Land Value Calculator Vic

And if youre purchasing between 600000 and 750000 there will be a discount. One of the biggest obstacles every land investor has to wrestle with is how to find the market value of vacant land.

Strata101 If You Own A Strata Titled Property In Victoria You Automatically Become Part Of The Owners Corporation For That Corporate Strata S Corporation

Strata101 If You Own A Strata Titled Property In Victoria You Automatically Become Part Of The Owners Corporation For That Corporate Strata S Corporation

From the 1 st July 2017 First Home Buyers will receive additional incentives when purchasing brand new or established property.

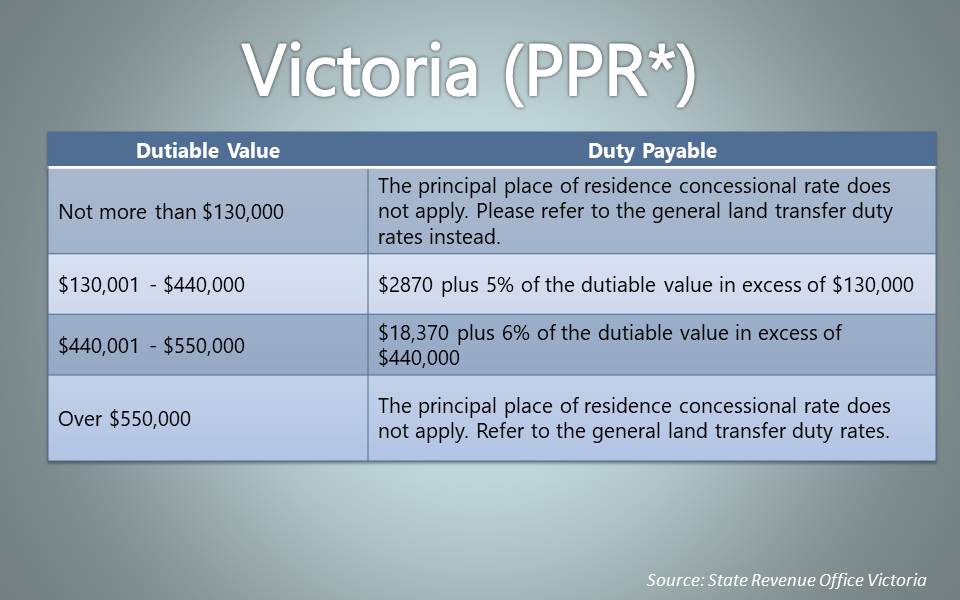

Land value calculator vic. Land Valuation AcreValue analyzes terabytes of data about soils climate crop rotations taxes interest rates and corn prices to calculate the estimated value of an individual field. This will include the value of land and any improvements on the land. This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on.

The site value of your land is used to calculate land tax. Site value and land tax Site value is the unimproved value of your land which means it excludes capital improvements such as buildings. Rates Calculator XLSX 42KB.

There is a Municipal Charge of 15000 per property to cover administration costs. Land Tax Calculator VIC This VIC land tax calculator will estimate the amount of land tax you need to pay for your taxable properties in VIC. For purchases up to 600000 youll receive an exemption of stamp duty.

Once a general valuation is completed councils receive the valuations to calculate the rates you pay. The rate in the dollar is multiplied by the valuation. The CIV is then multiplied by the current years rate in the dollar.

The date of the contract for your property purchase or if there is no contract the date it is transferred. We honour Elders past and present whose knowledge and wisdom has ensured the continuation of culture and traditional practices. The capital improved value of your land is used to calculate vacant residential land tax.

Property Value and Property Pages exist to help people researching Australian property make informed decisions when buying and selling. The VIC land tax is calculated on the combined taxable land value of the properties you have in VIC. The formula for calculating the rates for an individual property is the property valuation multiplied by the rate in the dollar set by the council.

Wonder what are the current VIC land tax rates and thresholds. For residential houses units and rural properties the NAV is calculated as 5 per cent of the capital improved value the value of the house and land. Whilst we understand some property owners may prefer this information be kept confidential we are licensed to display this information from various third parties.

Calculating proportional land tax. For land used by a nominated PPR beneficiary of a unit or discretionary trust please use our general rates calculator to calculate the land tax applying to this land. Do not include the value of any exempt land such as primary production land or land used as the home principal place of residence PPR of a nominated PPR beneficiary.

