Property Tax Increase After Renovations Nyc

Combine that with SmartAssets property tax calculator and youll get a general idea of how much more you can expect to pay in taxes. Any substantial addition to land or improvements including fixtures.

How Do I Pay For Home Renovations Infographic Rwc Home Improvement Loans Home Equity Loan Renovations

How Do I Pay For Home Renovations Infographic Rwc Home Improvement Loans Home Equity Loan Renovations

Renovating a bathroom or kitchen can revitalize a home and add to its worth but its also the most common reason why your property taxes rise says David Rae a certified.

Property tax increase after renovations nyc. Your local state or federal government laws may change causing property taxes to spike. Property tax bills can increase for a variety of reasons. Previously she said the department raised the assessment on such a property by 45 percent of the increased value of a renovation or a tax increase of 6 a year for every 100 in renovations.

New York City Property Tax Overhaul Will Be A Blow To Real Estate Market Industry Experts Say. The value of your neighborhood could rise a. A shed or deck.

Months after assessments are finalized by the assessor taxing units school districts cities towns and counties determine the amount of taxes that a taxing unit needs to collect. Thats because renovations can significantly raise a homes value which can increase the amount for which it is assessed. Assessed value is used to determine your property tax.

Reassessments dont increase the amount of taxes that need to be collected by local governments The assessor is not responsible for taxes - only for assessments. There are plenty of ways to make your home more appealing to your family or prospective buyers. Any physical alteration of any improvement or a portion thereof to a like new condition or to extend its economic life or to change the way in which the improvement or portion.

Owners of Brooklyn brownstones would see large property tax increases under proposed changes. Will My Property Taxes Go Up If I Get My House Appraised. Florida is among the exceptions.

If youre doing routine maintenance repairs or minimal upgrades you likely dont need to worry about property tax increases unless they increase for another reason. Any improvement made to help take care of a dependent doesnt increase a homes property taxes there Sepp explained. In some cases a homeowner will have.

Tax class 2a 2b 2c - 8 per year no more than 30 over 5 years for building with 10 or less units. New York State property taxes are some of the highest in the nation according to the nonprofit Tax Foundation. In addition your assessed value cannot exceed 6 of your homes market value.

More Ideas to Steer Clear of Property Tax Increases. Lets say the landlord spends just enough on an MCI to hit that cap in a year with about 259200 in building improvements the landlord can raise the rent by 6 percent to 1590. Many homeowners occasionally find themselves curious or even anxious about the value of their homes.

By law the assessed value of a class 1 property cannot increase by more than 6 per year or 20 over five years unless the value increases are due to new construction or renovations. The state technically doesnt impose a property tax and doesnt benefit from the tax revenuestheyre assessed by local governments county governments and school districtsbut the state code does offer exemptions for people who use their homes as their primary residences as. A deck a pool a large shed or any other permanent fixture added to your home is presumed to increase its value.

