How To Determine Property Plant And Equipment Costs

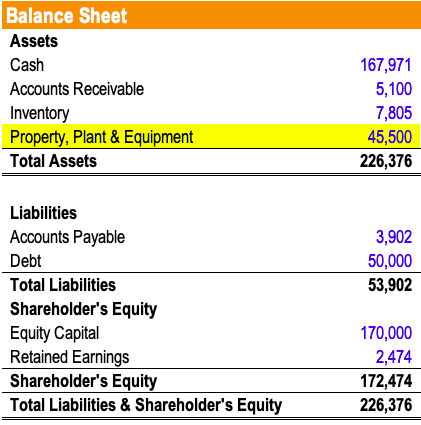

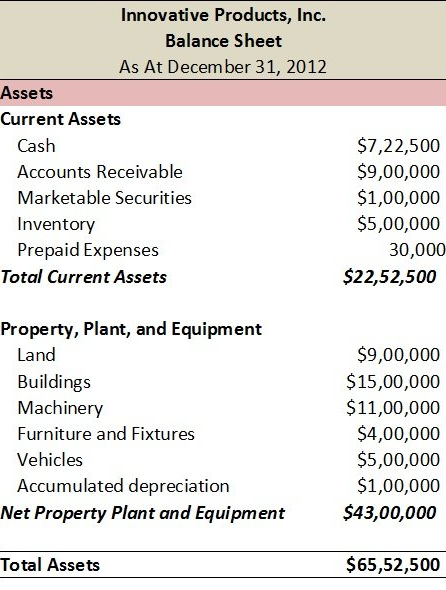

When a plant asset is purchased for cash its acquisition cost is simply the agreed on cash price. Property Plant and Equipment PPE is a non-current tangible capital asset shown on the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements.

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Whether you want to determine if renting is more cost effective or youre simply trying to work equipment rental into your budget youll need to be able to calculate rental rates.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

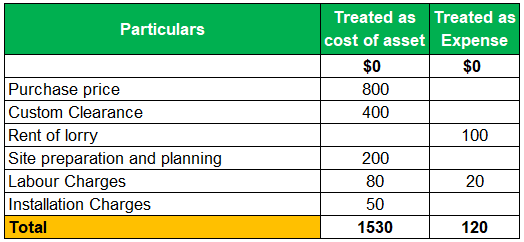

How to determine property plant and equipment costs. Measurement after Recognition of Property Plant and Equipment 1 Cost Model. Number of years it is likely to remain in service for the purpose of cost-effective. Between 2017 and 2019 most per acre costs increased between 7 and 9 percent.

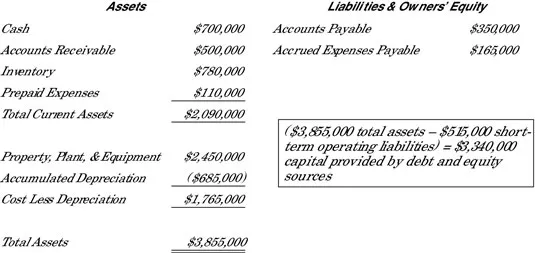

Land purchases often involve real estate commissions legal fees bank fees title search fees and similar expenses. Property Plant Equipment is a separate category on a classified balance sheet. These statements are key to both financial modeling and accounting of a business and is used to generate revenues and profits.

