Property Name Transfer Procedure After Death

For this all the other legal heirs have to execute a Registered Relinquishment Deed relinquishing their respective shares in the property in favour of your mother. The new owner will usually have to complete a little paperwork by filing an affidavit a simple statement and a copy of the death certificate with the countys land records office.

The Captivating Share Certificate Indiafilings For Share Certificate Template Companies House Pics Below Certificate Templates Certificate Business Template

The Captivating Share Certificate Indiafilings For Share Certificate Template Companies House Pics Below Certificate Templates Certificate Business Template

When a joint owner of a property dies fill in form DJP to remove their name from the register.

Property name transfer procedure after death. The grantor must execute a revocable transfer on death TOD deed prior to death. When we transfer the property from the original owner to someone else there is a change of ownership. On the basis of the said legal heir certificate the legal heirs have to approach the Authorities for mutation of the property in their name.

The Transfer of Property Deed Upon a Spouses Death. The Relinquishment Deed will involve very small stamp duty and registration fee. After a loved one dies their property needs to be transferred or retitled.

Take a certified copy of your spouses death certificate to the Register of Deeds office. Transfer of property after death without a Will. The property gets a new owner and hence the title needs to be changed.

The Affidavit of Heirship. The death certificate will be filed along with the existing deed to confirm transfer of the ownership interest in the real estate upon your spouses death. See Transferring Real Estate Held in a Trust for more on transferring the property from the trustee to the new owner.

For example if the property was titled in the name of the decedent and another person as joint tenants with rights of survivorship you can update the deed by bringing a copy of the death certificate and a few other forms to the clerk of the county where the property is located. However he or she needs to apply to the concerned nearby civil. There are basically two scenarios under which the property may be required to be transferred after the death of the owner.

The Registration cost is not as high as in case of registration of Sale Deed. The Surrogate Court of the county in which the decedent resided at the time of death has jurisdiction in New Jersey probate proceedings. Your mother and all your siblings will have equal share in the property.

Probate is the court-supervised process of settling a decedents estate and transferring the remaining assets to devisees or heirs according to the provisions of the decedents will if any. Two documents are recommended to transfer a house when a property owner dies without a Will. The transfer of property involves.

An affidavit of heirship can be used when someone dies without a will and the estate consists mostly of real property titled in the deceaseds name. Send the completed form to HM Land Registry along with an official copy of the death certificate. However you want that the property should be registered in your mothers name.

Assets owned in joint tenancy. Transfer of property with Will In case a registered will has been left by the person the property will get transferred and devolve upon the beneficiary named in the will by the testator. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased.

A successor in interest is someone who receives property through. If the real estate is the subject of a transfer-on-death deed. Joint Tenancy With Right of Survivorship.

This document is a sworn statement that identifies the heirs. On the demise of your father his heirs are his mother widow and children each one of whom succeeds equally to the property. The title of a property is an ownership certificate.

For help preparing one click here. If the deceased person filed a transfer-on-death deed that deed will specify the new owner of the property. Different forms of property ownership are handled in different ways when an owner dies.

If you wish to transfer your share to your mother then you may execute a release deed in her favour. Otherwise it likely goes through probate court where the executor or the administrator has the power to sell and transfer the property for the benefit of the heirs. Some property transfers automatically upon death.

The procedure to transfer the title of the property in your mothers name would be to enclose your fathers death certificate to the letter signed by all your siblings to the concerned authorities informing that the children have no objection to transfer the title of the property in their mothers name and request the revenue authorities to transfer the title from their fathers name to mothers name. You need to bring Demand draft around Rs6000- towards Stamp Fees and another Demand Draft around Rs1000-towards registration cost plus additional expenses like consultation drafting. The New owners name gets substituted for the ex-owner.

Automatic Transfer Upon Death. A transfer by devise like in a will descent or operation of law on the death of a joint tenant or tenant by the entirety a transfer to a relative after the death of a borrower a transfer where the spouse or children of the borrower become an owner of the property. It is an affidavit used to identify the heirs to real property when the deceased died without a will that is intestate.

After the death of the testator individual claiming through the WILL DEED or inheritance need not enroll the land in his name. The procedure to transfer the property from mother to son is by way of Gift Deed. The process of doing so is regulated by state law and depends on the type of asset and how it was owned at the time of death.