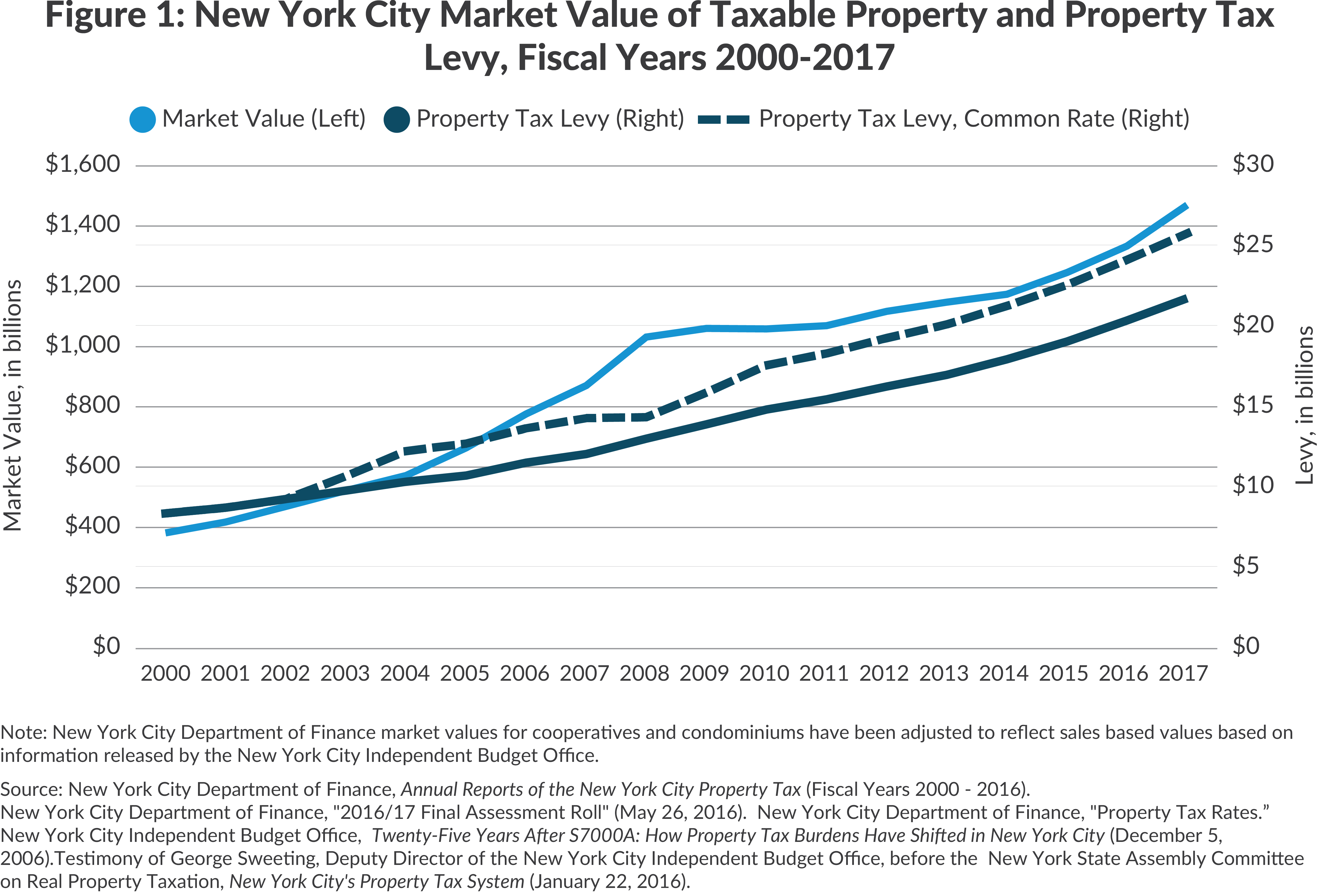

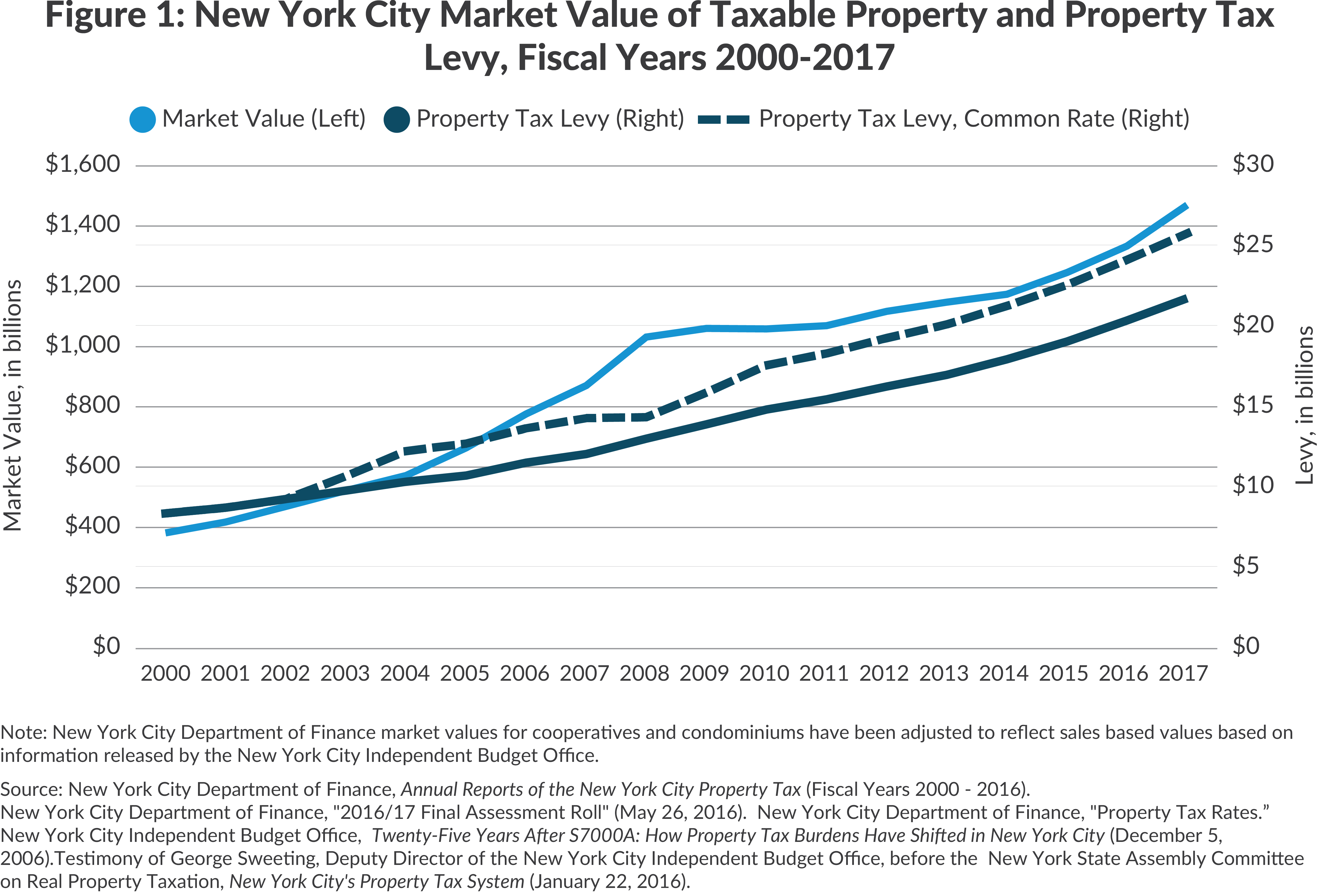

After adjusting for the rate increase the average annual increase in tax bills was higher for small homes 65 percent and large rentals 57 percent and slower for coops and condos 55 percent and small rental buildings 52 percent. Your tax class determines what limits apply to your property. IF you are facing a large tax increase for renovating your house you have a few more days to ask the New York City Tax Commission to review assessments done by the Finance Department and to make.

Any structural changes to a home or property will increase your tax bill. An Increase in Home Sales Around You We find that. Mansion Global poses a readers question to real estate tax attorneys and gets it answered in a weekly column highlighting the ins and outs of the often complex tax laws.

Tax class 1 - 6 per year no more than 20 over 5 years. State law limits how much Assessed Values can increase each year for certain tax classes. 3 s tep APPLY EXEMPTIONS ON FILE.

Under California property tax law new construction is defined in four general categories.

How Easy Is It To Challenge And Get Reduced Taxes In Nyc Streeteasy

How Easy Is It To Challenge And Get Reduced Taxes In Nyc Streeteasy

The Complete Guide To Closing Costs In Nyc Hauseit

The Complete Guide To Closing Costs In Nyc Hauseit

Real Estate Investing New York City Realestateinvestingforbeginners Real Estate Information Real Estate Career Real Estate Tips

Real Estate Investing New York City Realestateinvestingforbeginners Real Estate Information Real Estate Career Real Estate Tips

Is Now A Good Time To Invest In Manhattan New York Residential Property