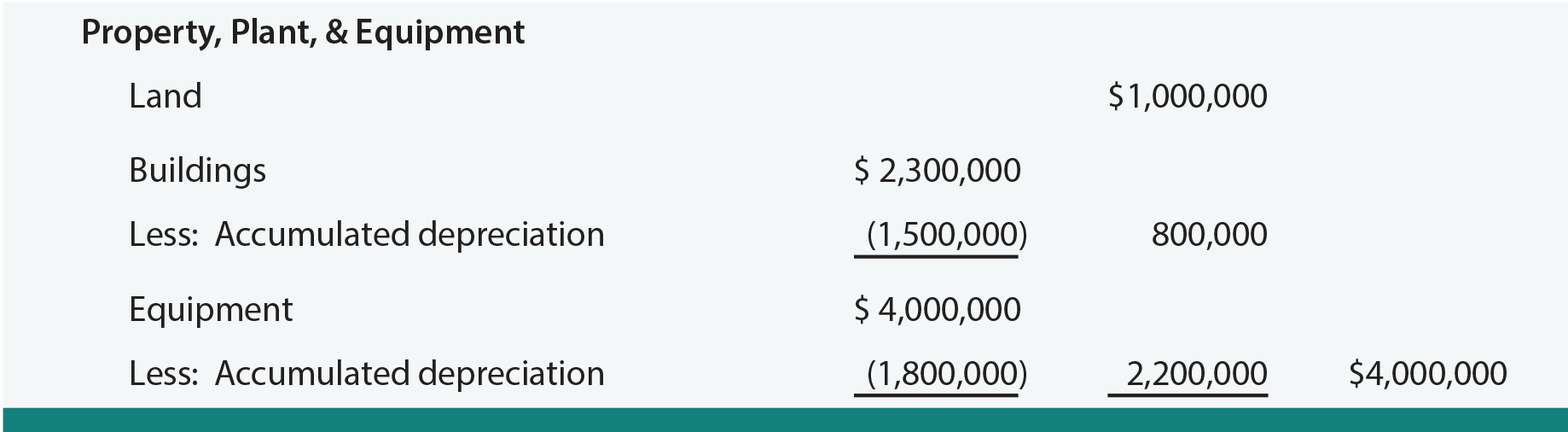

To be prepared for use land may need to be cleared of trees drained and filled graded to remove small hills and depressions and landscaped. Land buildings and equipment. As a whole property plant and equipment represents the fixed assets of an enterprise.

Initial recording of plant assets. Because units cannot update movable equipment information directly in Banner they use FABweb a web-based system. How to Determine a Tangible Assets Useful Life.

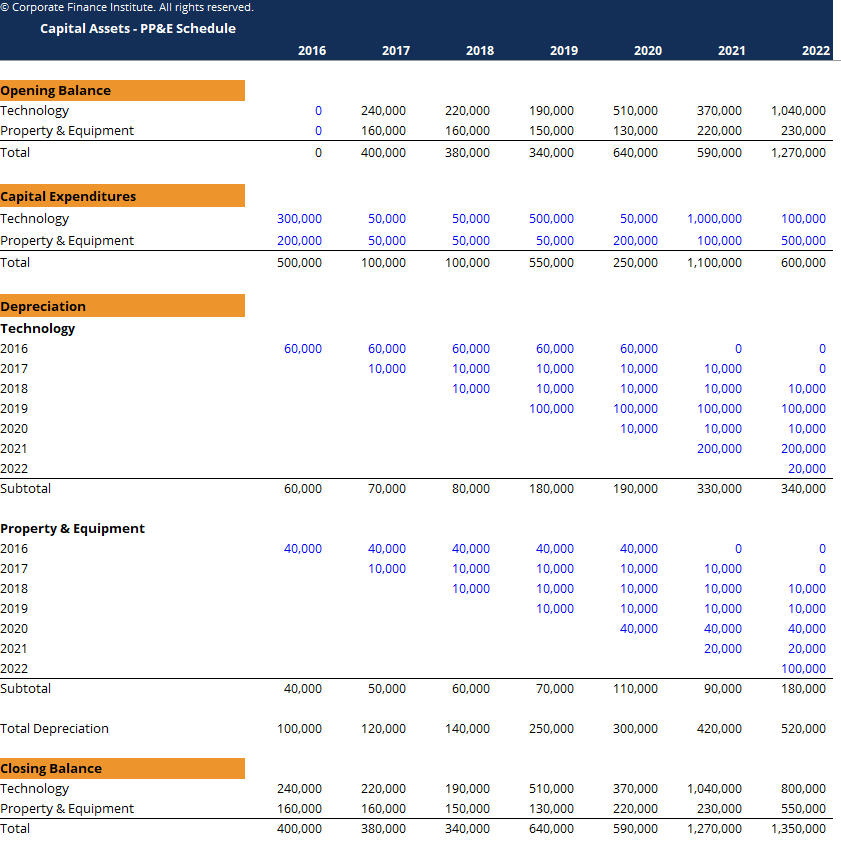

Gross PPE is the total cost you paid for all the assets at the start. To calculate PPE add the amount of gross property plant and equipment listed on the balance sheet to capital expenditures. And b the cost of the item can be measured reliably.

Cash inflow from sale of Land Decrease in Land BS Gain from Sale of Land 80000 70000 20000 30000 Cash outflow from purchase of property plant and equipment PPE 120000 170000 -50000. Before you can start calculating its essential to determine the cost of the equipment youre planning to rent. 7 The cost of an item of property plant and equipment shall be recognised as an asset if and only if.

