Property Assessor Pierce County Wa

Unclaimed Property Stale Dated Warrants. For questions about paying your property tax or your property valuation please contact your local county officials.

Https Jimcliffordrealty Com Wp Content Uploads Sites 351 2018 02 Piercetax2018 Pdf

Tax Title Properties Available.

Property assessor pierce county wa. EFile Personal Property Filing System Welcome to eFile the Pierce County web-based Personal Property Filing System. Tacoma-Pierce County Health Department. Look up your property tax payment amount.

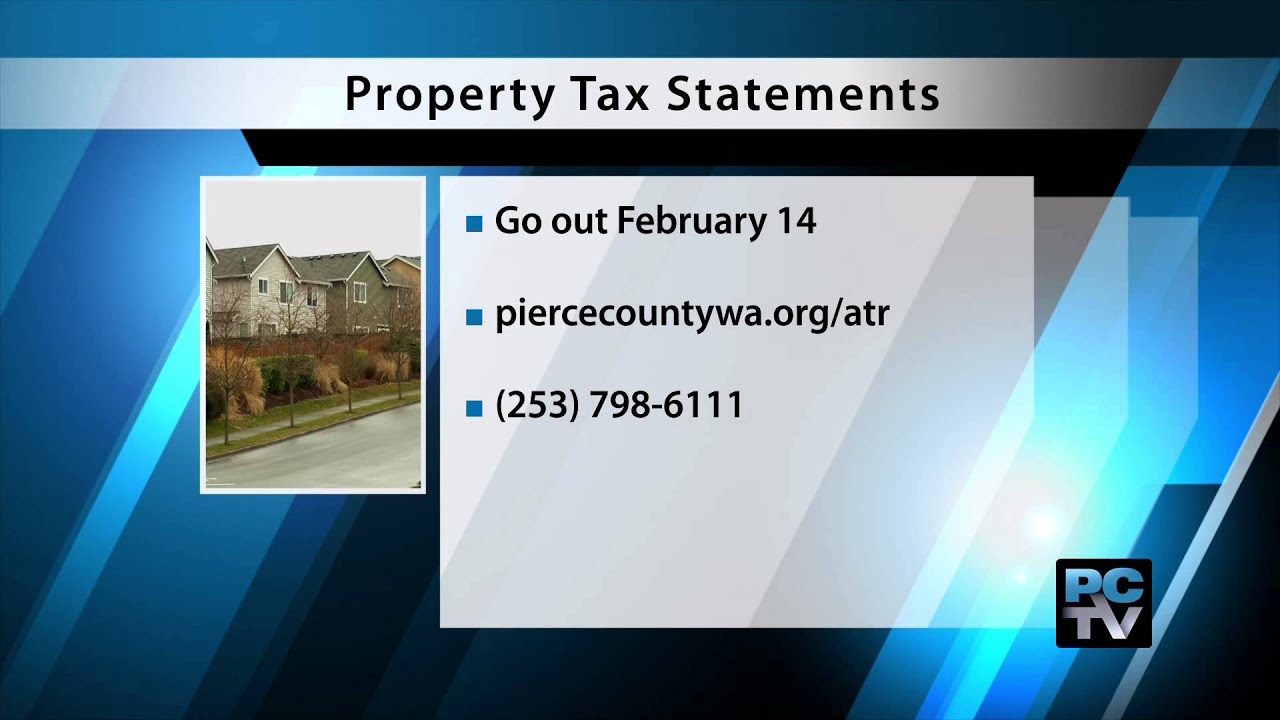

Unclaimed Property - State. Online using e-check debit card or credit card at wwwpiercecountywagovatr or by calling the Assessor-Treasurers automated telephone system at 253-798-3333. Pierce County Assessors Website httpswwwcopiercewaus91Assessor---Treasurer Visit the Pierce County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records.

Office of the Assessor-Treasurer Pierce County Washington. By mail to Pierce County Finance PO. Make checks payable to Pierce County and please include payment stub or parcel number.

