Nyc Department Of Finance Property Tax Abatement

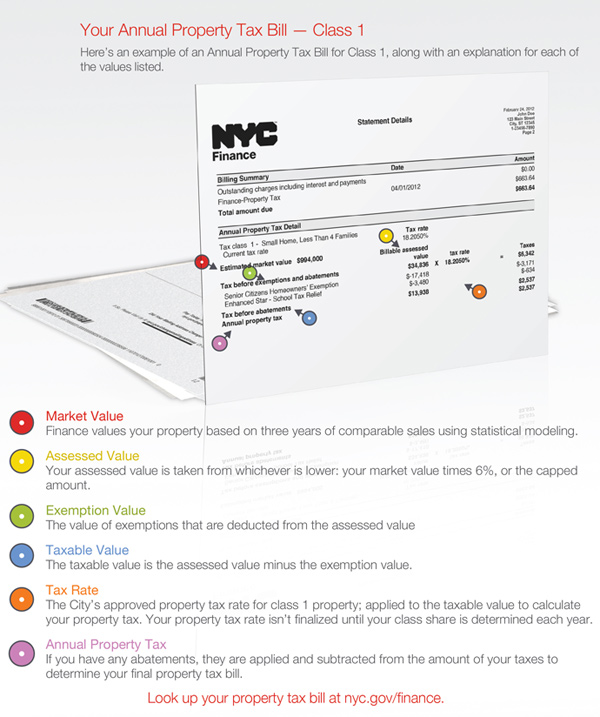

Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services. Exemptions lower the amount of tax you owe by reducing your propertys assessed value.

Buying An Apartment With A J 51 Tax Abatement Hauseit

Buying An Apartment With A J 51 Tax Abatement Hauseit

Visit Department of Labor for your unemployment Form 1099-G.

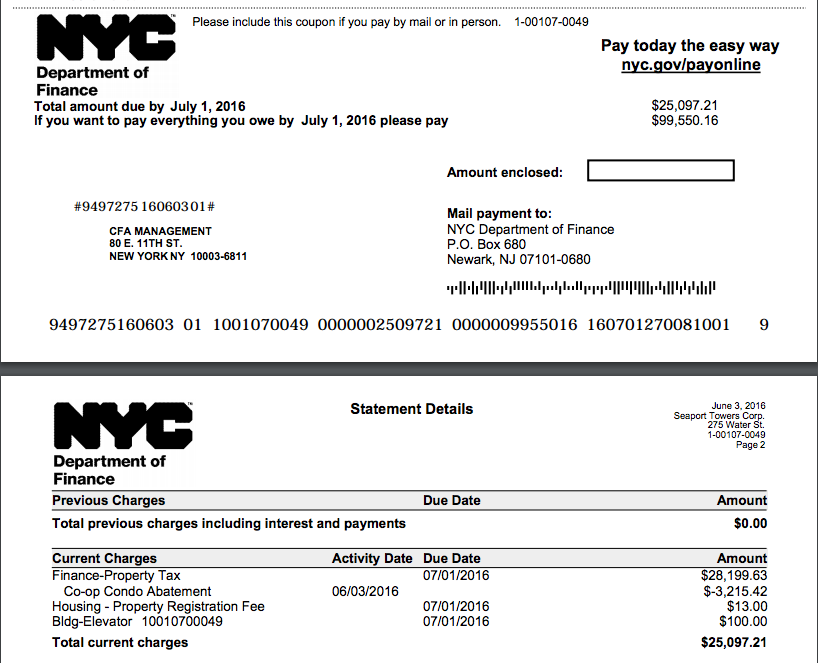

Nyc department of finance property tax abatement. Abatements reduce your taxes by applying credits to the amount of taxes you owe. The coop condo tax abatement in NYC is a reduction in annual property taxes of 175 for properties with average assessed values of 60001 and above up to 281 for properties with an average assessed value of 50000 or less based on the following sliding scale. NYC is a trademark and service mark of the City of New York.

Unemployment insurance UI recipients. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. Department of Finance 311 Search all NYCgov websites.

You may need to report this information on your 2020 federal income tax return. In Public Access you can. 100 of the tax shown on your 2019 return 110 of that amount if you are not a farmer or a fisherman and the New York adjusted gross income NYAGI or net earnings from self-employment allocated to the MCTD shown on that return is more than 150000 75000 if married filing separately for 2020.

