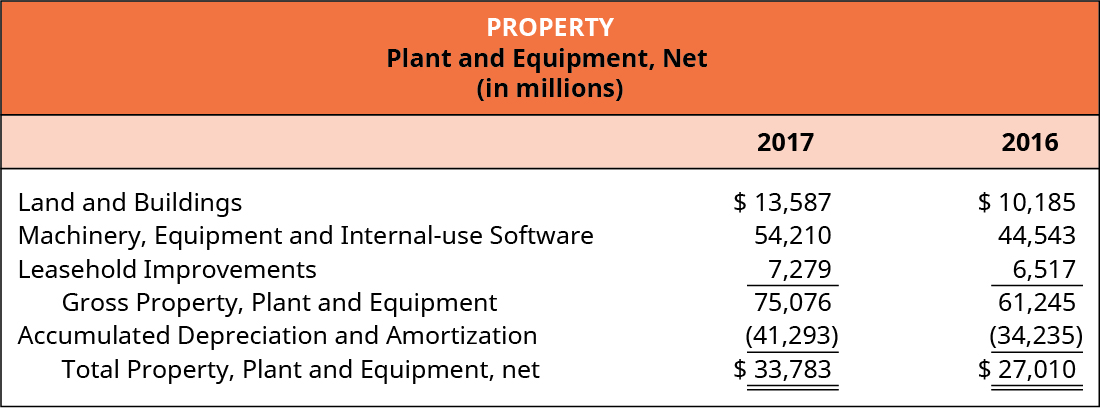

Examples of PPE include buildings machinery land. Property Plant and Equipment PPE is a non-current tangible capital asset shown on the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. Cash inflow from sale of Land Decrease in Land BS Gain from Sale of Land 80000 70000 20000 30000 Cash outflow from purchase of property plant and equipment PPE 120000 170000 -50000.

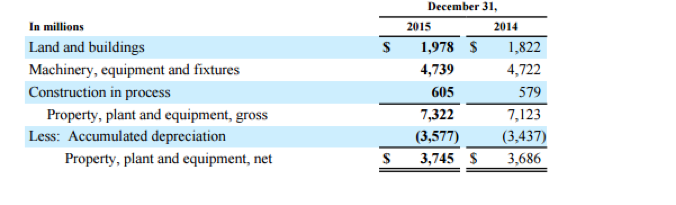

Accumulated depreciation recorded so far was at 5 million. There are two main items in non-current assets Land and Property Plant and Equipment. Property plant and equipment PPE are a companys physical or tangible long-term assets that typically have a life of more than one year.

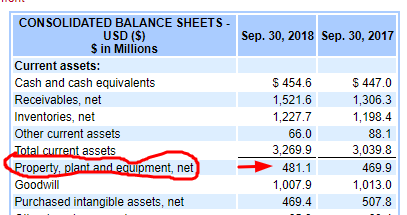

To calculate net PPE you take gross PPE add related capital expenses and subtract depreciation. E B I T D A o p e r a t i n g i n c o m e d e p r e c i a t i o n a n d a m o r t i z a t i o n. Gross PPE is the total cost you paid for all the assets at the start of the balance-sheet.

It is the historical cost of this asset. Property plant and equipment are tangible assets with physical substance often abbreviated to PPE. To calculate PPE add the amount of gross property plant and equipment listed on the balance sheet to capital expenditures.

Net Sales Gross sales less returns and allowances Average Fixed Assets NABB Ending Balance 2 NABB Net fixed assets beginning balance. Net investment indicates how much a company is spending to maintain and improve its operations. They are physical assets that a company cannot easily liquidate.

