Property Tax Rate Palm Beach County Fl

Tax Collector Palm Beach County 301 North Olive Ave 3rd Floor West Palm Beach FL 33401. Values can also change based upon market conditions.

Pin By Metro City Realty On Real Estate Tips Home Ownership Real Estate Infographic Consumer Finance

Pin By Metro City Realty On Real Estate Tips Home Ownership Real Estate Infographic Consumer Finance

Lucie 2198 Martin 2315 Collier 2399 Broward 2664 Monroe 2673 Palm Beach 2679 St.

Property tax rate palm beach county fl. Palm Beach County collects on average 102 of a propertys assessed fair market value as property tax. These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes. The median property tax also known as real estate tax in Palm Beach County is 267900 per year based on a median home value of 26190000 and a median effective property tax rate of 102 of property value.

I am honored to be chosen to lead this professional organization said Jacks. Wire transfers are accepted for payment of current and delinquent taxes. Currently the Palm Beach Countys tax rate is 478 for every 1000 in taxable value a rate that has not changed in seven years.

Skip to Main Content. Johns 2702 Miami-Dade 2756. Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida.

11202020 West Palm Beach FL Palm Beach County Property Appraiser Dorothy Jacks CFA AAS was elected to serve as president of the Florida Association of Property Appraisers FAPA Tuesday night. Palm Beach Countys average effective property tax rate is 106 which is higher than most Florida counties. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Box 2029 Palm Beach FL 33480 Phone. That rate was third-highest among Floridas 43 largest counties. Property Tax Appeals for Palm Beach County Tel.

Florida Counties With the HIGHEST Median Property Taxes. Palm Beach County Property Records are real estate documents that contain information related to real property in Palm Beach County Florida. Our Palm Beach County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States.

Please submit our Wire Transfer Instructions form. FAPA members are committed to upholding the highest professional standards in the real estate. COVID-19 UPDATE WEEKLY COVID-19 UPDATE.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The median property tax in Palm Beach County Florida is 2679 per year for a home worth the median value of 261900. Location Address 14190 PALM BEACH POINT BLVD.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The property tax rate for Palm Beach County is 130 which is about equal to the the nationwide average effective property tax rate. Total billing is 44.

Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected. Property owners can pay 2020 property tax now through March 31 2021 West Palm Beach Fla. Property Tax Information Palm Beach County Tax Collector.

Box 3353 West Palm Beach FL 33402-3353. An increase in the future millage rate may further increase taxes and non Ad Valorem assessments are subject to change. The instructions will.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Gannon announced the collection of 2020 property tax begins today Friday October 30 two days ahead of schedule. 3309 Northlake Blvd Suite 105 Palm Beach Gardens FL 33403.

The analysis says Palm Beach County imposed a property tax rate of 126 percent on single-family homes in 2017. Learn about property taxes in Palm Beach. Hillsborough 2168 Lee 2197 St.

Since the median value of property in Palm Beach County FL is 199700 the median annual property tax payment in West Palm Beach is 2587. The median real estate tax payment is 2805 also one of the highest. 360 South County Road PO.

Box 3353 West Palm Beach FL 33402-3353. Tax Collector Palm Beach County PO. Palm Beach County Tax Collector.

Gannon Constitutional Tax Collector Serving Palm Beach County PO. Constitutional Tax Collector Anne M.

2020 Best Places To Buy A House In Palm Beach County Fl Niche

2020 Best Places To Buy A House In Palm Beach County Fl Niche

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Downtown West Palm Beach Fl Downtown West Palm Beach Palm Beach Atlantic West Palm Beach

Downtown West Palm Beach Fl Downtown West Palm Beach Palm Beach Atlantic West Palm Beach

Palm Beach December 2018 Market Update Palm Beach County Portstlucie Florida Realestate Newhome Home Stl Palm Beach County Palm Beach Miami Dade County

Palm Beach December 2018 Market Update Palm Beach County Portstlucie Florida Realestate Newhome Home Stl Palm Beach County Palm Beach Miami Dade County

County Administer Seeks Higher Property Tax Rate For Next Year S Budget Indian River County Indian River County

County Administer Seeks Higher Property Tax Rate For Next Year S Budget Indian River County Indian River County

Beach At Boca Raton Florida Beach Delray Beach Deerfield Beach

Beach At Boca Raton Florida Beach Delray Beach Deerfield Beach

The Booker Vernie Team Is Proud To Present Prestigious Wellington Florida Property Berkshire Hathaway Homeservices Florida Realty Florida Real Estate Estate Homes Realty

The Booker Vernie Team Is Proud To Present Prestigious Wellington Florida Property Berkshire Hathaway Homeservices Florida Realty Florida Real Estate Estate Homes Realty

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Fau Overpricing In South Florida Housing Markets December 2020