How to Calculate Net PPE To calculate net PPE you take gross PPE add related capital expenses and subtract depreciation. It typically follows Long-term Investments and is oftentimes referred to as PPE Items appropriately included in this section are the physical assets deployed in the productive operation of the business like land buildings and equipment. Which functions as the official record of property plant and equipment.

Physical Inventory of Equipment Property Accounting CONTROLLER iii. And computing indirect costs on sponsored projects. Note that idle facilities and land held for speculation are more.

When a company acquires a plant asset accountants record the asset at the cost of acquisition historical cost. Depreciation applies to three classes of plant assets. There are two main items in non-current assets Land and Property Plant and Equipment.

To Understanding Property Plant and Equipment PPE. Depreciation is a process of asset valuation not cost allocation. A it is probable that future economic benefits associated with the item will flow to the entity.

2 Revaluation Model. HOW TO DETERMINE PROPERTY PLANT AND EQUIPMENT COSTS Plant Assets Resources that are physical have size and shape Used in operations of business Not intended for sale to customers HISTORICAL COST PRINCIPPLE REQUIRES THAT COMPANIES REPORT PLANT ASSETS AT COST Cost consists of all expenditures necessary to acquire an asset and make it ready for its intended use. Expenditure incurred on purchase or construction of property plant and equipment is called capital expenditure.

Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. The book value of a plant asset should approximate its fair value. This line item value includes real estate warehouses and other structures presses and other manufacturing equipment as well as office furniture such as desks file cabinets and computers.

Depreciation provides for the proper matching of expenses with revenues. To illustrate assume the Miller Company purchases a lathe from the Arnold Company. Such an expenditure is capitalized which means that it is recorded on the balance sheet and written off as expense over the useful life of the fixed asset through a process called depreciation.

The Asset is recorded as per the revalued amount. The cost of property plant and equipment includes the purchase price of the asset and all expenditures necessary to prepare the asset for its intended use. Dale Lattz and Gary Schnitkey Weekly Farm Economics Machinery cost estimates for agricultural uses have been updated for 2019.

The Asset is measured at its cost reduced by accumulated depreciation and impairment loss if any. The last time machinery costs were released on farmdoc was in 2017. On the balance sheet these assets appear under the heading Property plant and equipment.

Some places will. It is the assets net cash equivalent price paid plus all other costs necessary to get the asset ready to use. Next subtract accumulated depreciation from the result.

Cash Acquisitions When property plant and equipment are purchased for cash the acquisition price is easy to determine.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

Land Clearing Costs Land Clearing Site Preparation Garden Services

Land Clearing Costs Land Clearing Site Preparation Garden Services

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Interest Capitalization Ch10 P 2 Intermediate Accounting Cpa Exam Cpa Exam Accounting Accounting Notes

Interest Capitalization Ch10 P 2 Intermediate Accounting Cpa Exam Cpa Exam Accounting Accounting Notes

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Fixtures And Fittings Write It Off Fixtures And Fittings Also Known As Plant Equipment Or Articles Are Generally Removabl How To Remove Writing Deduction

Fixtures And Fittings Write It Off Fixtures And Fittings Also Known As Plant Equipment Or Articles Are Generally Removabl How To Remove Writing Deduction

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

Pin Von Elhassen Auf The Accountant In Me Auszug

Pin Von Elhassen Auf The Accountant In Me Auszug

Balance Sheet Template Sample Balance Sheet Template Balance Sheet Sheet

Balance Sheet Template Sample Balance Sheet Template Balance Sheet Sheet

Chart Of Accounts For Small Business Template Double Entry For Bookkeeping For A Small Busi Chart Of Accounts Bookkeeping Templates Small Business Accounting

Chart Of Accounts For Small Business Template Double Entry For Bookkeeping For A Small Busi Chart Of Accounts Bookkeeping Templates Small Business Accounting

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

Plant Assets What Are They And How Do You Manage Them The Blueprint

Plant Assets What Are They And How Do You Manage Them The Blueprint

Real Estate Profit And Loss Statement Form How To Create A Real Estate Profit And Loss Statement Form Download Th Profit And Loss Statement Profit Templates

Real Estate Profit And Loss Statement Form How To Create A Real Estate Profit And Loss Statement Form Download Th Profit And Loss Statement Profit Templates

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

How To Read The Balance Sheet Understand B S Structure Content Balance Sheet Financial Statement Balance

How To Read The Balance Sheet Understand B S Structure Content Balance Sheet Financial Statement Balance

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Schedule Template Download Free Excel

Business Balance Sheet Balance Sheet Template Balance Sheet Trial Balance

Business Balance Sheet Balance Sheet Template Balance Sheet Trial Balance