Property Appraiser Union County Nj

Formerly the Homestead Rebate NJ Saver Programs New Jersey residents are eligible if they owned or rented property in New Jersey as of October 1st of the year prior to the application. 1997-2018 Union County Clerk Version 2015.

Union County Tax Assessor S Office

Union County Tax Assessor S Office

Enter below an inquiry for a piece of property.

Property appraiser union county nj. Checking the Union County property tax due date Reporting upgrades or improvements. Public Property Records provide information on land homes and commercial properties in Union including titles property deeds mortgages property tax assessment records and other documents. Sift through statewide ownership property records while applying filters such as.

Taxes are 463 annually. Dukes - Lake. This property was built in 2020 and is owned by MAYORGA OSCAR O who lives at 228 ERIE ST.

We are pleased you are visiting this site which contains information recorded into the Official Land Records of Union County New Jersey from June 1 1977 through February 18 2021. 228 ERIE ST is a Residential 4 Families or less property with 2280 sqft of space. New Jerseys Largest Property Database Simplified access to current historical property records and maps.

The Tax Assessor establishes values for all real property within the Township. The dwelling must be subject to property taxes and such property taxes for the previous year must have been paid. Free Union County Property Records Search.

This property was last sold on 2020-12-16 for 600000. Search either by reference number map number or street name. Data is compiled from official government agencies inluding state county courthouses and public records.

Union County Government Center 500 North Main Street Monroe NC 28112 704-283-3500 Contact Us. Neither Union County nor the Union County Clerk shall incur a liability for errors or omissions with respect to the information provided in the index. It is this valuation that is the basis for the Townships property tax levy which is calculated by the Tax Assessor.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The Land Document Index that you can search by is provided as a public service for your convenience. Please feel free to contact the Property Appraisers office if we may help in any way.

The information provided here is for convenience ONLY. Tax Administration lists appraises and assesses all real and personal property in Union County according to state law. Union County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps.

Union County Property Appraiser - Bruce D. Union County Property Records Search New Jersey Perform a free Union County NJ public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens. View all available data.

The Property Appraisers Office works in cooperation with the Florida Department of Revenue and the Appraiser is elected every four years by the citizens of Union County. An Union Property Records Search locates real estate documents related to property in Union New Jersey. Union County Property Search.

The records located at the Union County AssessorTax Collectors office are the one and only legal instruments for assessment and taxation. Each year as of January 1 the Assessor must compile a tax roll of property subject to ad valorem according to value taxation. Due to the public health emergency caused by COVID-19 and the subsequent issuance of the Governors Executive Order 107 the Union County Board of Taxation effective April 16 2020 and until further notice will conduct all future meetings remotely by teleconference without providing a physical meeting place.

Please feel free to contact the Property Appraisers office if we may help in any way. In-depth Union County NJ Property Tax Information. Taxpayers can appeal their propertys assessment with the Hunterdon County Tax Board on or before April 1 of each year.

This property is valued at 263 per sqft based on sales price. Welcome to the Union County Clerks Online Public Land Records Search Page. You can contact the Union County Assessor for.

Assessments are based on the market value of each property. The Union County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Union County New Jersey. The Property Appraisers Office works in cooperation with the Florida Department of Revenue and the Appraiser is elected every four years by the citizens of Union County.

Union County Arrest Court And Public Records

Union County Arrest Court And Public Records

Union County Property Tax Records Union County Property Taxes Nj

Union County Property Tax Records Union County Property Taxes Nj

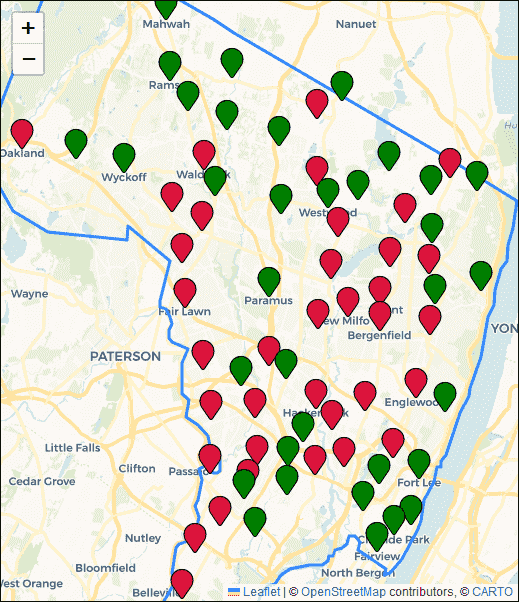

2020 Property Tax Rate Map For All Towns In Bergen County Nj

2020 Property Tax Rate Map For All Towns In Bergen County Nj

Plainfield Today Plainfield Union County Property Taxes Compared Union County Plainfield County

Plainfield Today Plainfield Union County Property Taxes Compared Union County Plainfield County

Union County Couldn T Possibly Have A Problem With Corruption Waste Or Mismanagement Right Make A

Union County Couldn T Possibly Have A Problem With Corruption Waste Or Mismanagement Right Make A

Senior Citizens Can Learn How To Qualify For Property Tax Relief With An Informative Video From The Senior Citizens Council County Of Union

Senior Citizens Can Learn How To Qualify For Property Tax Relief With An Informative Video From The Senior Citizens Council County Of Union

Union County Nj Recently Sold Homes Realtor Com

Union County Nj Recently Sold Homes Realtor Com

2020 Best Places To Live In Union County Nj Niche

2020 Best Places To Live In Union County Nj Niche

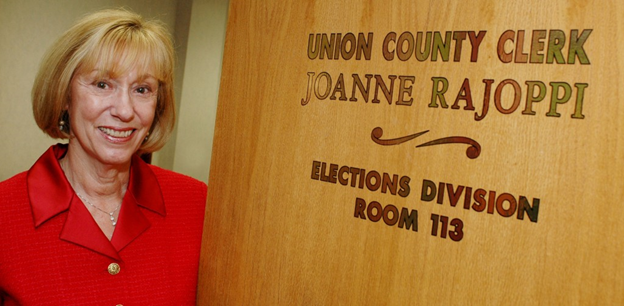

About The County Clerk Joanne Rajoppi County Of Union

About The County Clerk Joanne Rajoppi County Of Union

The Official Website Of The Borough Of Roselle Nj News

Department Of Corrections County Of Union

Department Of Corrections County Of Union

Online Tax Payment Township Of Union

Online Tax Payment Township Of Union

Office Of The Union County Surrogate County Of Union

Office Of The Union County Surrogate County Of Union

Township Of Hillside Nj The Township Of Hillside

Township Of Hillside Nj The Township Of Hillside

The Official Website Of The Borough Of Roselle Nj Tax Assessor

The Official Website Of The Borough Of Roselle Nj Tax Assessor