Fau Overpricing In South Florida Housing Markets December 2020

Palm Beach County Property Taxes

Palm Beach County Property Taxes

Www Pbctax Com Mortgage Interest Rates Palm Beach Real Estate Investing

Www Pbctax Com Mortgage Interest Rates Palm Beach Real Estate Investing

Palm Club Village Home For Rent West Palm Beach Palm Beach Palm Beach Fl

Palm Club Village Home For Rent West Palm Beach Palm Beach Palm Beach Fl

Palm Beach County Property Tax Records Palm Beach County Property Taxes Fl

Palm Beach County Property Tax Records Palm Beach County Property Taxes Fl

Newly Listed Palm Beach Gardens Florida Home For Sale Newlisting Mirasol Palmbeachg Palm Beach Gardens Palm Beach Gardens Florida South Florida Real Estate

Newly Listed Palm Beach Gardens Florida Home For Sale Newlisting Mirasol Palmbeachg Palm Beach Gardens Palm Beach Gardens Florida South Florida Real Estate

November 2020 Market Snippet In 2021 Real Estate Education Boynton Beach Marketing

November 2020 Market Snippet In 2021 Real Estate Education Boynton Beach Marketing

2020 Property Tax Constitutional Tax Collector

2020 Property Tax Constitutional Tax Collector

Real Estate Market Update March 2016 Mortgage Masters Group Real Estate Marketing Marketing Marketing Jobs

Real Estate Market Update March 2016 Mortgage Masters Group Real Estate Marketing Marketing Marketing Jobs

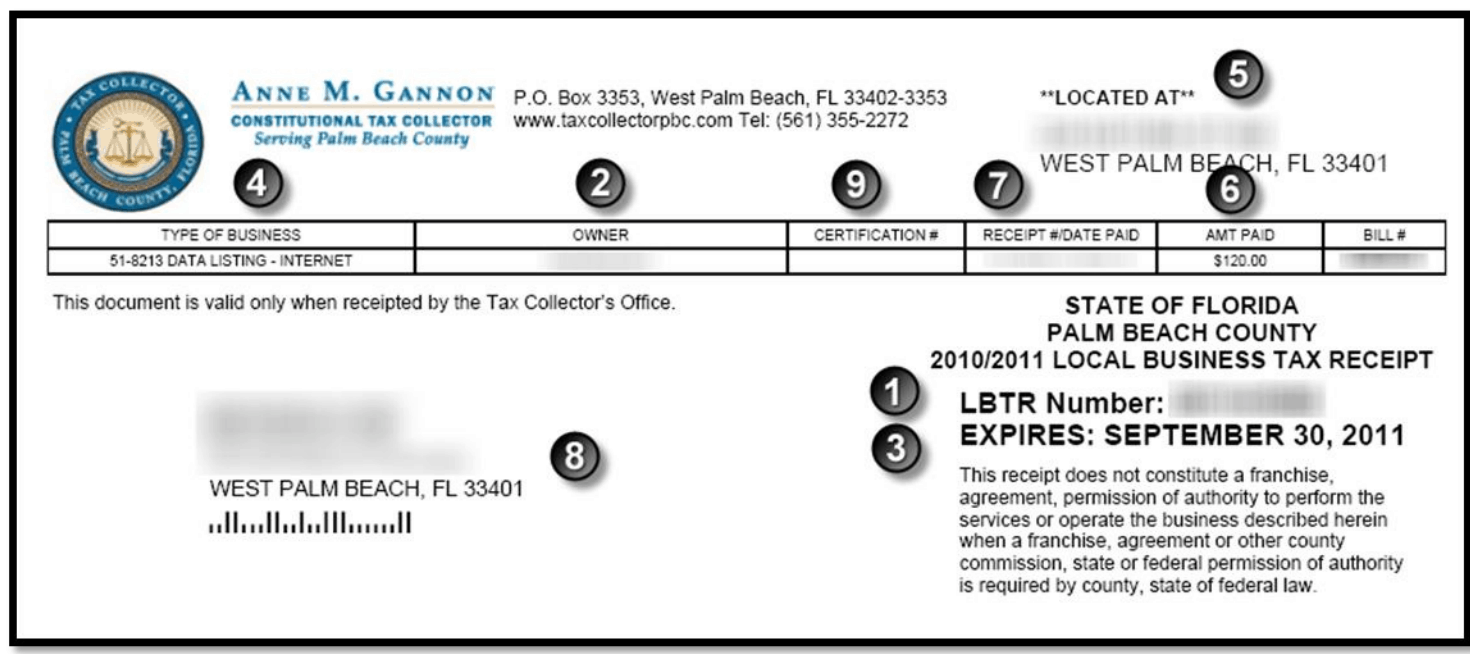

Local And County Tax Receipt Laws In Palm Beach County

Local And County Tax Receipt Laws In Palm Beach County