Property Plant And Equipment Balance Sheet Presentation

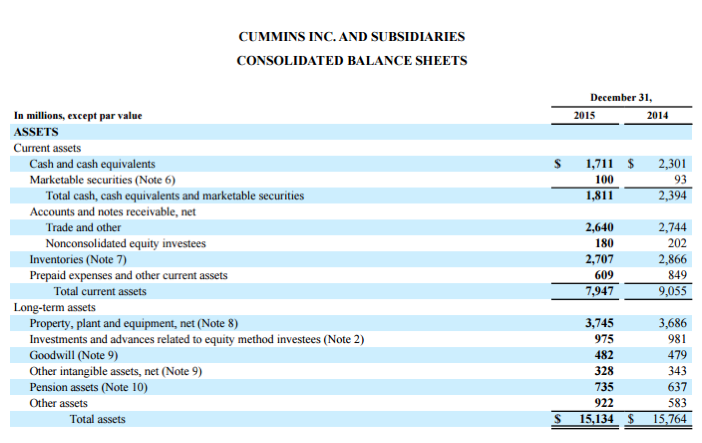

Presentation of Financial Statements Topic 205 and Property Plant and Equipment Topic 360 No. These are non-current assets that are used in the companys operations for a longer part of the time.

How Do Intangible Assets Show On A Balance Sheet

Examples of PPE include.

Property plant and equipment balance sheet presentation. Evaluate financial statements presentation and disclosure for property plant and equipment and for related revenues and expenses. To calculate PPE add the amount of gross property plant and equipment listed on the balance sheet to capital expenditures. In the statement of cash flows lease payments are classified.

Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Property Plant and Equipment PPE is a non-current tangible capital asset shown on the balance sheet of a business and is used to generate revenues and profits. They are also called as the fixed assets of the company as it cannot be easily liquidated.

Property plant and equipment PPE are long-term tangible assets that are physical in nature. Property Plant and Equipment When you own stuff often time when you use it a lot or over a long period of time it wears out and is worth less Remember. The reason for not appearing on the balance sheet is because the logo was developed internally and does not have a price that can be used to assign fair market value as would be the case had the.

Where a lessee chooses not to present its right-of-use assets separately on the face of the balance sheet they must be presented in the same line item that would be used if the underlying asset were owned. PPE is initially valued at the cost to acquire these assets We try to estimate the reduction in value of these assets due to getting older or wear. Machinery vehicles buildings com.

