Property Tax Percentage Toronto

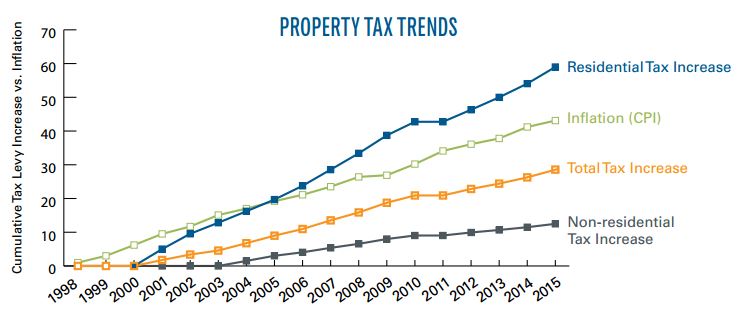

On one side Mayor John Tory and his allies back inflation-based increases like the 255. Every four years the Municipal Assessment Corporation MPAC conducts an evaluation of properties all over Ontario and submits assessed values for each.

The Rent Is Too Damn High And City Taxes Are To Blame Frpo Federation Of Rental Housing Providers Of Ontario

The Rent Is Too Damn High And City Taxes Are To Blame Frpo Federation Of Rental Housing Providers Of Ontario

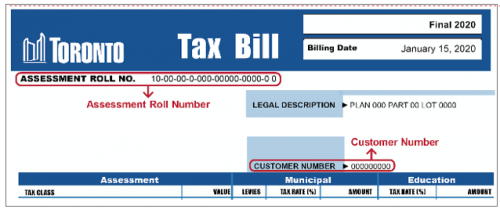

The City levy has been calculated by multiplying your propertys 2020 phased-in assessment by the Citys tax rate as approved by Toronto City Council.

Property tax percentage toronto. Property Tax Lookup Get residential tax estimates. How much those changes could raise depends on the percentage charged at what tier homes over 2 million 3 million or more and the number of homes in the applicable tiers. Commercial and industrial vacant land is taxed at a rate that is approximately 30 lower then the respective full tax rate.

Tax Certificate A statement of all amounts owing for taxes issued by the Citys Treasurer pursuant to Section 317 of the City of Toronto Act 2006. The PST general rates are as follows. Bola Owolabi who lives in Toronto earns an income of 95000 per year.

Municipal tax of 0451568 education tax of 0161000 and other taxes of 0002202 for a total in property tax of 0614770. How Much You Need To Earn To Afford A Home In These GTA Cities. Other taxes Assesment value x Other taxes rate 100 Property tax Municipal tax Education tax Other taxes.

The Ontario Government is offering assistance to eligible businesses affected by public health restrictions. Taxes in Toronto If you go to Canada youll need to pay tax on your income that is unless you earn under the tax-free threshold of 12069 in 2019. This translates into 5532 of property taxes based on the average June 2018 home value of 870559.

View your property tax account. Canadian tax rates are progressive meaning the more you earn over the tax-free allowance the more tax you need to pay. For example the Toronto tax rate is 063551 per cent.

Your final 2020 property taxes consist of a City levy education levy and City Building fund. His provincial marginal and average. If you bought or owned a 500K condo you may expect to pay an annual property tax of 3074 500K x Property Tax Rate.

The QST rate is 9975. Someone who owns a million-dollar property would pay. On December 17 2019 City Council adopted an increase to the City Building Levy by addressing one per cent in 2020 and 2021 to the existing 05 per cent increment and an additional 15 per cent annually from 2022-2025 inclusively Item EX1126 The Government of Ontario mandated no tax increase on Multi-Residential property classes.

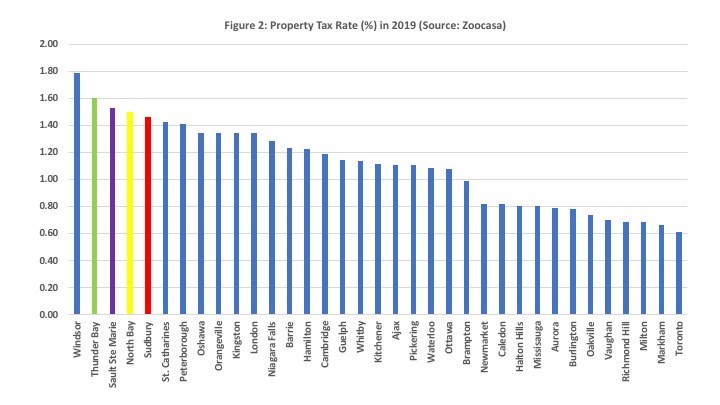

It ranges from the lowest in the City of Toronto at 063551 per cent to the highest in Orangeville at 140990 per cent. Meanwhile homeowners in Windsor Ont. In 2019 the City of Torontos official property tax rate was 0614770.

Band 1 Band 2 are assigned by the City of Toronto. Toronto had the lowest property tax rate out of 35 municipalities at 0599704 in 2020. Only the 5 GST is levied in Alberta and the territories.

Toronto property tax is based on the assessed value of your home. Bills Tax Relief for Businesses to learn what help is available to cover operational costs. 7142 per certificate Tax History Statement A record of all transactions occurring within a property tax account for a specific taxation year.

Average Tax Rate Tax Paid Total Income x 100. Torontos tax rate is the lowest in the province at 0614770 per cent meaning that people owning a home valued at 500000 will pay approximately 3074 in property taxes. In fact according to Bloomberg its the lowest property tax rate of any city in Canada or the US beating out Honolulu at 033 per cent.

