How Much Is Property Tax In Alaska

Each state has its own taxation system usually a combination of income sales and property taxes. There are over 90000 Real Property parcels within the Municipality of Anchorage covering over 1900 square miles of land.

7 States Without An Income Tax And An 8th State On The Way Income Tax Tax Rate Tax Free States

7 States Without An Income Tax And An 8th State On The Way Income Tax Tax Rate Tax Free States

Because paying a cash lump-sum for a home is out of reach for most buyers it is important to take advantage of every tax deduction available.

How much is property tax in alaska. Statewide the average property tax rate is 1209 meaning if a home sold at the median list price around 3409 in property taxes would be due. The amount is 10 percent of assessed. The current tax rate of 35 was set in 2013 by Senate Bill 21 commonly known as the More Alaska Production Act or MAPA.

Alaska State Payroll Taxes. The 2021 rates range from 1 to 54 on the first 43600 in wages paid to each employee in a calendar year. In addition some states place limits on how much property tax rates may increase per year or impose rate adjustments to achieve uniformity throughout the state.

As an employer in Alaska what you do have to pay is unemployment insurance to the state. The tax is based on the net value of oil and gas which is the value at the point of production less all qualified lease expenditures. Property taxes are deductible in the year in which you pay them.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. As of 2016 renting an apartment in Anchorage area costs an average of 1135 per month. These taxes are billed and collected through the tax section of the Treasury Division.

The median property tax in Alaska is 242200 per year for a home worth the median value of 23290000. While we are charged with collecting state taxes and administering tax laws we also regulate charitable gaming and provide revenue estimating and economic forecasting. The third way is to evaluate how much income your property would produce if it were rented as an apartment house a store or a warehouse.

Why Assessed Values May Change from Year to Year. In Alaska the median property tax rate is 1183 per 100000 of assessed home value. Nope nothing to see here.

We promote tax compliance through quality service and fair administration. New Hampshire and Alaska relied most heavily on property taxes which respectively accounted for 638 percent and 456 percent of their tax collections in FY 2018. These services are funded in part by Real Estate Personal and Business Property taxes.

Property taxes offer another way to lower your tax bill. A property tax break may also be available if youre the survivor of a qualified taxpayer. Counties in Alaska collect an average of 104 of a propertys assesed fair market value as property tax per year.

Alaska State Unemployment Insurance. With local taxes the total sales tax rate is between 0000 and 9500. The state sales tax rate in Alaska is 0000.

Alaska AK Sales Tax Rates by City. In Anchorage that percentage is 1355 which would increase the total to 3821. Zillow has 4597 homes for sale in Alaska.

Alaska property tax rates are recalculated each year after all property values have been. Residential Leasing in Alaska. Meanwhile in Juneau the rate is only 0907 which would only equate to 2558 in annual property taxes.

Kenai a small town is somewhat cheaper with an average rent of 888 per. Real Estate Property Taxes. We provide accurate and timely information to Alaska taxpayers.

Tax amount varies by county. But according to the Tax Foundation the statewide average is only 176. Go to Alaskas Full.

In tax year 2019 the Tax Section mailed out over 104000 tax bills and collected approximately 556000000 on behalf of General Government and the Anchorage School District. Alaska is one of 5 states that does not have a state sales tax the others are Delaware Montana New Hampshire and Oregon. Alaska tax rates and resources for taxes on personal income sales property estate and more.

The Last Frontiers residents are pretty lucky when it comes to. Overview of Alaska Taxes. In Alaska the tax exemption is available to residents 65 or older.

The Municipality of Anchorage provides a variety of services to its citizens. The assessor must consider operating expenses taxes insurance maintenance costs and the return most people would expect on your type of property.

Property Tax Rate In Illinois Close To Nation S Highest Racial Diversity City States

Property Tax Rate In Illinois Close To Nation S Highest Racial Diversity City States

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

Property Tax Isn T The Only Tax To Be Concerned With We Saved 20 000 In One Year Just From Living In A State With All Around Lower In 2020 Property Tax Low Taxes

Property Tax Isn T The Only Tax To Be Concerned With We Saved 20 000 In One Year Just From Living In A State With All Around Lower In 2020 Property Tax Low Taxes

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Map The Most And Least Tax Friendly States Best Places To Retire Retirement Locations Map

Map The Most And Least Tax Friendly States Best Places To Retire Retirement Locations Map

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Mapped The Cost Of Health Insurance In Each Us State Healthcare Costs Health Insurance Coverage Health Insurance Cost

Mapped The Cost Of Health Insurance In Each Us State Healthcare Costs Health Insurance Coverage Health Insurance Cost

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Moving To Florida

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Moving To Florida

Where Do People Pay The Most In Property Taxes In The Us Property Tax Map This Is Us

Where Do People Pay The Most In Property Taxes In The Us Property Tax Map This Is Us

