Property Gains Tax Ontario

Provincial Land Transfer Tax called LTT is. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

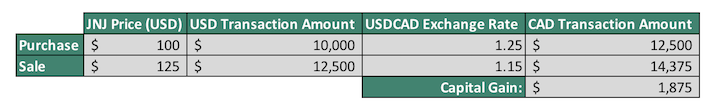

Property gains tax ontario. When a person buys a home and lives in that home as their primary residence for 2 out of the last 5 years that homeowner is entitled to exempt up to 250000 of profit gain from any federal income taxes. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price.

Top Real Estate Agents in. The capital gains tax rate is 15 if youre married filing jointly with taxable income between 78750 and 488850. Their marginal tax rate is 3148 if they lived in Ontario which means theyd pay 1574 in capital gains tax half their marginal rate.

This total is now your new personal income amount and therefore you will be taxed on your capital gains according to the tax bracket that you are in. In general youll pay higher taxes on property youve owned for less than a year. Long-term capital gains are gains on assets you hold for more than one year.

Current tax rates for long-term capital gains can be as low as 0 and top out at 20 depending on your income. Land Transfer Tax and Municipal Land Transfer Tax. Paying Capital Gains Tax on Sale of Primary Residence A.

WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. Capital Gain Tax A tax on capital gains which is the profit realized on the sale of a non-inventory asset that was purchased at an amount that was lower than the amount realized on the sale. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2021.

If youve lived in a property for at least two of the last five years capital gains tax on the sale of that property is exempt up to 250000 for single filers and 500000 for married couples. In Canada you only pay tax on 50 of any capital gains you realize. Gains on the sale of collectibles are taxed at 28.

The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed. In part II we will discuss property taxes capital gains tax and business income tax. 505 on the portion of your taxable income that is 43906 or less plus.

This is because short-term capital gains are taxed at the same rate as ordinary income. Theyre taxed at lower rates than short-term capital gains. Because capital gains tax is owed in the calendar year in which a property is sold that gives you 16 months before you owe tax on those earnings in April of the following year.

The information in this chapter also applies if for the 1994 tax year you filed Form T664 Election to Report a Capital Gain on Property Owned at the End of February 22 1994 for your shares of or interest in a flow-through entity. There are various methods of reducing capital gains tax including tax-loss. Wait until they pass away and the entire value of their.

If the property was solely your principal residence for every year you owned it you do not have to pay tax on the gain. Effective January 1 2020 the tax bracket breakdown for Ontario personal income tax is below. Long-term capital gains are taxed at more favorable rates.

The Canadian Annual Capital Gains Tax Calculator is updated for the 202122 tax year. Capital Loss The difference of selling a property at a price lower than the purchase price. The share of income in the property may be either in the form of rentals or may even be capital gains arising at the time of sale of such building.

Land Transfer Tax and Municipal Land Transfer Taxes are one of the largest additional expenses incurred to a purchaser when purchasing a property in Ontario. In 2017 that rate is between 10 and 396 of your profit but most people pay around 25. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income.

Long-term capital gains taxes apply to profits from selling something youve held for a year or more. Exclusion for Sale of Primary Residence. If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on.

Over the 10-year ownership period youve claimed a total of 90900 in depreciation expense. With respect to property jointly owned by co-owners Section 26 of the Income Tax Act gives clear guidelines for taxation of the share of such co-owners in a building.

Capital Gains Attribution Rules In Canada Versus The Us

Capital Gains Attribution Rules In Canada Versus The Us

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

Capital Gains Tax On Primary Residence Is Coming Toronto Realty Blog

Capital Gains Tax On Primary Residence Is Coming Toronto Realty Blog

Capital Gains Tax Rate On Farm Land Rating Walls

Capital Gains Tax Rate On Farm Land Rating Walls

I Am A Non Resident And I Am Selling My Rental Property In Canada Grant Matossian Cga Cfp

I Am A Non Resident And I Am Selling My Rental Property In Canada Grant Matossian Cga Cfp

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax Rate Rules In Canada 2020 What You Need To Know

Capital Gains Tax Rate Rules In Canada 2020 What You Need To Know

Inheriting A Secondary Residence Some Planning May Be Required Dfsin Sfl Wealth Management Sfl Investments

Inheriting A Secondary Residence Some Planning May Be Required Dfsin Sfl Wealth Management Sfl Investments

How To Avoid The Capital Gains Tax Loans Canada

How To Avoid The Capital Gains Tax Loans Canada

Tax On Real Estate Sales In Canada Madan Ca

Tax On Real Estate Sales In Canada Madan Ca

Capital Gains Tax In Canada Explained Youtube

Capital Gains Tax In Canada Explained Youtube

Avoid Capital Gains Tax In Canada In 2021 Finder Canada

Avoid Capital Gains Tax In Canada In 2021 Finder Canada

How Do Capital Gains And Losses Affect Your Income Tax

How Do Capital Gains And Losses Affect Your Income Tax

U S Taxes For Canadian Investors What You Need To Know Sure Dividend

U S Taxes For Canadian Investors What You Need To Know Sure Dividend

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Canadian Tax Planning Via The Lifetime Capital Gains Exemption Lcge

Canadian Tax Planning Via The Lifetime Capital Gains Exemption Lcge