Nyc Property Tax Deferral Covid-19

Payment is due on. Property Records ACRIS Deed Fraud Alert.

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

July 1 October 1 January 1 and April 1.

Nyc property tax deferral covid-19. There is no interest imposed on the deferred taxes. The New York City Council today gave landlords a slight reprieve on property taxes but advocates for the industry called it insufficient. The program which offers three different payment plans allows property owners to defer paying as much of 25 of the equity on a one to three family home and 50 of the equity on a condominium.

Need of stopping the spread of COVID-19 as well as having the free cash to deal. The FY 2019 Budget created a new Charitable Gifts Trust Fund in the joint custody of the New York State Commissioner of Taxation and Finance and the State Comptroller to accept donations for the purposes of improving health care and public education in New York State. Coronavirus COVID-19 Alert While the coronavirus is affecting New York City it is strongly recommended that you pay your property taxes online with CityPay.

-- With many people out of work due to the coronavirus COVID-19 pandemic the City Department of Finance DOF is offering several programs to assist property owners who are having a hard time. 31 2021 and the other 50 by Dec. Two new bills in the City Council would allow New Yorkers to defer their property taxes and tenants to put off their rent too.

The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19. How Covid-19 is affecting New Yorks largest publicly held companies view gallery. We will update this page as new information becomes available.

The Property Tax and Interest Deferral Program allows for the deferral or partial payment of property taxes. The average property tax bill on a single-family home in 2019 was about 3600 but average bills are three to five times higher in some areas of the country including parts of New York New. A bill sponsored by Public Advocate Jumaane Williams.

You may be eligible for a PT AID payment plan if. The NYC Department of Finance recognizes that an unexpected event or hardship may make it difficult for you to pay your property taxes. Property Bills Payments.

You own a 1- 2- or 3-family home or a condominium unit. Property Tax and Interest Deferral PT AID Program If you are experiencing hardship and have fallen behind on your property taxes or are in danger of falling behind you may want to consider applying for a Property Tax and Interest Deferral PT AID plan instead of a standard payment plan. 50 of the deferred amount must be paid by Dec.

NYC is a trademark and service mark of the City of New York. Quarterly 4 times a year. The New York State Tax Department along with the Governors office and other agencies throughout the state is responding to the spread of coronavirus COVID-19 with information for those affected.

But this is not forgiveness or a waiver of such taxes. The Property Tax and Interest Deferral PT AID program helps homeowners who are experiencing hardship defer payments for past and future property taxes and avoid the tax lien sale. Data and Lot Information.

The official website of Jumaane D. The citys new initiative the Property Tax and Interest Deferral program allows homeowners to defer or reduce property taxes because of extenuating circumstances To qualify tax payers must. If you qualify for the Property Tax and Interest Deferral PT AID program you can defer your property tax payments or pay only a small percentage of your income so that you can remain in your home.

We know your first priority is to keep your family safe and well. Property Tax Bills. A Brooklyn councilman is calling on New York City to extend a property tax payment deadline due to coronavirus.

The first bill would allow property owners whose buildings are. Williams Public Advocate for the City of New York. If youre interested in making a contribution review our guidance to learn more.

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Nyc Property Tax And Interest Deferral Program District News News Lincoln Square Bid

Nyc Property Tax And Interest Deferral Program District News News Lincoln Square Bid

Want To Help Residents Just Reduce Property Taxes No Strikes Needed

Want To Help Residents Just Reduce Property Taxes No Strikes Needed

Momentum To Overhaul Confusing Unfair Tax System Stalls Another Coronavirus Casualty Nyc Property Tax Reform The New York Cooperator The Co Op Condo Monthly

Momentum To Overhaul Confusing Unfair Tax System Stalls Another Coronavirus Casualty Nyc Property Tax Reform The New York Cooperator The Co Op Condo Monthly

New York City Council To Consider Two Property Tax Deferral Bills

New York City Council To Consider Two Property Tax Deferral Bills

How Do Taxes In The United States Compare Https Taxfoundation Org Country United States In 2020 The Unit Inheritance Tax Capital Investment

How Do Taxes In The United States Compare Https Taxfoundation Org Country United States In 2020 The Unit Inheritance Tax Capital Investment

Petition Calls For Nyc Landlords To Withhold Property Tax 6sqft

Petition Calls For Nyc Landlords To Withhold Property Tax 6sqft

Property Owners Worry As July 1 Tax Payments Loom Nyc Leaders Debate Property Tax And Interest Rates The New York Cooperator The Co Op Condo Monthly

Property Owners Worry As July 1 Tax Payments Loom Nyc Leaders Debate Property Tax And Interest Rates The New York Cooperator The Co Op Condo Monthly

5 States With No Property Tax In 2018 Mashvisor

5 States With No Property Tax In 2018 Mashvisor

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

New York City Business And Civic Leaders Are Now Pushing For Property Tax Relief

New York City Business And Civic Leaders Are Now Pushing For Property Tax Relief

Will Your Property Taxes Fall Due To Covid 19 Millionacres

Will Your Property Taxes Fall Due To Covid 19 Millionacres

City Ranks Sixth Highest In The Nation Nyc Residents Pay 5 633 In Annual Property Taxes The New York Cooperator The Co Op Condo Monthly

City Ranks Sixth Highest In The Nation Nyc Residents Pay 5 633 In Annual Property Taxes The New York Cooperator The Co Op Condo Monthly

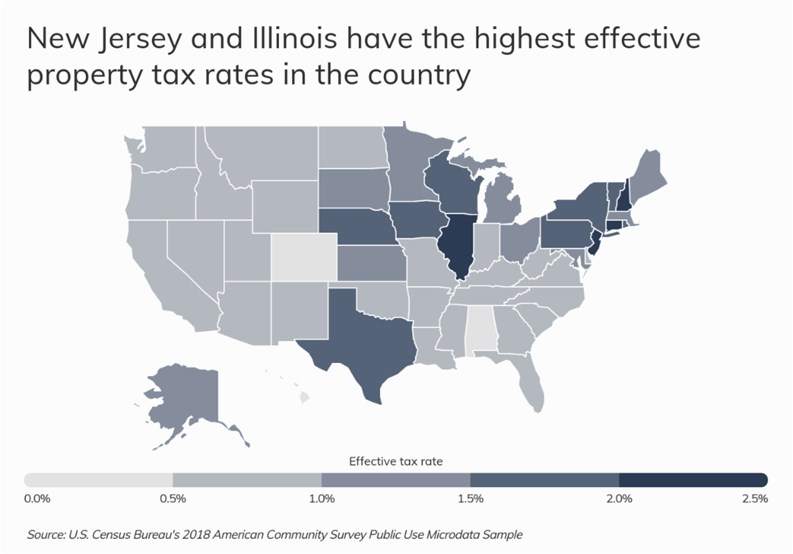

News Nys Property Taxes In The News

News Nys Property Taxes In The News

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Nyc S Property Tax Reforms Are Pitting Homeowners Against Renters Commercial Observer

Nyc S Property Tax Reforms Are Pitting Homeowners Against Renters Commercial Observer