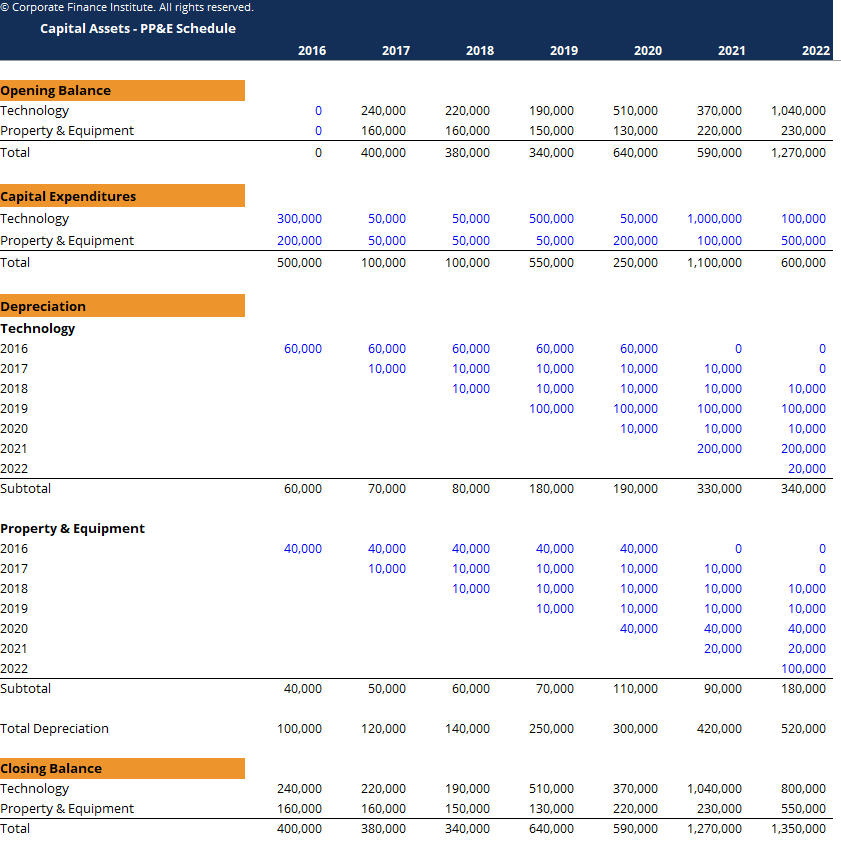

They are expected to be used by the business for more than one year and consequently categorized as non-current assets. Maintenance CapEx Capex PPE of Sales Sales growth decrease Lets calculate the numbers for 2018 with our formula. Examples include property plant and equipment.

The term Net means that it is Net of accumulated depreciation expenses. They are initially included at cost which is purchase price plus any incidentals associated with their acquisition. The first formula is below.

Calculate the average gross property plant and equipmentPPEsales ratio over five years. Next subtract accumulated depreciation from the result. Begin aligned text EBITDAtext operating income text.

There is an asset disposal. Net PPE is short for Net Property Plant and Equipment. Buildings Gross LandImprovements Gross MachineryEquipment Gross Construction in Progress Gross Leases Gross Natural Resources Gross.