As with any other type of deed quitclaim or grant the TOD relinquishes rights to property.

How To Transfer Ownership Of Inherited Land In The Philippines Lamudi

How To Transfer Ownership Of Inherited Land In The Philippines Lamudi

3 Steps To Take When You Inherit A Property

3 Steps To Take When You Inherit A Property

Free Printable Power Of Attorney General Legal Forms Power Of Attorney Form Legal Forms Power Of Attorney

Free Printable Power Of Attorney General Legal Forms Power Of Attorney Form Legal Forms Power Of Attorney

West Bengal Property Registration Online Procedure In 2020 West Bengal Bengal Registration

West Bengal Property Registration Online Procedure In 2020 West Bengal Bengal Registration

How To Remove Someone S Name From A Property Deed Finder Com

How To Remove Someone S Name From A Property Deed Finder Com

17 Superb Last Will And Testament Template For Married Couple Last Will And Testament Will And Testament Templates

17 Superb Last Will And Testament Template For Married Couple Last Will And Testament Will And Testament Templates

How To Change Name In Property Tax Online A Handy Guide In 2020 Online Taxes Mortgage Payment Property Tax

How To Change Name In Property Tax Online A Handy Guide In 2020 Online Taxes Mortgage Payment Property Tax

Abap On Sap Hana Part Ix Amdp Abap Managed Database Procedure Sapspot Database System Sap Sap Netweaver

Abap On Sap Hana Part Ix Amdp Abap Managed Database Procedure Sapspot Database System Sap Sap Netweaver

Affidavit Of Death Create An Affidavit Of Death Template

Affidavit Of Death Create An Affidavit Of Death Template

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Trademark Assignment In 2020 Assignments What Is A Trademark Trademark

Trademark Assignment In 2020 Assignments What Is A Trademark Trademark

Property Transfer Process And Requirements Finder Com

Property Transfer Process And Requirements Finder Com

Estate Planning Letter Of Instruction Template Fresh Important Estate Planning Documents Business Plan Template Free Marketing Plan Template Estate Planning

Estate Planning Letter Of Instruction Template Fresh Important Estate Planning Documents Business Plan Template Free Marketing Plan Template Estate Planning

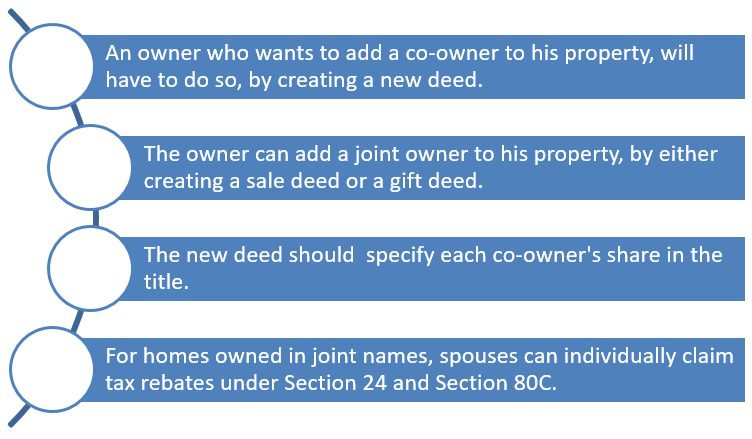

How To Add A Co Owner In A Property Housing News

How To Add A Co Owner In A Property Housing News

Power Of Attorney Format For Nri Procedure For Power Of Attorney In India Power Of Attorney Power Of Attorney Form Attorneys

Power Of Attorney Format For Nri Procedure For Power Of Attorney In India Power Of Attorney Power Of Attorney Form Attorneys

Power Of Attorney Form Templates Unique Free Power Of Attorney Templates In Fillable Pdf Format Power Of Attorney Form Power Of Attorney Important Facts

Power Of Attorney Form Templates Unique Free Power Of Attorney Templates In Fillable Pdf Format Power Of Attorney Form Power Of Attorney Important Facts

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

G P Fund Final Payment Complete Procedure With All Forms Allpaknotfications Com Fund Completed Payment

G P Fund Final Payment Complete Procedure With All Forms Allpaknotfications Com Fund Completed Payment

How To Change Name On Pan Card How To Change Name Names Cards

How To Change Name On Pan Card How To Change Name Names Cards