Property Insurance Premises Definition

Premises liability is the legal principle that property owners have some level of accountability for accidents and injuries on their property or premises. Business property insurance is something every company needs whether you own your own building lease or work from home.

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

Property insurance refers to a series of policies that offer either property protection or liability coverage.

Property insurance premises definition. One of the core coverages in a businessowners policy BOP commercial property insurance protects your building and its contents as well as exterior fixtures such as a fence or outdoor sign. These clauses are often used in property insurance contracts for policyholders who cannot fit all of their items in one location. An off-premise clause is a clause in an insurance contract that stipulates that a policyholder will receive coverage for property that is stored in a separate location from the primary insured property.

Insurance companies offer premises liability insurance products that help cover premises liability risks. The one family dwelling where you reside. That part of any other building where you reside.

Commercial property insurance is insurance used to cover property and equipment from the risk of disasters. Leases often contain the misnomer casualty insurance when property insurance is intended. The policy defined residence premises as follows.

Insurance on buildings and their contents. 2 Building or land occupied or owned by an insured. Premises and operations insurance is part of the general liability insurance policy.

The law stipulates that a premises owners are expected to provide reasonable safety and precaution to guests and licensees. Employees are covered by workers compensation insurance. Property insurance alone is seldom enough however.

This means that your business is protected if somebody is injured within your facility or on your property. One of the most essential parts of a CGL policy is premises liability coverage. The two three or four family dwelling where you reside in at least one of the family units.

Commercial property insurance protects your business from financial losses caused by damage to its physical assets. This coverage is not extended to you or your employees. Definition Premises 1 In a property insurance policy the location where coverage applies.

Premises liability impacts businesses that own business property and that are legally responsible for the safety of invited guests to that property. The particular location of the property or a portion of it as designated in an insurance policy. Property insurance generally covers loss arising from damage to real or personal property owned by the insured.

So any inaccuracy can lead to unintended. The purpose of property insurance for the small business is to provide critical financial assistance in the event of a loss so that the enterprise can continue to operate with as little disruption as possible. Every business owner has some type of premises liability exposure.

Its a broad category that includes direct damage time element inland marine and crime insurance. Premises and operations coverage insures a policyholder specifically against BI and PD claims for damages resulting from negligence associated with owning property and the day-to-day operations necessary to conduct business. Under the ISO Building and Personal Property Coverage Form many of the coverages and extensions are defined in relation to the insured premises.

Usually described in the policy with a legal address. Slip-and-fall that occurs on your premises. This portion of your commercial general liability policy offers bodily injury and property damage coverage related to the ownership or maintenance of business premises.

Property insurance can include homeowners insurance renters insurance flood. And which is shown as the residence premises in the Declarations. Keep in mind that the standard off-premises coverage is 10 of the personal property limit shown on your policy.

It is intended to cover property damage liability and bodily injuries that occur to the public when they are at your place of business. It should be but one part of an overall risk management and disaster recovery plan. Different types of properties and equipment are considered for commercial property.

The typical example would be a fire where the building owners property insurance policy would pay to repair the damage. In this sense property insurance encompasses inland marine boiler and machinery BM and crime insurance as well as what was once known as fire insurance now simply called property insurance. So for example if your home is covered at 100000 and personal property is covered at half of that or 50000 then your total off-premises protection is 5000.

Property Insurance first-party insurance that indemnifies the owner or user of property for its loss or the loss of its income-producing ability when the loss or damage is caused by a covered peril such as fire or explosion. Premises liability insurance is coverage provided to pay for the for costs that may arise from property destruction or personal injury ie.

Https Www Zurichna Com Media Project Zwp Zna Docs Kh Prop Pppfocusonrightcoverage Pdf La En Hash 00b11d814e4ffef027a835bab0a30b1e

What Evidence Is Needed In A Premises Liability Case Kbg Injury Law

What Evidence Is Needed In A Premises Liability Case Kbg Injury Law

Https Www Beazley Com Documents Management 20liability Crime Crime 20policy Pdf

Additions And Extensions Of Property Coverage Expert Commentary Irmi Com

Additions And Extensions Of Property Coverage Expert Commentary Irmi Com

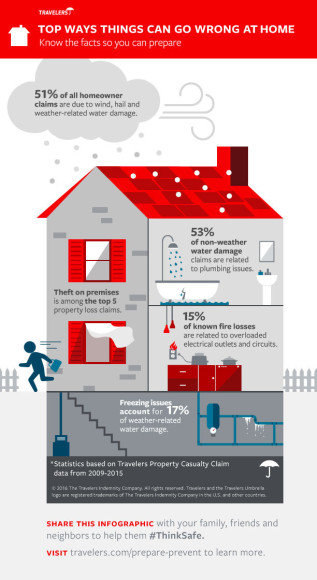

Top Homeowners Insurance Claims

Top Homeowners Insurance Claims

Https Www Deanshomer Com Docs Forms 35250612 Pdf

Protecting Assets When Home Ownership Is Transferred Expert Commentary Irmi Com

Protecting Assets When Home Ownership Is Transferred Expert Commentary Irmi Com

5 Things To Know About Commercial Property Insurance

5 Things To Know About Commercial Property Insurance

Property Insurance Coverage Insights Property Insurance Claims Lawyers Robinson Cole

Property Insurance Coverage Insights Property Insurance Claims Lawyers Robinson Cole

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

Insurance Definitions Property Casualty Allen Financial Insurance

Insurance Definitions Property Casualty Allen Financial Insurance

Https Insurance Mo Gov Consumers Home Documents Apc185 Pdf

Https Northstarmutual Com Userfiles File Forms Policyforms Current Cf 6a Pdf

Premises Liability Insurance Are You Covered Trusted Choice

Premises Liability Insurance Are You Covered Trusted Choice

B2b Mortgage Lender And Auto Third Party The Certificate

B2b Mortgage Lender And Auto Third Party The Certificate

Homeowners Insurance Off Premises Coverage

Homeowners Insurance Off Premises Coverage

Https Www Deanshomer Com Docs Forms 47061210 Pdf

Https Www Blcinsurance Com Documents Emc Personal Emc 20equipment 20breakdown 20faq Pdf

/commercial-property.tmb-.png?sfvrsn=8) Commercial Property Policy Insurance Glossary Definition Irmi Com

Commercial Property Policy Insurance Glossary Definition Irmi Com