Property Held In Trust After Death

Real or personal property that the person who died owned with someone else joint tenancy Property community quasi-community or separate that passed directly to the surviving spouse Life insurance death benefits or other assets not subject to probate that pass directly to. The beneficiary will be liable for any tax due regardless.

A living trust is set up when a property owner wishes his heirs to avoid the costs and hassle of probate after he dies.

Property held in trust after death. Specifically under section 1015 b the assets of a grantor trust after death have the same basis once grantor trust status is turned off as they had before death. Examples include bank accounts and investments accounts held in one individuals name without a payable on death a transfer on death or an in trust for designation. The trustee needs to collect trust assets beneficiary information pay debts pay individual andor estate taxes and possibly ready assets such as a home for sale.

If the grantor acted as trustee while he was alive the named co-trustee or. If you sell the home shortly after her death you and your brother will pay no federal income taxes on the sale. Assets owned in the decedents name alone.

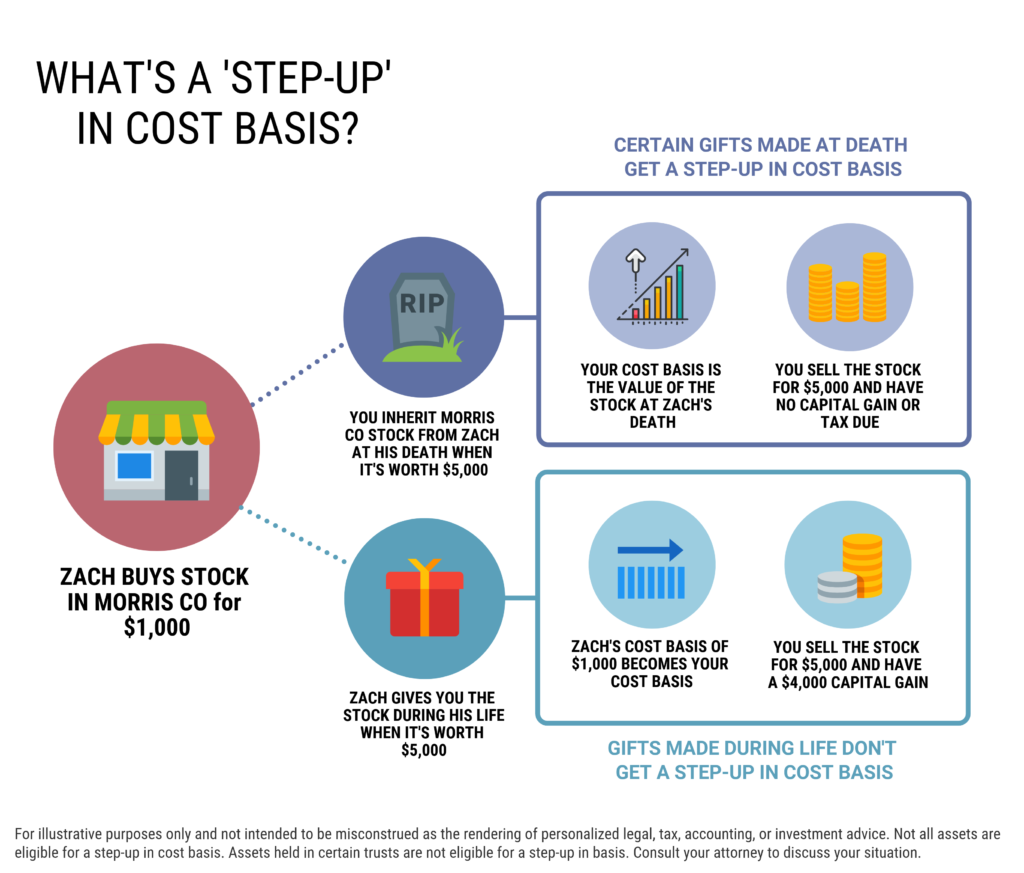

If the deceased person held assets inside a trust at the time of death the trust agreement determines to whom and under what circumstances those assets can be distributed. This maybe too little too late but upon death of the owner the property gets a step-up in basis equal to its FMV at the date of death of the grantor of the trust. This effectively makes the cost basis the same as the sales price so theres no gain.

The trustee is required to follow the terms of the trust which may require that the house be sold or distributed to the beneficiaries. Unless the trust terms state otherwise a trust cannot continue indefinitely. When the grantor who is also the trustee dies the successor trustee named in the Declaration of Trust takes over as trustee.

Distributing a persons assets after they pass away depends on the instructions left behind in a will or trust. In other words consistent with the IRS view that grantor trusts do not qualify for a step-up in basis at death section 1015 b imposes a carryover basis. Or Any combination of the above.

Actually it does not make one bit of difference whether the trust sells the property and distributes net gain or distributes the property in-kind and the beneficiary sells the property. Trust administration is the process that begins when the grantor dies and the trustee must managedistribute trust property accordingly. The trustee named in the agreement has the authority to retitle assets by making distributions out of the trust.

If the trustee fails to do this a beneficiary could sue him or her for breach of duty. Upon the death of the surviving spouse the property held in both the decedents trust and the survivors trust is distributed to the beneficiaries named in the trust document. How to Transfer Real Estate After Death If the real estate is held in a trust.

