Property Tax Calculator Patna

The first number after the decimal point is tenths 1 the second number after the decimal point is hundredths 01 and going out three places is thousandths 001 or mills. This calculator is designed to estimate the real estate tax proration between the home buyer seller at closing.

New Town To Pay Property Tax Under Uaa System Kolkata News Times Of India

New Town To Pay Property Tax Under Uaa System Kolkata News Times Of India

Enter the number of years you want to calculate property taxes.

Property tax calculator patna. Patna Municipal Corporation पटन नगर नगम. Patna Municipal Corporation is always devoted for your service. To keep city clean green liveable please follow the rules regulations of Patna Municipal Corporation.

That is nearly double the national median property tax payment. Home Tools Property Tax Calculator. Estimate your Louisiana Property Taxes Use this Louisiana property tax calculator to estimate your annual property tax payment.

Login here to pay your Property Tax. Tax calculator for any hypothetical example click here. There are typically multiple rates in a given area because your state county local.

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. Property Tax Calculator - Estimate Any Homes Property Tax. Select a tax district from the dropdown box at the top of the form.

The assessed value in this year is the value you entered above. Louisiana Property Tax Calculator. Enter an assessed value for the property.

Please note that we can only estimate your property tax based on median property taxes in your area. Property Tax Proration Calculator. Pay your taxusercharges on time registered the incident of birth and death in your family within the prescribed time period.

The countys average effective property tax rate is 081. This is your own city. As a way to measure the quality of schools we analyzed the math and readinglanguage arts proficiencies for every school district in the country.

The average effective property tax rate in Tennessee is 064. Overview of Louisiana Taxes. Simply close the closing date with the drop down box.

To Calculate an Estimate of Your Bill. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate. This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year.

Tennessee has some of the lowest property taxes in the US. At just 053 Louisiana has the fifth lowest effective property tax rate of any US. Tennessee Property Tax Calculator.

Nationwide the median property tax payment is a. Urban development and housing departments e-Municipality website to apply for birth certificate death certificate building permission town planning property tax PTAX assessment Right to information RTI across various urbal local bodiesmunicipalitiesmunicipal corporations under Goverment of Bihar. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

The median annual property tax payment in Louisiana is 919 though this can drop to around 200 in some counties. Number of Days Please enter close date Per Diem Amount 000 Pro Rate Tax Amount 000. The median annual property tax paid by homeowners in Tennessee is 1220 about half the national average.

The district numbers match the district number you receive on your bill. Do you remember when you were in school and you were working on decimals. At that rate the total property tax on a home worth 200000 would be 1620.

Use the property tax calculator to estimate your real estate taxes. A schedule will be created listing each year and a total tax amount. See the online functions available at the Property Appraisers Office.

Overview of Tennessee Taxes. Starting Year The starting year of the years you want to calculate. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county.

Roads To Be Recategorised For Property Tax Assessment Patna News Times Of India

Roads To Be Recategorised For Property Tax Assessment Patna News Times Of India

Property Tax Corporation Devises Formula To Calculate Property Tax On Basic Street Rate Chennai News Times Of India

Property Tax Corporation Devises Formula To Calculate Property Tax On Basic Street Rate Chennai News Times Of India

Kmc To Follow Twin Systems For Property Tax Calculation Kolkata News Times Of India

Kmc To Follow Twin Systems For Property Tax Calculation Kolkata News Times Of India

Land Tax Meaning Charge Calculation Online And Offline Payment

Land Tax Meaning Charge Calculation Online And Offline Payment

From April Calculate Your Own Property Tax Kolkata News Times Of India

From April Calculate Your Own Property Tax Kolkata News Times Of India

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Property Tax Check How To Calculate Property Tax Online In India

Property Tax Check How To Calculate Property Tax Online In India

Wisconsin Seller Closing Costs Net Proceeds Calculator Closing Costs Seller Title Insurance

Wisconsin Seller Closing Costs Net Proceeds Calculator Closing Costs Seller Title Insurance

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses For A N Investment Property Spreadsheet Investing

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses For A N Investment Property Spreadsheet Investing

Filling Mcd Property Tax Online

States With The Highest And Lowest Property Taxes Property Tax States State Tax

States With The Highest And Lowest Property Taxes Property Tax States State Tax

How To Pay Bihar House Tax Property Tax Online House Tax Pay In 2020 Technews Youtube

How To Pay Bihar House Tax Property Tax Online House Tax Pay In 2020 Technews Youtube

Area Based Assessment Of Property Tax Patna Municipal Corporation Youtube

Area Based Assessment Of Property Tax Patna Municipal Corporation Youtube

Property Tax Online Payment How To Pay House Tax Of Patna Nagar Nigam Youtube

Property Tax Online Payment How To Pay House Tax Of Patna Nagar Nigam Youtube

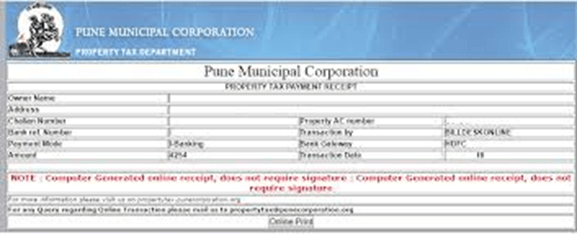

Pune Municipal Corporation Pmc Property Tax Paying Property Tax Online

Pune Municipal Corporation Pmc Property Tax Paying Property Tax Online

Property Tax Calculation Unit Area System Hindi Youtube

Property Tax Calculation Unit Area System Hindi Youtube

Understanding Property Tax Implications Importance And Calculation Method

Understanding Property Tax Implications Importance And Calculation Method

All About Your Property Tax And How To Pay It Online

All About Your Property Tax And How To Pay It Online