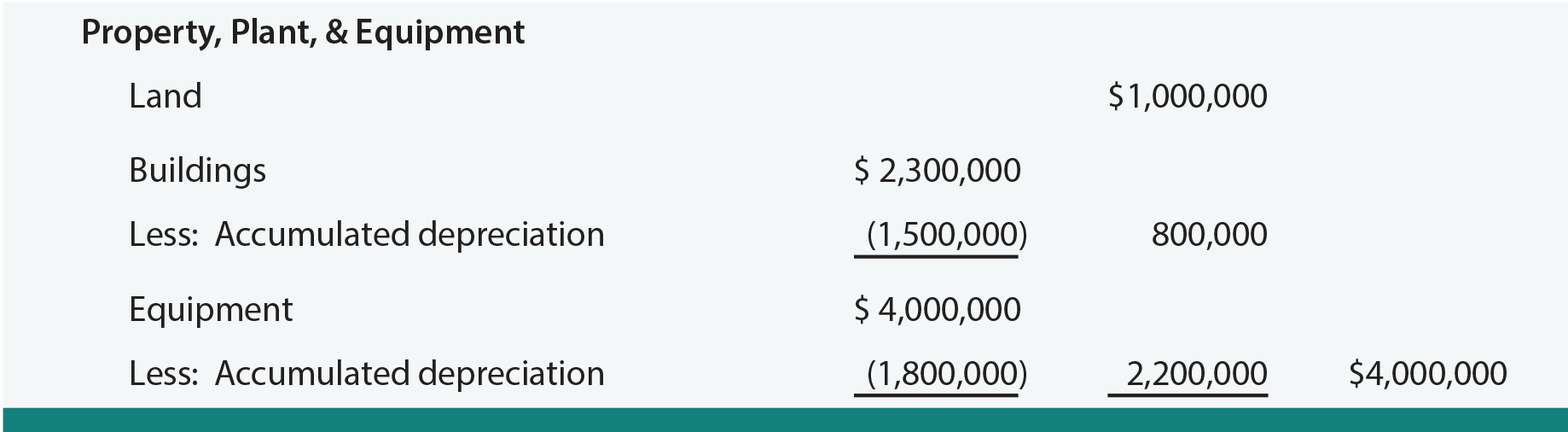

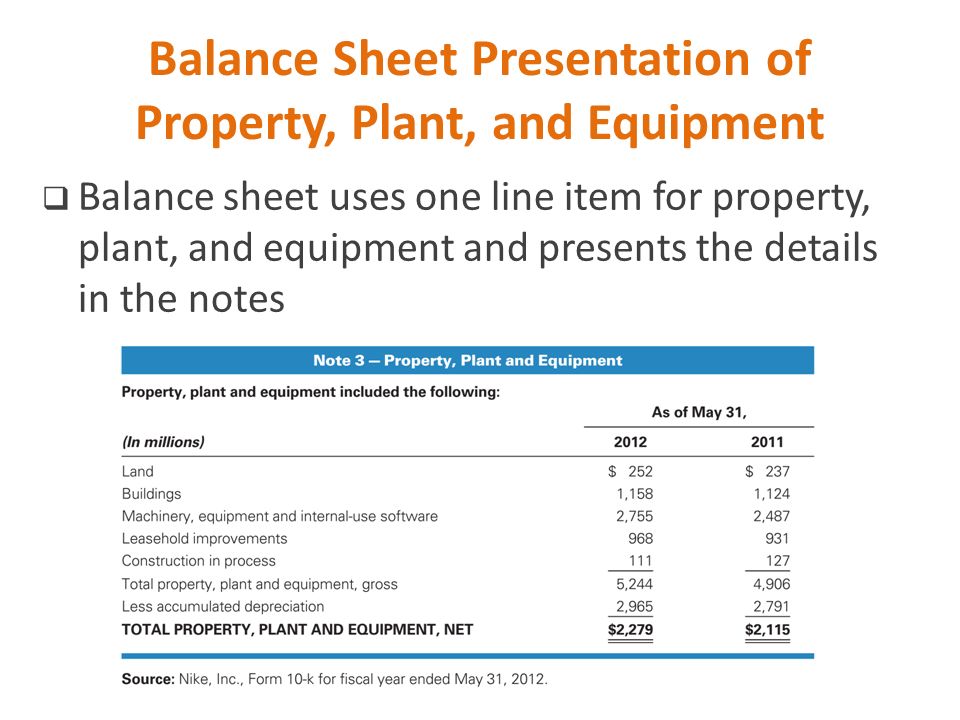

The balance sheet or accompanying notes should disclose balances of major classes of depreciable assets accumulated depreciation methods for computing depreciation base of valuation property pledged and property not in current use. Systems Jahangirnagar University Savar Slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising. PPE is made up of tangible capital assets.

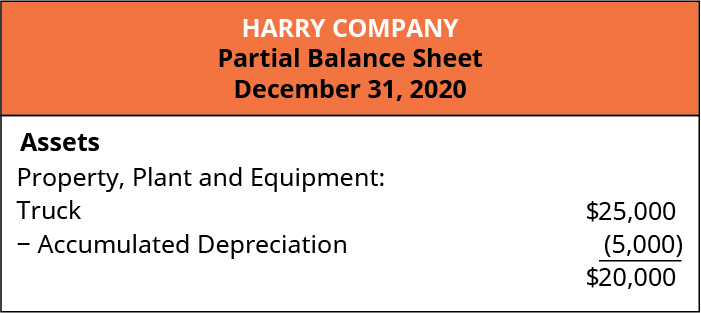

Next subtract accumulated depreciation from the result. PPE includes fixed assets that the entity uses for the production of goods andor rendering of services. This line item value includes real estate warehouses and other structures presses and other manufacturing equipment as well as office furniture such as desks file cabinets and computers.

