Property Damage Insurance Defined

A broad form property damage endorsement is an addition to a commercial general liability policy that has removed the exclusion of property as part of the insurance coverage. Links for IRMI Online Subscribers Only.

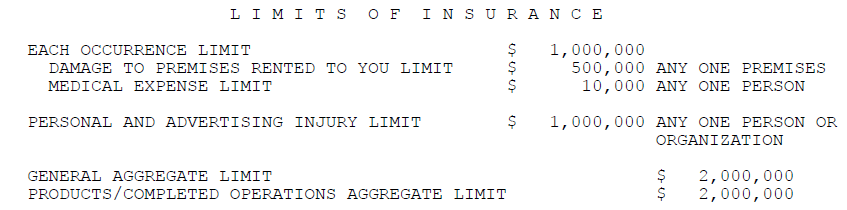

Commercial General Liability Cgl Insurance Explained Landesblosch

Commercial General Liability Cgl Insurance Explained Landesblosch

Most commonly your property damage will pay out when you are at fault for an accident that causes damage to someone elses car.

Property damage insurance defined. The standalone Terrorism policy insures the property real and personal against physical loss or damage by an act or series of acts of terrorism or sabotage. Property damage is a risk that can be covered by property insurance. However property damage will cover other property types as well.

This insurance can be extended to the consequential losses extra expenses rental value or business interruption resulting directly from a physical loss or damage. Property Damage PD as defined in the general liability policy physical injury to tangible property including resulting loss of use and loss of use of tangible property that has not been physically injured. Property damage typically involves physical damage to tangible property or loss of use of tangible property.

However a policy might not cover a particular peril. April 26 2017 by. When evaluating whether the property shows signs of wear and tear or covered damage there arent always clearly defined standards.

Its often more of an I know it when I see it situation. Property damage liability insurance covers the cost of damages to someone elses property after an accident you cause. Property damage insurance is the portion of your auto insurance coverage that insures the property of other people that your car damages in an accident.

Property damage liability car insurance is a type of coverage that pays for damage to someone elses property such as their car or home resulting from an accident caused by the policyholder. Vehicle repairs for the other party. Insurance protecting against all or part of an individuals legal liability for damage done as by his or her automobile to the property of another First Known Use of property damage insurance circa 1946 in the meaning defined above.

Commercial property insurance covers property damage caused by incidents like fires and storms but not wear and tear caused by everyday use. Content Team Property damage is defined as some harm that is inflicted upon someones property as the result of another persons negligence willful destruction of that persons property or by an act of nature. Personal liability and property damage is a type of car insurance coverage that protects you in the case of at-fault accidents that cause injury to another person or damage to property.

It protects you from having to pay out-of-pocket for expenses like. Property damage liability is the often-overlooked part of your car insurance that pays for damage to other peoples property from an accident youre responsible for. Property damage liability coverage defined The property damage portion of your liability insurance coverage pays for the physical damage that you cause in an at-fault car accident.

In business insurance property damage is damage to either the property of a business including its contents or the property of a third party. Property damage liability coverage is required by law in most states. Also addressed in the homeowners and personal auto policies.

Property damage liability coverage is one of two types of liability insurance along with bodily injury liability and it is required in most states. Tangible property is something that can be touched or felt like a building or computer monitor. Damage caused by an earthquake for example should be specified in most property insurance policies so that a company can financially assist the policyholder with the repair or reconstruction of the damaged property.

Definition of property damage insurance. Property damage liability insurance is one of the major coverage types that drivers are required to have by law. This coverage pays for the damage to the other peoples vehicle or other property.

It helps pay to repair damage you cause to another persons vehicle or property. This insurance covers the cost of damages caused to others -- whether you damaged their car house or any other type of personal property. Your insurance policy includes 15000 of uninsured motorist property damage coverage with a 200 deductible.

Injury to real or personal property through anothers negligence willful destruction or by some act of nature. The driver who rear-ended your car caused 5000 in damage before they drove off. In some states it is the minimum coverage you must have to drive legally.

Today a broad form. Flooding caused by a hurricane is an example of property damage caused by an act of nature. In lawsuits for damages caused by negligence or a willful act property damage is distinguished from personal injury.

Property damage liability coverage is part of a car insurance policy.

Loss Of Use As Property Damage Expert Commentary Irmi Com

Loss Of Use As Property Damage Expert Commentary Irmi Com

Vacant Home Insurance Home Insurance Homeowners Insurance Vacant

Vacant Home Insurance Home Insurance Homeowners Insurance Vacant

Wear And Tear Vs Property Damage Understanding Your Office Insurance Insureon

Wear And Tear Vs Property Damage Understanding Your Office Insurance Insureon

Category 3 Water Exclusions Expert Commentary Irmi Com

Personal Property Insurance What You Should Know Insuropedia By Lemonade

Personal Property Insurance What You Should Know Insuropedia By Lemonade

Https Oci Wi Gov Documents Consumers Pi 233 Pdf

Contingent Business Interruption Getting All The Facts Expert Commentary Irmi Com

Contingent Business Interruption Getting All The Facts Expert Commentary Irmi Com

How To Choose Liability Bodily Injury And Property Damage Coverages

How To Choose Liability Bodily Injury And Property Damage Coverages

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

Property Damage Liability What It Covers And How Much You Need The Zebra

Property Damage Liability What It Covers And How Much You Need The Zebra

Commercial General Liability Insurance Defined Allen Financial Insurance Group

Commercial General Liability Insurance Defined Allen Financial Insurance Group

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

An Insurance Rider Is Used To Broaden The Coverage Of Your Base Policy Although An Additional Premium Is Critical Illness Insurance Critical Illness Insurance

An Insurance Rider Is Used To Broaden The Coverage Of Your Base Policy Although An Additional Premium Is Critical Illness Insurance Critical Illness Insurance

The Future Is Now When Eventual Indemnity Obligations Become Present Defense Obligations Expert Commentary Irmi Com

The Future Is Now When Eventual Indemnity Obligations Become Present Defense Obligations Expert Commentary Irmi Com

Understanding Home Insurance Policies Insurance Policy Home Insurance Homeowners Insurance

Understanding Home Insurance Policies Insurance Policy Home Insurance Homeowners Insurance

Damaged Business Properties And Insurance Claims Hays Companies

Damaged Business Properties And Insurance Claims Hays Companies

The Impaired Property Exclusion Expert Commentary Irmi Com

The Impaired Property Exclusion Expert Commentary Irmi Com