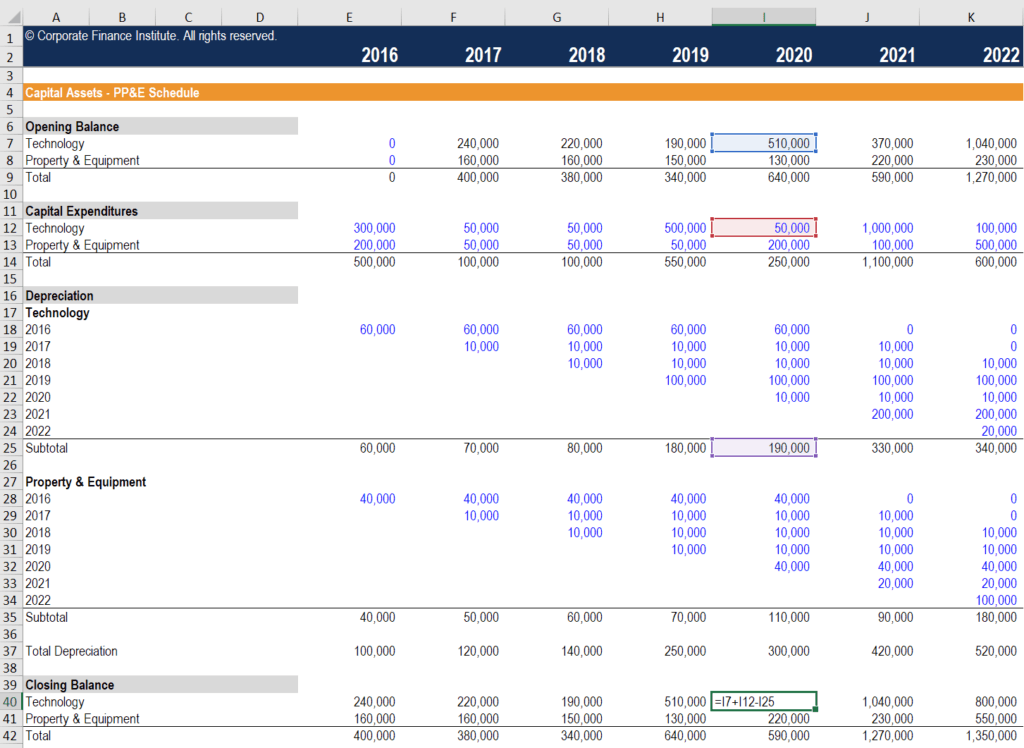

Net fixed asset for 2017 Gross fixed assets 2017 Accumulated depreciation 2017 Net fixed asset for 2018 Gross fixed assets 2018 Accumulated depreciation 2018 Average net fixed asset Net fixed assets 2017 Net fixed assets 2018 2. PPE Formula Net PPE Gross PPE Capital Expenditures Accumulated Depreciation INC Corp. If net investment is positive the company is expanding its capacity.

Capex PPE Ending PPE Beginning Depreciation Subtraction PPE stands for property plant and equipment and represents the fixed tangible assets owned by a company. Other PropertyPlantEquipment - Gross Other PropertiesPlantEquipment Gross represents gross property plant and equipment other than those included in the following items. What is my tax obligation when I apply for title in Illinois.

And finally we are going to come up with ending amount of gross plant property and equipment. Here the term vehicle refers to cars trucks vans motorcycles ATVs. The formula for the capitalization rate is calculated as net.

But what is the reduction from gross PPE. Gross annual income refers to all earnings before any deductions are generated by the property after. The capitalization rate is a profitability metric used to determine the return on investment of a real estate property.

The formula can be rearranged to give the capex formula shown below. FAT Net Sales Average Fixed Assets where. Property Plant and Equipment is the value of all buildings land furniture and other physical capital that a business has purchased to run its business.

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg) Are Depreciation And Amortization Included In Gross Profit

Are Depreciation And Amortization Included In Gross Profit

Ias 16 Property Plant Equipment Ppe

Ias 16 Property Plant Equipment Ppe

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Property Plant And Equipment Pp E Assignment Point

Property Plant And Equipment Pp E Assignment Point

Capital Expenditure Capex Guide Examples Of Capital Investment

Capital Expenditure Capex Guide Examples Of Capital Investment

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

How To Calculate Capex Formula Example And Screenshot

How To Calculate Capex Formula Example And Screenshot

Net Fixed Assets Formula Examples How To Calculate

Net Fixed Assets Formula Examples How To Calculate

:max_bytes(150000):strip_icc()/GettyImages-1167496026-1825e1c54d4e4db095bacb9dd03590f2.jpg) What Is Property Plant And Equipment Pp E

What Is Property Plant And Equipment Pp E

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Capital Investment Formula How To Calculate Capital Investment

Capital Investment Formula How To Calculate Capital Investment

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Net Financial Edge Training

Property Plant And Equipment Net Financial Edge Training

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg) What Is Property Plant And Equipment Pp E

What Is Property Plant And Equipment Pp E

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)