First Home Buyers in Victoria. Each councils Financial Performance can be viewed and compared in the Compare Councils section of this site. To do this click on the service area icon select your council from the filter then use the checkbox to select three additional similar councils for comparison from the list.

Property estimates are simply better when these characteristics are taken into account so we calculate the value of your property by combining the the latest market data with your unique knowledge - and thats how our online property value estimator is different. Discover the value of over 9 million properties in Australia with Price Estimator. Your absentee owner status.

For example if the Capital Improved Value of a property is 250000 and the council rate in the dollar is set at 042 cents the rate bill would be 1050 250000 x 00042. We acknowledge and respect Victorian Traditional Owners as the original custodians of Victorias land and waters their unique ability to care for Country and deep spiritual connection to it. Do not include the value of any exempt land such as your home also known as your principal place of residence PPR or primary production land.

The Victorian legislation that enables councils to levy rates and charges is the Local Government Act 1989. Site value is determined as part of the annual statewide general valuation process by the Valuer-General Victoria. The valuation used will be either the Capital Improved Value CIV or the Net Annual Value NAV.

Onthehouse helps you discover Real Estate in Australia with Property Values Real Estate for Sale and Real Estate for Rent Onthehouse is an all-in-one real estate research site that gives you all the information you need about homes for sale apartments for rent suburb insights markets and trends to help you figure out exactly what where. 275 480000 - 250000 x 02 735. Therefore Alice must pay 735 in land tax calculated as follows.

It may seem like an odd dilemma to a conventional real estate investor but trust me if youve ever tried to find comps or relevant valuation data for a parcel of raw land you know how challenging it can be to nail down a concrete value for this type of real estate. We calculate rates based on each propertys Net Annual Value NAV. The general land tax rate for land holdings valued from 250000 to less than 600000 is 275 02 of any amount greater than 250000.

Calculate your land tax. Changes in the rate in the dollar or of a valuation may impact the rates payable. How we calculate rates.

Use the online stamp duty calculator to do your own calculation. We use site value find the total taxable value on your land tax assessment notice.

Coin Currency Coins Australian Money Currency

Coin Currency Coins Australian Money Currency

The Luno Field Is An Oil Field Located In The Norwegian Sector Of The North Sea Which Incorporates Both The Luno And Tellus Discover Norway North Sea Stavanger

The Luno Field Is An Oil Field Located In The Norwegian Sector Of The North Sea Which Incorporates Both The Luno And Tellus Discover Norway North Sea Stavanger

Stakeholder Analysis Stakeholder Matrix Stakeholder Analysis Stakeholder Management Analysis

Stakeholder Analysis Stakeholder Matrix Stakeholder Analysis Stakeholder Management Analysis

Yarraville Vic Nissen Hut By Livingstone Clark Design Our House Quonset Homes Quonset Hut Homes Steel Building Homes

Yarraville Vic Nissen Hut By Livingstone Clark Design Our House Quonset Homes Quonset Hut Homes Steel Building Homes

O P P Cruiser Victoria Police Police Police Cars

O P P Cruiser Victoria Police Police Police Cars

For Sale In Australia 1983 Toyota Landcruiser Hj60 Deluxe Everything Fj60

For Sale In Australia 1983 Toyota Landcruiser Hj60 Deluxe Everything Fj60

How To Make Calculation With Successive Bisection Of Arcs Method For Setting Out A Horizontal Circular Land Surveying Civil Engineering Software Bridge Design

How To Make Calculation With Successive Bisection Of Arcs Method For Setting Out A Horizontal Circular Land Surveying Civil Engineering Software Bridge Design