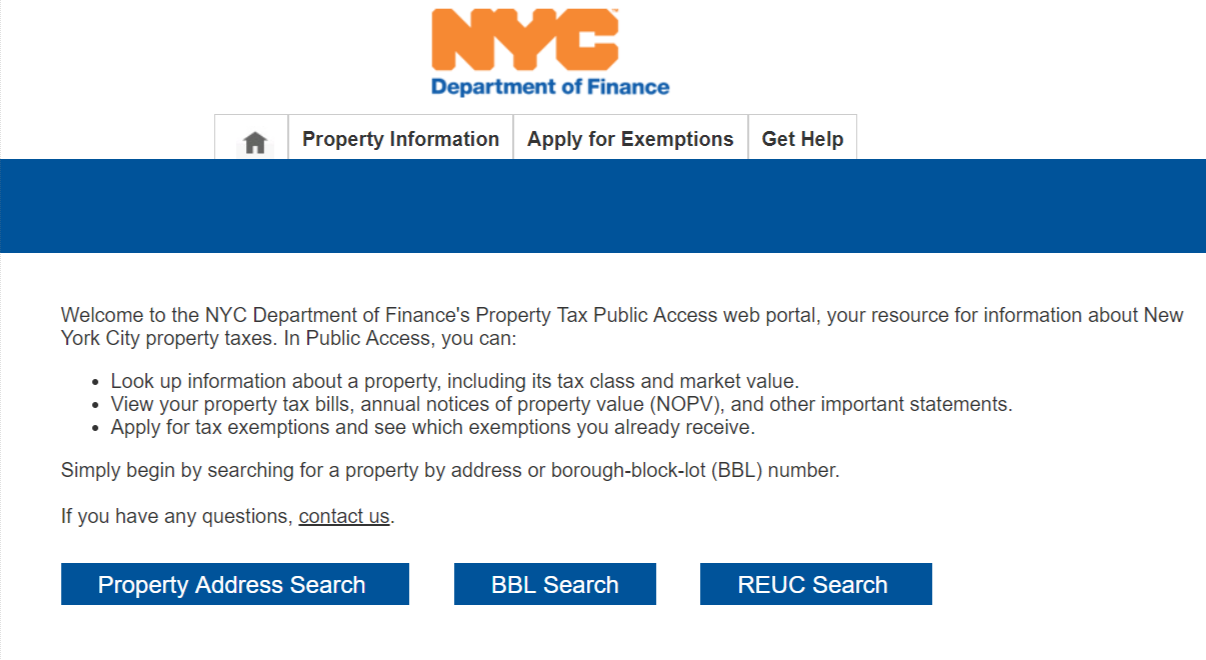

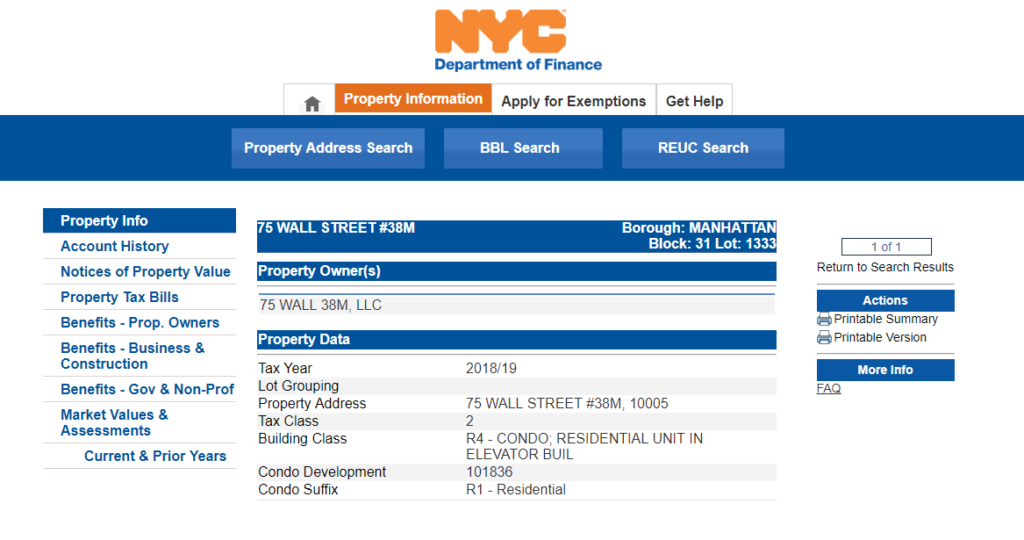

You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. View your property tax bills annual notices of property value NOPV and other important. Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief STAR program.