COVID-19 Relief for Businesses. In reality you would likely pay around 1900 in annual property taxes due to differences between the assessed value of the property and its market. Let us assume Mr.

Are saddled with the provinces highest property tax rate of 1789394 per cent with taxes on a 500000 home coming in at 8947. As usual in Toronto property taxes have been front-and-centre in the debate over this years city budget. The property tax rate varies wildly depending on what Greater Toronto Area city you live in.

Living in a city with a low property tax rate doesnt always mean you pay lower taxes if average home prices are higher. The property classes in the property tax rates are assigned to City of Toronto by MPAC using the definitions in the Provincial Assessment Act. The federal GST rate is 5 and the HST rate is 13 for goods and services supplied in the provinces of NB NL and ON 14 for PEI and 15 for NS.

An assesment value of 455 500 the property tax rate of Toronto. Toronto property tax rates are the lowest property tax rates in Ontario for municipalities with a population greater than 10K. How Much You Need To Earn To Afford A Home In These GTA Cities.

2020 Property Tax Rates. How much property tax will you need to pay each year. The average or effective tax rate is the actual percentage of your income that is paid out as tax.

By comparison in the City of Toronto which has the lowest tax rate at 0599704 among the municipalities included on our list a homeowner would pay a comparatively lower 2999 for a property. Ontario Marginal vs Average Tax Rate Example.

The Exciting World Of Investment Property Taxes Toronto Real Estate

The Exciting World Of Investment Property Taxes Toronto Real Estate

Toronto Has Room To Hike Property Taxes By 20 To Fund City Services Researchers Say Cbc News

Toronto Has Room To Hike Property Taxes By 20 To Fund City Services Researchers Say Cbc News

Http Www Toronto Ca Legdocs Mmis 2020 Ex Bgrd Backgroundfile 145880 Pdf

Zoocasa Ranked Sudbury Poorly For Property Taxes But Economist Says It S All In How You Use The Data Sudbury Com

Zoocasa Ranked Sudbury Poorly For Property Taxes But Economist Says It S All In How You Use The Data Sudbury Com

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Barrie Places 23rd On List Of Property Tax Rates Ranked Lowest To Highest As City Looks For Budget Feedback Barrie 360barrie 360

Barrie Places 23rd On List Of Property Tax Rates Ranked Lowest To Highest As City Looks For Budget Feedback Barrie 360barrie 360

Ontario Property Tax Rates Lowest And Highest Cities

Ontario Property Tax Rates Lowest And Highest Cities

How To Calculate Commercial Property Tax Mileiq Canada

How To Calculate Commercial Property Tax Mileiq Canada

Toronto Land Transfer Tax Rates 2021 Land Transfer Tax Calculator Toronto

Toronto Land Transfer Tax Rates 2021 Land Transfer Tax Calculator Toronto

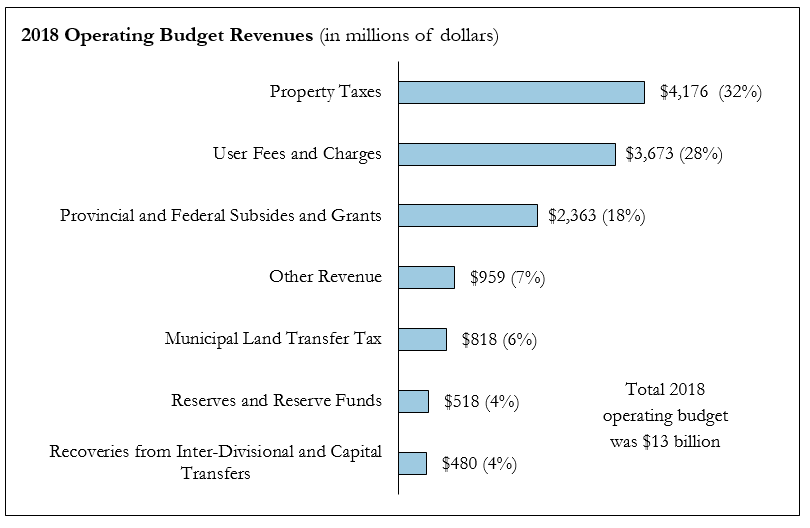

2018 Issue Briefing The City S Operating Revenue Base City Of Toronto

2018 Issue Briefing The City S Operating Revenue Base City Of Toronto

City Revenue Fact Sheet City Of Toronto

City Revenue Fact Sheet City Of Toronto

Https Www Toronto Ca Wp Content Uploads 2019 01 96d2 Property Tax Brochure Pdf

City Of Brampton Taxes Assessment Taxation

City Of Brampton Taxes Assessment Taxation

Tax Bill Explained City Of Pickering

Tax Bill Explained City Of Pickering

Property Tax Utilities Current Customer Service Answers City Of Toronto

Property Tax Utilities Current Customer Service Answers City Of Toronto

Georgina Innisfil Listed Among 10 Highest Property Tax Rates In Gta Study Toronto Com

Georgina Innisfil Listed Among 10 Highest Property Tax Rates In Gta Study Toronto Com

How To Calculate Property Tax In Toronto Instructions Faq

How To Calculate Property Tax In Toronto Instructions Faq

King Property Tax 2021 Calculator Rates Wowa Ca

King Property Tax 2021 Calculator Rates Wowa Ca