The company has an independent appraisal that attests to this amount. The Property Plant and Equipment PPE classification is shown on the Statement of Financial PositionBalance Sheet under Non-Current Assets. IAS 16 Property Plant and Equipment outlines the accounting treatment for most types of property plant and equipment.

These statements are key to both financial modeling and accounting of a business used to generate revenues and profits. 2014-08 April 2014 Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity An Amendment of the FASB Accounting Standards Codification. As a whole property plant and equipment represents the fixed assets of an enterprise.

Mary Smith Capital. PPE plays a key part in the financial planning and analysis of a companys operations and future expenditures especially with regards to capital expenditures. It is located in the long-term asset section of the balance sheet under the heading of property plant and equipment.

Balance Sheet Presentation 1. Property plant and equipment includes deeds title insurance policies or abstract of title and an attorneys opinion as to title property tax bills insurance policies purchase contracts purchase. Machinery equipment vehicles buildings land and office space.

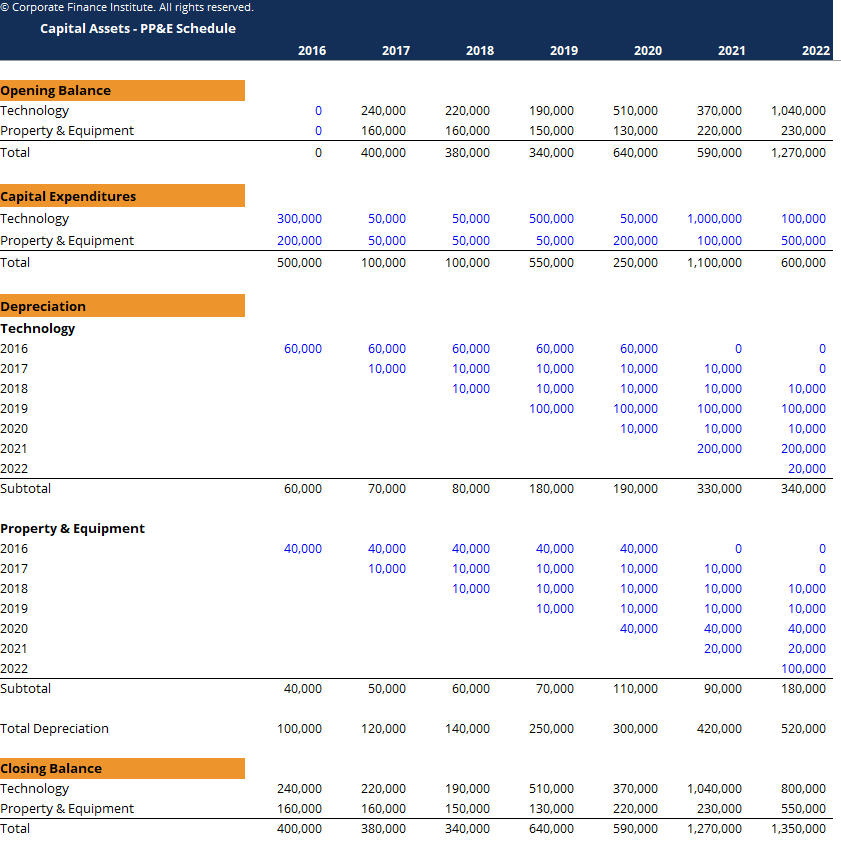

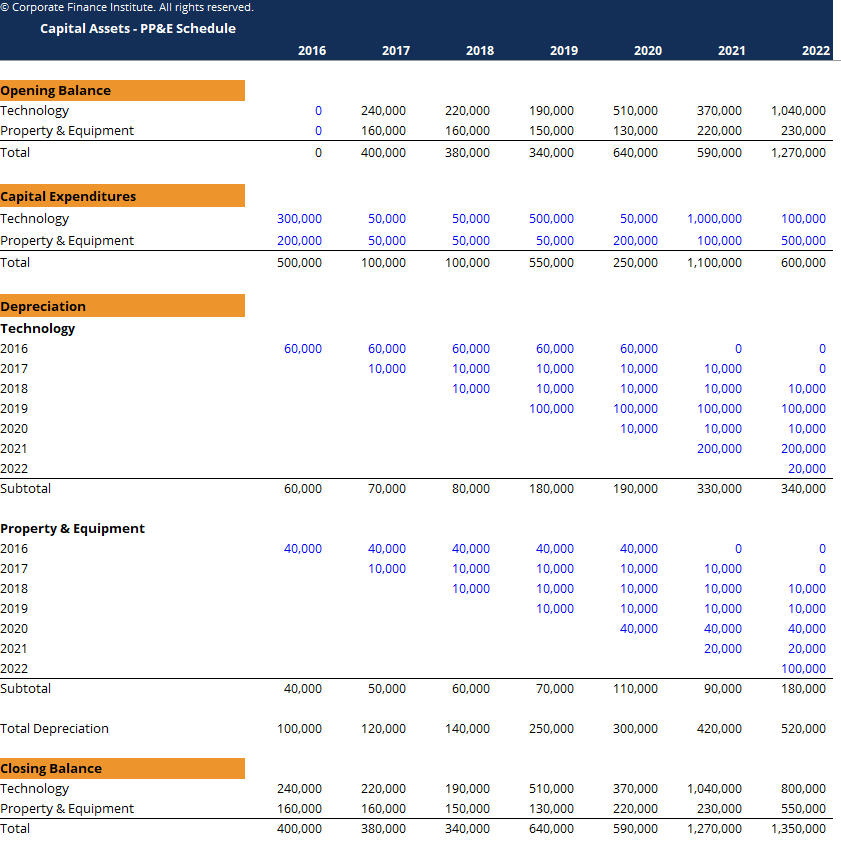

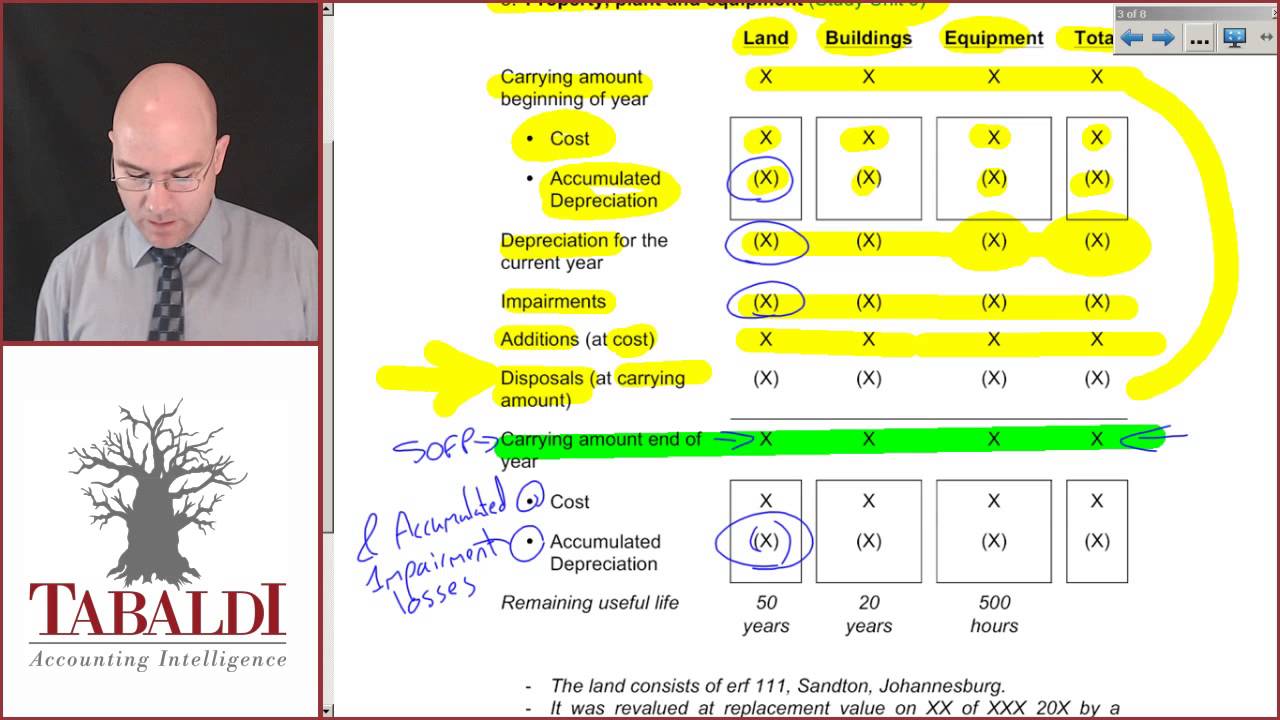

For each class of property plant and equipment a company must disclose the measurement bases the depreciation method the useful lives or equivalently the depreciation rate used the gross carrying amount and the accumulated depreciation at the beginning and end of the period and a reconciliation of the carrying amount at the beginning and end of the period. Description This is a simple and easy to use one-sheet worksheet that will allow you to monitor analyse and schedule the Property Plant Equipment PPE of your business over a 5 year period. The amount reported on the balance sheet for Property Plant and Equipment is the companys estimate of the fair market value as of the balance sheet date.

The property plant and equipment account is stated at cost except that it includes a parcel of land purchased for investment purposes at a cost of 40000. Of Accounting Info. Because of rising land prices the value of the land has been written up to 60000.

In many but not all cases this will be property plant and equipment. A presentation on Property Plant Equipment PPE-IAS 16 Prepared by a few students of Dept. Property Plant and Equipment PPE is a non-current tangible capital asset on the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements.

One of the most useful lines on a balance sheet for business owners and investors is the value of property plant and equipment known in short as PPE. 1316 The most appropriate balance sheet presentation of factory machinery not being used in present. Estimated total useful life Over longer time periods this ratio is a useful measure of companys depreciation policy and can be used for comparisons with competitors.

Solved Windsor Company Comparative Balance Sheets Decembe Chegg Com

Solved Windsor Company Comparative Balance Sheets Decembe Chegg Com

Financial Statement Presentation You Are The Senio Chegg Com

Financial Statement Presentation You Are The Senio Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg) Current And Noncurrent Assets The Difference