We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Request penalty abatement for my client Did you know you can request a penalty waiver for your client right from your Tax Professional Online Services account. You must have filed a return for 2019 and.

Confirm that the tax benefits are about to expire by visiting the NYC Department of Finance J-51 Exemption and Abatement and 421-a Exemption webpages. See our Municipal Profiles for your local assessors mailing address. Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due.

Look up information about a property including its tax class and market value. Co-op and condo unit owners may be eligible for a property tax abatement. Review the requirements in HCR Fact Sheet 41.

Bills are generally mailed and posted on our website about a month before your taxes are due. Theres no waiting on hold or being transferred and you wont need to get your client on the phone when you have a signed completed E-ZRep Form TR-2000 Tax Information Access and. Other New York City Tax Abatement Programs.

If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year. NYC is a trademark and service mark of the City of New York. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes.

If you a condo or coop owner do not have a board of directors or managing agents call 311 or contact the Department of Finance on the next steps to apply. Pay Property Tax Online. Daily News catches Trump in a tax dodge.

If you received an income tax refund from us for tax year 2019 view and print New York States Form 1099-G on our website. Abatements reduce your taxes after theyve been calculated by applying dollar credits to the amount of taxes owed. Department of Finance 311 Search all NYCgov websites.

After The News asked the city Department of Finance about the abatement it was removed from Trumps tax records for the new tax year. Property Bills Payments. There are several other tax abatement programs in New York City that can be useful depending on the needs of specific individuals.

Property tax forms - Exemptions Exemption applications must be filed with your local assessors office. If a bank or mortgage company pays your property taxes they will receive your property tax bill. The Department of Finance administers a number of property related benefits including in the form of Exemptions and Abatements.

Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Co-opCondo Abatement by February 15 or the following business day if February 15 falls on a weekend or holiday. The Department of Finance DOF administers business income and excise taxes. Welcome to the NYC Department of Finances Property Tax Public Access web portal your resource for information about New York City property taxes.

Get Form 1099-G for tax refunds. If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways. DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales.

Https Www1 Nyc Gov Assets Finance Downloads Pdf Brochures Ota Property Assessment Appeals Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Coop Condo Abatement Cca Online User Guide Pdf

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Http Www Cynthiaramirez Nyc Uploads 1 1 8 7 118704813 Class 1 Guide 1 Pdf

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc Real Estate Taxes Blooming Sky

Nyc Real Estate Taxes Blooming Sky

Pin On Politics News Current Events Science Religion

Pin On Politics News Current Events Science Religion

Letter Report On The Audit On The Calculation And Application Of Property Tax Abatement Benefits For The Commercial Revitalization Program By The Department Of Finance Office Of The New York City

Letter Report On The Audit On The Calculation And Application Of Property Tax Abatement Benefits For The Commercial Revitalization Program By The Department Of Finance Office Of The New York City

What Is The Nyc Senior Citizen Homeowners Exemption Sche Property Tax Senior Citizen Nyc

What Is The Nyc Senior Citizen Homeowners Exemption Sche Property Tax Senior Citizen Nyc

Saratoga County Property Tax Records Saratoga County Property Taxes Ny

Saratoga County Property Tax Records Saratoga County Property Taxes Ny

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Poor Donald Trump S Property Tax Break Take 2 Don T Mess With Taxes

How Much Is The Coop Condo Tax Abatement In Nyc Hauseit

How Much Is The Coop Condo Tax Abatement In Nyc Hauseit

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

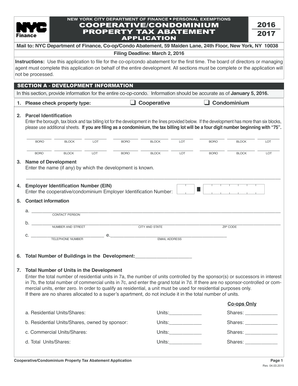

Fillable Online Tm New York City Department Of Finance Personal Exemptions 2016 2017 Cooperative Condominium Property Tax Abatement Finance L Application Mail To Nyc Department Of Finance Coop Condo Abatement 59 Maiden Lane 24th

Fillable Online Tm New York City Department Of Finance Personal Exemptions 2016 2017 Cooperative Condominium Property Tax Abatement Finance L Application Mail To Nyc Department Of Finance Coop Condo Abatement 59 Maiden Lane 24th