Alaska Property Tax Calculator Smartasset

Alaska Property Tax Calculator Smartasset

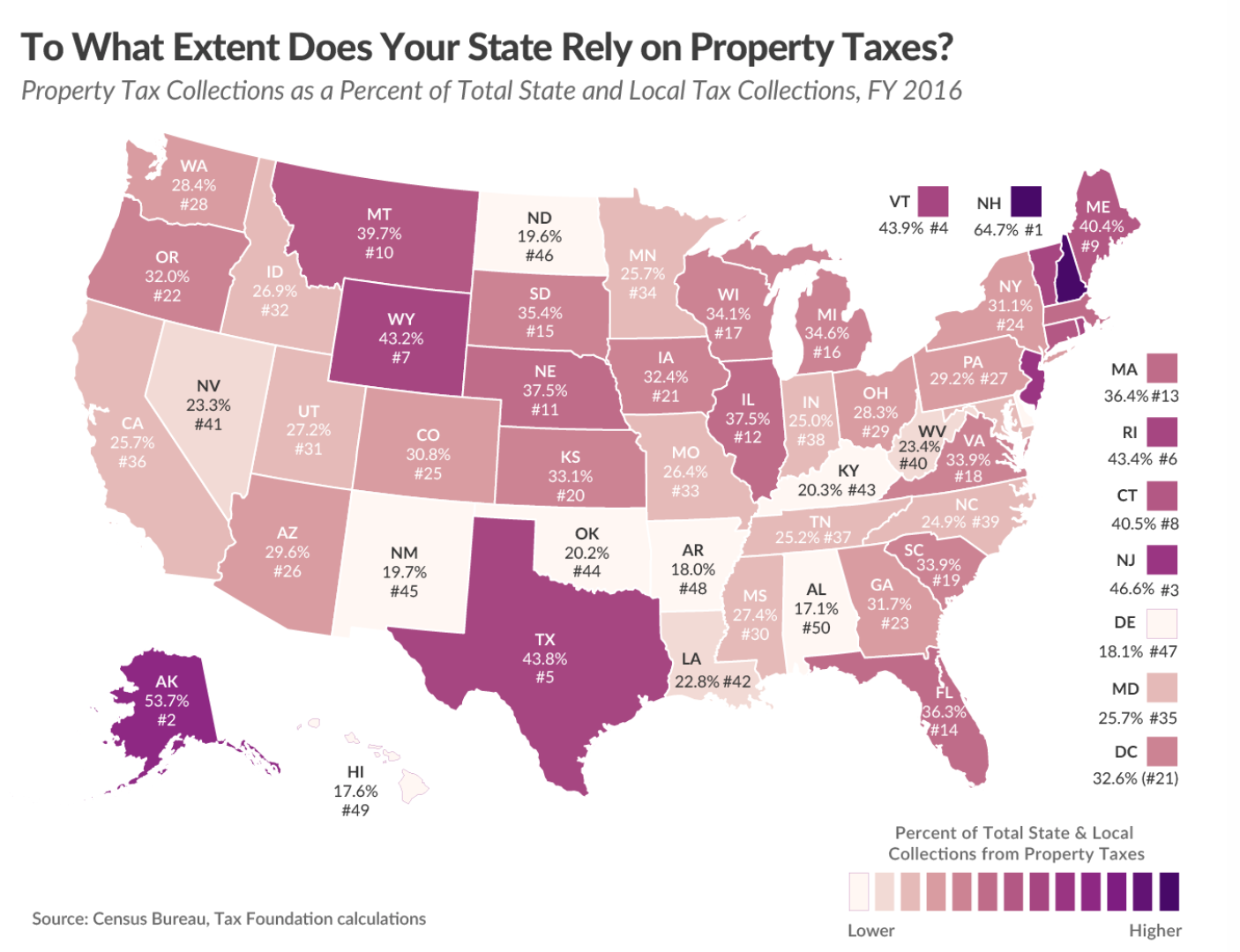

To What Extent Does Your State Rely On Property Taxes Gar Associates Ny Real Estate Appraisal And Market Analysis Firm

To What Extent Does Your State Rely On Property Taxes Gar Associates Ny Real Estate Appraisal And Market Analysis Firm

United States Map Of States With No Income Tax Alaska Washington Nevade Wyoming Texas South Dakota And Florida As Retirement Budget Retirement Retirement Fund

United States Map Of States With No Income Tax Alaska Washington Nevade Wyoming Texas South Dakota And Florida As Retirement Budget Retirement Retirement Fund

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

The 10 States With The Best Tax Systems And The 10 Worst Business Tax Small Business Tax Tax

The 10 States With The Best Tax Systems And The 10 Worst Business Tax Small Business Tax Tax

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Best Places To Retire Retirement

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Best Places To Retire Retirement

Property Taxes On Owner Occupied Housing By State Tax Foundation Infographic Map Property Tax Map

Property Taxes On Owner Occupied Housing By State Tax Foundation Infographic Map Property Tax Map