Properties exempt from the service charge include parcels consisting entirely of tidelands rivers lakes or streams parks federally-owned lands and some non-profit holdings. County assessors value and assess the tax and county treasurers collect it. In-depth Pierce County WA Property Tax Information.

Discover why properties owned by taxing districts are exempt from property taxes. Obtain information about properties owned by cemeteries and non-profit organizations that may apply for property tax exemption. Pierce County Assessors Website httpswwwcopiercewaus91Assessor---Treasurer Visit the Pierce County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records.

Information can also be found online. County Assessor-Treasurer extends property tax due date to June 1 Citing the financial impact of the COVID-19 virus on Pierce County residents Assessor-Treasurer Mike Lonergan in coordination with the County Finance Director has extended the due date for first-half property tax payments to June 1 2020. Look up your property tax payment amount.

The Pierce County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. For information regarding your current property tax status please call the Automated Tax and Value Information System at 253 798-3333 or the Pierce County Assessor-Treasurer Customer Service Hotline at 253 798-6111. Box 11621 Tacoma WA 98411.

Revaluation of real property is performed on an annual basis in Pierce County using current market value trends. The property owner of record per Pierce County Assessor-Treasurer records is responsible for paying the SWM Utility service charge. The new maximum is 65 of the median household median which in Pierce County is 45708.

More Pierce County homeowners will qualify for property tax relief this year due to an important change in State Law. The previous maximum household income allowed for a partial tax exemption was 40000 per year. Submit an application for special valuation of a historic property you may own.

The Pierce County Assessors Office located in Tacoma Washington determines the value of all taxable property in Pierce County WA. UCC Documents Fixture Filing Auditor. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Changes to flood thresholds of White River and South Prairie Creek to aid in flood preparation. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. This system allows businesses to electronically file Personal Property Tax Listings with the Pierce County Assessor-Treasurers Office for established accounts only.

Intent to purchase form. For information regarding your current property tax status please call the Automated Tax and Value Information System at 253 798-3333 or the Pierce County Assessor-Treasurer Customer Service Hotline at 253 798-6111. Property tax is administered by local governments.

According to the state law RCW 8440030 assessors are required to value all taxable property at 100 of its true and fair market value taking into consideration the highest and best use of the property. The Pierce County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Pierce County.

Assessments Are In Pierce County Property Values Continue To Climb Courier Herald

Assessments Are In Pierce County Property Values Continue To Climb Courier Herald

Pierce County Wa Official Website

Pierce County Cares Business Relief Programs Worksource Pierce

Pierce County Cares Business Relief Programs Worksource Pierce

Http Www Co Pierce Wa Us Documentcenter View 38470 02 General Overview

Taxes Fees In Lakewood City Of Lakewood

Taxes Fees In Lakewood City Of Lakewood

2019 Is A Better Year For Many Pierce County Property Taxpayers

2019 Is A Better Year For Many Pierce County Property Taxpayers

Pierce County Wa Official Website

Pierce County Wa Official Website

Pierce County Procurement And Contract Services

Pierce County Procurement And Contract Services

Https Cityofedgewood Org Documentcenter View 1241 Ordinance No 200588 Setting The Property Tax Levy For Fiscal Year 2021

Pierce County Wa Official Website

Https Www Clark Wa Gov Sites Default Files Dept Files Community Planning Attachment 20a 20 20pierce 20snohomish 20and 20thurston 20counties Summary Pdf

Pierce County Wa Official Website

Pierce County Wa Official Website

Https Www Sumnersd Org Cms Lib Wa01919505 Centricity Domain 64 Property Exemptions Pdf

Http Mrsc Org Corporate Media Medialibrary Sampledocuments Ords P83o2775 Pdf

Https Www Valbridge Com Amass Doc Get Pub Contact 2 Shedd 20resume Pdf

Pierce County Wa Official Website

Pierce County Wa Official Website

Assessor Treasurer Extends Property Tax Payment Due Date

Assessor Treasurer Extends Property Tax Payment Due Date