The new trustee is responsible for distributing the trust property to the beneficiaries named in the trust document. If the deceased person held the property in a trust the most recent deed should show that the property was transferred to the trustee of the trust. But when you have an irrevocable trust your property or land is essentially removed from your estates value which means youll save money in taxes after your passing.

A revocable trust is sometimes referred to as a living trust or an inter-vivos trust which literally means a trust between living persons because it is created during the grantors lifetime. The continued management of assets for others after the grantors death. By inheriting the property even if it is held inside a trust it receives a stepped-up basis.

I of the trusts existence ii of the identity of the decedent iii of the beneficiarys right to request a copy of the trust agreement and iv of the right to a trustees report as described immediately below in paragraph 34. Here are a few more putting property in a trust. Reviewing the Trust Document A trust document is essentially a list of instructions that the person in charge of the trust called the trustee must follow.

Sole Ownership Sole ownership means that a property is owned by one person in his or her individual name and without any transfer-on-death designation. Both titled property like houses and personal property like jewelry can be included in the living trust and if it is set up properly you will be able to freely move assets into and out of the trust during your lifetime. When the maker of a revocable trust also known as the grantor or settlor dies the assets become property of the trust.

Trusts can be complicated so its important to know exactly what trust youre. This means that the cost of the home to you and to your brother is the value of the home at or around the time your mom died. Only if the trust holds onto the property for a time after death will new gains have a chance to start accruing.

For example it might say To Tomas Penko and Marla Penko trustees of the Penko Family Trust dated March 3 2015. The Pros of Putting Property In a Trust. In situations where instructions werent left the state laws govern the distribution of property regardless of the desires a person may have expressed before passing away.

Property held in trust including a living trust. Within a reasonable time after the death of the trusts creator the trustor the trustee must notify the beneficiaries. This is just one upside to consider.

Trust Flowchart Revocable Living Trust Flow Chart Living Trust

Trust Flowchart Revocable Living Trust Flow Chart Living Trust

Find Out If A Revocable Living Trust Is Right For You And How It Works Revocable Living Trust Living Trust Revocable Trust

Find Out If A Revocable Living Trust Is Right For You And How It Works Revocable Living Trust Living Trust Revocable Trust

Printable Sample Last Will And Testament Form Will And Testament Last Will And Testament Free Basic Templates

Printable Sample Last Will And Testament Form Will And Testament Last Will And Testament Free Basic Templates

What Is The Difference Between The Will And A Living Trust In 2020 Living Trust Business Help Probate

What Is The Difference Between The Will And A Living Trust In 2020 Living Trust Business Help Probate

Trust Agreement Real Estate Forms Legal Forms Real Estate Contract

Trust Agreement Real Estate Forms Legal Forms Real Estate Contract

Reverse Family Tree Template Family Tree Template Estate Planning Revocable Living Trust

Reverse Family Tree Template Family Tree Template Estate Planning Revocable Living Trust

Does An Irrevocable Trust Automatically Terminate Upon A Certain Date In 2020 Revocable Trust Estate Planning Money Management

Does An Irrevocable Trust Automatically Terminate Upon A Certain Date In 2020 Revocable Trust Estate Planning Money Management

The Difference Between Wills And Trusts Posteri Legal Pllc

The Difference Between Wills And Trusts Posteri Legal Pllc

Free Trust Agreement Form Printable Real Estate Forms Franchise Agreement Real Estate Forms Agreement

Free Trust Agreement Form Printable Real Estate Forms Franchise Agreement Real Estate Forms Agreement

Last Will And Testament Template Form Colorado Will And Testament Last Will And Testament Doctors Note Template

Last Will And Testament Template Form Colorado Will And Testament Last Will And Testament Doctors Note Template

Free Quit Claim Form Quitclaim Deed Printable Pdf Download Template Sample Quitclaim Deed Templates Printable Free Letter Example

Free Quit Claim Form Quitclaim Deed Printable Pdf Download Template Sample Quitclaim Deed Templates Printable Free Letter Example

What Is A Discretionary Trust Advantages And Disadvantages Infographic Http Www Assetprotectionpackage C Budgeting Money Estate Planning Financial Tips

What Is A Discretionary Trust Advantages And Disadvantages Infographic Http Www Assetprotectionpackage C Budgeting Money Estate Planning Financial Tips

What Is A Step Up In Basis Cost Basis Of Inherited Assets

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Understanding Probate Wills And Trusts Estate Planning Essentials Ebook Wells Fargo Essentials

Understanding Probate Wills And Trusts Estate Planning Essentials Ebook Wells Fargo Essentials

Revocable Living Trust Form Living Trust Revocable Living Trust Rental Agreement Templates

Revocable Living Trust Form Living Trust Revocable Living Trust Rental Agreement Templates

How To Distribute The Assets Of A Living Trust After Death Legalzoom Com

How To Distribute The Assets Of A Living Trust After Death Legalzoom Com

Estate Sale Contract Template Inspirational Sales Contract Template 21 Word Pdf Documents Download Free Word Document Contract Template Real Estate Contract

Estate Sale Contract Template Inspirational Sales Contract Template 21 Word Pdf Documents Download Free Word Document Contract Template Real Estate Contract

Free Printable Trust Agreement Assorted Legal Forms In 2020 Legal Forms Real Estate Forms Real Estate Contract

Free Printable Trust Agreement Assorted Legal Forms In 2020 Legal Forms Real Estate Forms Real Estate Contract

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)