Is Now A Good Time To Invest In Manhattan New York Residential Property

Nyc Mansion Tax Here S What It Will Cost Starting In 2019 Streeteasy

Nyc Mansion Tax Here S What It Will Cost Starting In 2019 Streeteasy

What Is A 421a Tax Abatement In Nyc Streeteasy

What Is A 421a Tax Abatement In Nyc Streeteasy

Tax Benefits For Investment Properties In Nyc Propertynest

Tax Benefits For Investment Properties In Nyc Propertynest

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

2020 Nyc Housing Predictions What We Expect Next Year Streeteasy

2020 Nyc Housing Predictions What We Expect Next Year Streeteasy

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Property Taxes All You Need To Know Blocks Lots

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

Https Www Lincolninst Edu Sites Default Files Pubfiles Gates Wp19mg1 Pdf

Using Adjustable Rate Mortgage When Buying A Co Op In Nyc Hauseit Adjustable Rate Mortgage Mortgage Rate

Using Adjustable Rate Mortgage When Buying A Co Op In Nyc Hauseit Adjustable Rate Mortgage Mortgage Rate

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Real Estate Buying

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Real Estate Buying

New York City Business And Civic Leaders Are Now Pushing For Property Tax Relief

New York City Business And Civic Leaders Are Now Pushing For Property Tax Relief

5 Ways To Thrive In A Seller S Market Real Estate Buyers Marketing Real Estate Broker

5 Ways To Thrive In A Seller S Market Real Estate Buyers Marketing Real Estate Broker

Global Property Investments By Targetive Inc Real Estate Infographic Real Estate Advice Commercial Real Estate

Global Property Investments By Targetive Inc Real Estate Infographic Real Estate Advice Commercial Real Estate