Current And Noncurrent Assets The Difference

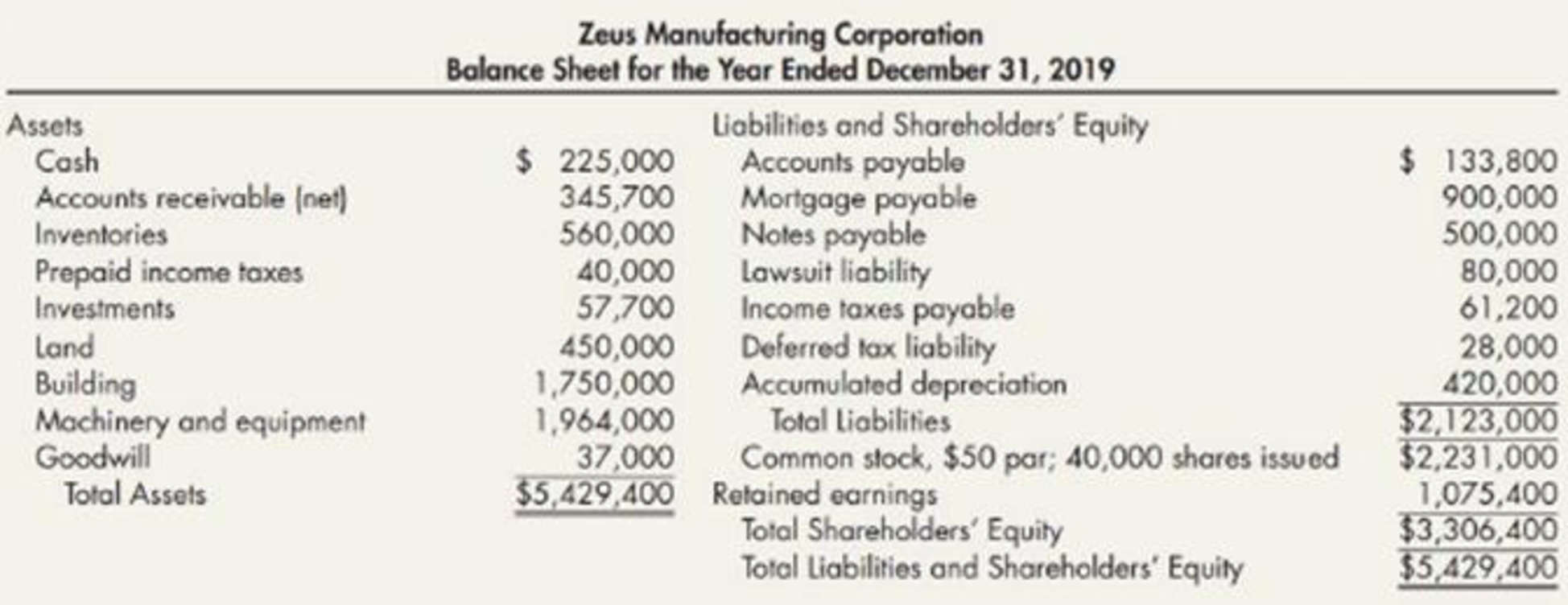

Complex Balance Sheet Presented Below Is The Unaudited Balance Sheet As Of December 31 2019 Prepared By Zeus Manufacturing Corporation S Bookkeeper Your Company Has Been Engaged To Perform An Audit During Which

Complex Balance Sheet Presented Below Is The Unaudited Balance Sheet As Of December 31 2019 Prepared By Zeus Manufacturing Corporation S Bookkeeper Your Company Has Been Engaged To Perform An Audit During Which

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Schedule Template Download Free Excel

Ias 16 Property Plant And Equipment Ppt Download

Ias 16 Property Plant And Equipment Ppt Download

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

11 Property Plant And Equipment Notes To The Consolidated Financial Statements Consolidated Financial Statements Registration Document 2014

Explain And Apply Depreciation Methods To Allocate Capitalized Costs Principles Of Accounting Volume 1 Financial Accounting

Explain And Apply Depreciation Methods To Allocate Capitalized Costs Principles Of Accounting Volume 1 Financial Accounting

Operating Assets Property Plant And Equipment And Intangibles Ppt Video Online Download

Operating Assets Property Plant And Equipment And Intangibles Ppt Video Online Download

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Net Financial Edge Training

Property Plant And Equipment Net Financial Edge Training

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

Fac2601 Property Plant And Equipment Notes Youtube

Fac2601 Property Plant And Equipment Notes Youtube

Information To Be Presented Either In The Statement Of Financial Position Or In The Notes Annual Reporting

Information To Be Presented Either In The Statement Of Financial Position Or In The Notes Annual Reporting

Ias 16 Property Plant Equipment Ppe

Ias 16 Property Plant Equipment Ppe

5 1 Intermediate Accounting 5 Balance Sheet And Statement Of Cash Flows Kieso Weygandt And Warfield Ppt Download

5 1 Intermediate Accounting 5 Balance Sheet And Statement Of Cash Flows Kieso Weygandt And Warfield Ppt Download