Vic Stamp Duty Calculator 2020 Land Transfer Duty

Vic Stamp Duty Calculator 2020 Land Transfer Duty

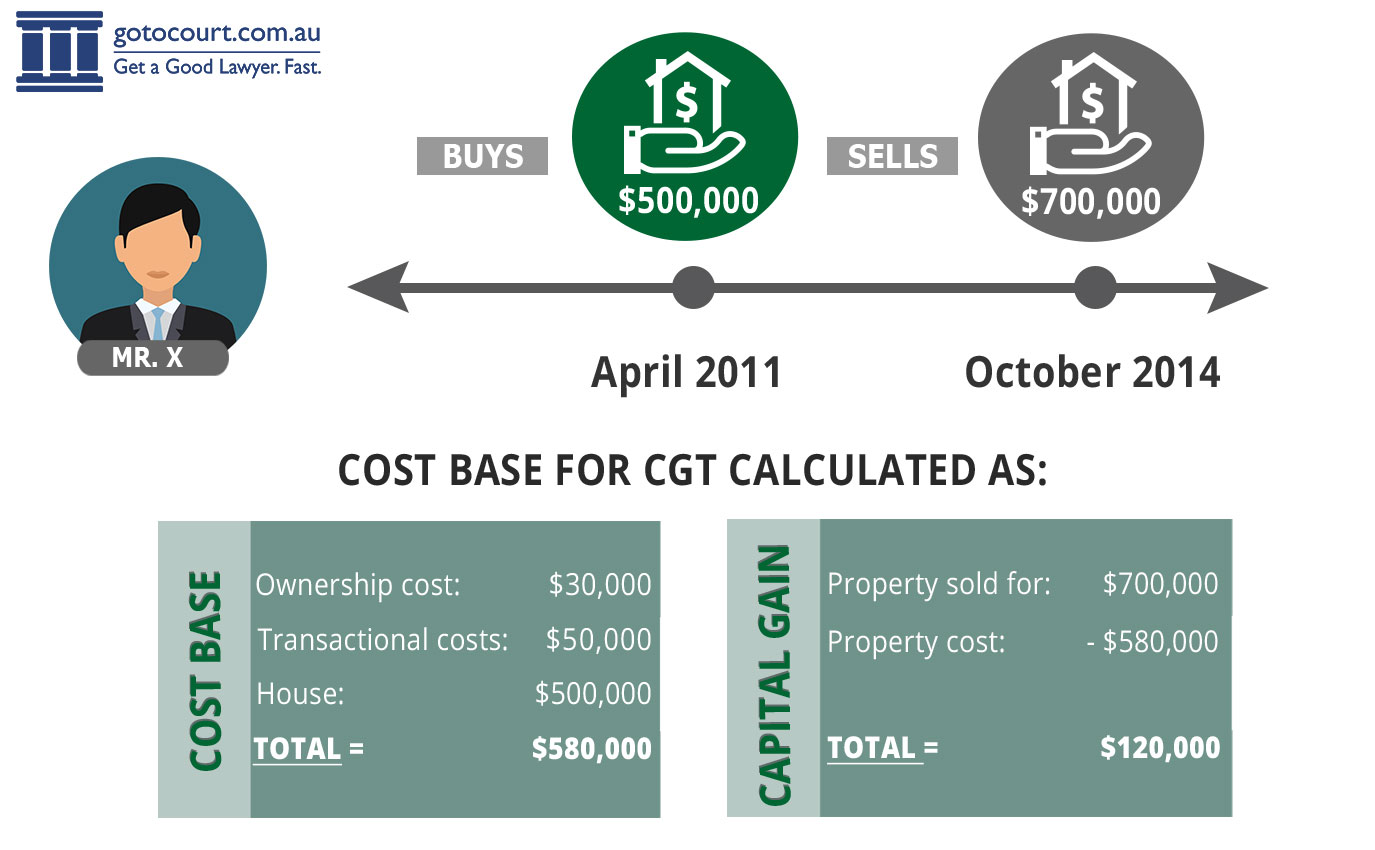

Calculating Capital Gains Tax Cgt In Australia

Calculating Capital Gains Tax Cgt In Australia

Land Tax For Property Held In Smsf

Land Tax For Property Held In Smsf

Wheaton Il Police 366 Ford Cvpi Police Cars Emergency Vehicles Police Uniforms

Wheaton Il Police 366 Ford Cvpi Police Cars Emergency Vehicles Police Uniforms

3 Statement Modeling And Valuation Model Efinancialmodels Excel Financial Financial Modeling

3 Statement Modeling And Valuation Model Efinancialmodels Excel Financial Financial Modeling

Pin By Berkshire Hataway Homeservices On Website Things To Sell Berkshire

Pin By Berkshire Hataway Homeservices On Website Things To Sell Berkshire

Stamp Duty Vic Stamp Duty Calculator Rates Mozo

Stamp Duty Vic Stamp Duty Calculator Rates Mozo

Stamp Duty Calculator Vic Victoria Compare The Market

Stamp Duty Calculator Vic Victoria Compare The Market

Stamp Duty Victoria Vic Stamp Duty Calculator

Stamp Duty Victoria Vic Stamp Duty Calculator