Property Tax Calculator Harris County

Harris County Tax Office Election Day Call Center Has Over 190 Trained Employees Ready to Help October 05 2020. The median property tax also known as real estate tax in Harris County is 304000 per year based on a median home value of 13170000 and a median effective property tax rate of 231 of property value.

Harris County Home Values Rise By 6 On Average Coronavirus Disaster Will Not Trigger Tax Relief Community Impact Newspaper

Harris County Home Values Rise By 6 On Average Coronavirus Disaster Will Not Trigger Tax Relief Community Impact Newspaper

Harris County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Property tax calculator harris county. Harris County has one of the highest median property taxes in the United States and is ranked 152nd of the 3143 counties in order of median property taxes. The median property tax on a 13170000 house is 304227 in Harris County. Harris County currently provides a 20 optional homestead exemption to all homeowners.

Property taxes also are known as ad valorem taxes because the taxes are levied on the value of the property. The median property tax on a 13170000 house is 238377 in Texas. The median property tax on a 19600000 house is 205800 in the United States.

The Harris County Tax Office is pleased to offer estimators for the various fees that residents pay for their passenger cars buses trailers and motor homes. County taxes all homeowners. Just select a category from the links above to access the fee estimator.

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Harris County. The median property tax payment in Texas is 3390 and the median home value is 200400.

The Property Tax Department is open for in-office appointments. Property Tax Payment Calculator Enter the amount you owe in property taxes and an estimated monthly payment and your savings with a property tax loan will automatically calculate. Our Harrison County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Mississippi and across the entire United States.

The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700. Harris County 2020 Property Tax Statements are in the Mail October 30 2020. The general countywide rate is 0391.

The median property tax on a 19600000 house is 162680 in Georgia. Harris County Assessors Office Services. The median property tax on a 13170000 house is 138285 in the United States.

Optional exemptions all homeowners. The average effective property tax rate in Harris County is 203 significantly higher than the national average. Harris County collects on average 231 of a propertys assessed fair market value as property tax.

The percentage depends on local tax rates from schools and other county concerns so it varies per area. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The highest rates however are those levied by school districts.

The median property tax on a 19600000 house is 139160 in Harris County. But high property taxes dont necessarily mean you should be a renter for life. King County Washington Property Tax Calculator Show 2015 Show 2016 Show 2017 Show 2018 Show 2019 Show 2020 Places Receiving the Most Value for Their Property Taxes.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Harris County. Your actual payment with us may be slightly higher or lower depending on your individual circumstances and loan preferences. In Harris County where Houston is located the average effective property tax rate is 203.

That average rate incorporates all types of taxes including school district taxes city taxes and special district levies. Harris County Voter Registrar Ann Harris Bennett Reminds the Public that TODAY is the LAST DAY to Register to Vote. This calculator assumes a 120 month loan.

Harris County property tax bills can be paid by touch-tone phone at any time from any place in the world seven days a week. For example a house appraised at 250000 in Houston or one of its suburbs has an effective tax rate of 182 or 4550 a year. The Harris County Tax Assessor-Collectors Office Property Tax Division maintains approximately 15 million tax accounts and collects property taxes for 70 taxing entities including Harris County.

Property tax rates in Texas are levied as a percentage of a homes appraised value. That means thousands of dollars a year in property taxes for the typical Texas homeowner. The phone number for making property tax payments is 713-274-2273.

Please click on the Property Transaction Appointment button below if you wish to schedule an appointment. Property taxpayers may use any combination of credit cards andor e-Checks for payment. Harris Countys 3356 median annual property tax payment and 165300 median home value are actually not that far off the statewide marks.

The Harris County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Harris County and may establish the amount of tax due on that property based on the fair market value appraisal. This means for example that if your home is valued at 100000 the exemption will reduce its taxable value for Harris County taxes by 20000 to 80000.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Illinois Property Tax Calculator Smartasset Com Property Tax Income Tax Tax

Illinois Property Tax Calculator Smartasset Com Property Tax Income Tax Tax

Minnesota Property Tax Calculator Smartasset

Minnesota Property Tax Calculator Smartasset

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Harris County Tx Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

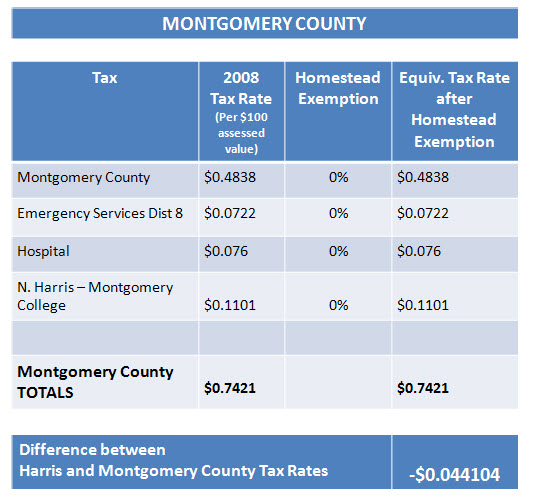

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

Harris County Appraisal District How Property Is Appraised Property Tax Appraisal Appraised Property Hcad Property Ta Appraisal Property Tax Harris County

Harris County Appraisal District How Property Is Appraised Property Tax Appraisal Appraised Property Hcad Property Ta Appraisal Property Tax Harris County

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

Property Tax Houston Texas Taxes And Houses A Harris County Property Tax Overview Tax Lawyer Tax Debt Credit Card Debt Relief

Property Tax Houston Texas Taxes And Houses A Harris County Property Tax Overview Tax Lawyer Tax Debt Credit Card Debt Relief

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Harris County Texas Property Taxes 2021

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

Tax Rates Harris County Georgia

Property Taxes In Texas Harris County Commissioners Eyeing Property Tax Rates Abc13 Houston

Property Taxes In Texas Harris County Commissioners Eyeing Property Tax Rates Abc13 Houston

Map The Most And Least Tax Friendly States Best Places To Retire Retirement Locations Map

Map The Most And Least Tax Friendly States Best Places To Retire Retirement Locations Map

How To Lower Property Taxes Keeping Your Value Low Poconnor Com

How To Lower Property Taxes Keeping Your Value Low Poconnor Com

Houston Property Tax Altus Group

Houston Property Tax Altus Group

Predictive Crm Real Estate Crm Crm Software Crm

Predictive Crm Real Estate Crm Crm Software Crm