Property Tax Rate King County Wa

Many more people in King County are now eligible for help with their property taxes. Beginning in 2020 Income Threshold 3 is based on the county median household income of the county where the residence is located.

Taxing Property Instead Of Income In B C

Taxing Property Instead Of Income In B C

Rates in many King County cities have been falling as home values have been increasing.

Property tax rate king county wa. Each agency will update its pages with current information. The qualifying applicant receives a reduction in the amount of property taxes due. After 2022 both parts of the state property tax levy will be budget-based.

The income limit is now indexed to 65 of the median household income in King County. Overall property tax collections for the 2020 tax year are 63 billion an increase of 767 million or 137 from the previous year of 57 billion. Its also the county with the states highest median annual property tax payment at 4611.

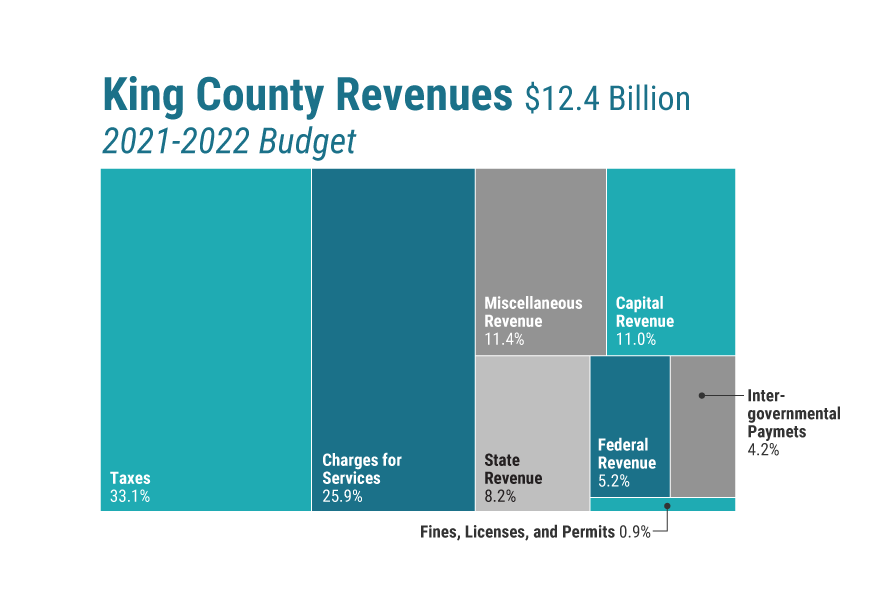

Washington State law RCW 8456010 doesnt allow county treasurers to collect property taxes until February 15 of the year that they are due. The average effective property tax rate in King County is 093. Property taxes make up at least 94 percent of the states General Fund which supports public services for Washington residents.

King County collects the highest property tax in Washington levying an average of 357200 088 of median home value yearly in property taxes while Ferry County has the lowest property tax in the state collecting an average tax of 94100 064 of median home value per year. The median property tax also known as real estate tax in King County is 357200 per year based on a median home value of 40770000 and a median effective property tax rate of 088 of property value. Interest continues to accrue until the taxes are paid in full.

King County Assessor John Wilson Taxpayer Transparency Tool 2021 Taxes Tax Relief Commercial COVID Impact Electronic Valuation Notices Look up Property Info eReal Property eSales eMap Go Paperless eValuations. Taxes for the second half of the year can be paid in advance but the first half cant. Thats exactly equal to the state of Washingtons overall average effective property tax rate.

King County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. You can apply online here. Payment deadline for first half of property taxes is April 30 2021 and second half November 1 2021.

Revenue at a Glance provides more detail on property taxes and how they help fund these services. Property tax exemptions are only applicable to real and personal property located in Washington State. Taxpayers should remember that King County will not process applications that are not complete and without supporting documents.

Two changes in our states school funding formula will lead to a 137 increase in property tax collections in King County for the 2020 tax year. The new limit is 58423 rather than set at a fixed amount. For property taxes due in 2018 through 2022 the Legislature established a total combined rate for both parts of the state property tax levy.

This changes the state property tax from being budget-based to being rate-based for property taxes due between 2018 and 2022. Please note you will need your completed 2019 tax return prior to applying. To qualify for taxes payable in 2020 andor 2021 you will need to meet the following criteria.

Many King County services are continually adapting because of the COVID-19 pandemic. King County mails out a statement in the middle of February. After April 30th property taxes are considered delinquent and subject to 1 interest per month.

In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations. For property in King County you can apply for taxes payable in 2020 as early as January 2020 when 2020 application is readily available. If your taxes are still delinquent on June 1st you are subject to a 3 penalty.

King County Property Tax Payment Information. King County Washingtons average effective property tax rate is 093. King County The Department of Revenue oversees the administration of property taxes at state and local levels.

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

If You Re One Of Those Homeowners Who Winces A Little Bit When The Property Tax Bill Comes In The Mail Get Ready Preliminary Numbers Property Tax Bills Tax

If You Re One Of Those Homeowners Who Winces A Little Bit When The Property Tax Bill Comes In The Mail Get Ready Preliminary Numbers Property Tax Bills Tax

Create Livable Communities Strategic Initiatives Seattle King County Area Agency On Aging King County Community Seattle

Create Livable Communities Strategic Initiatives Seattle King County Area Agency On Aging King County Community Seattle

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

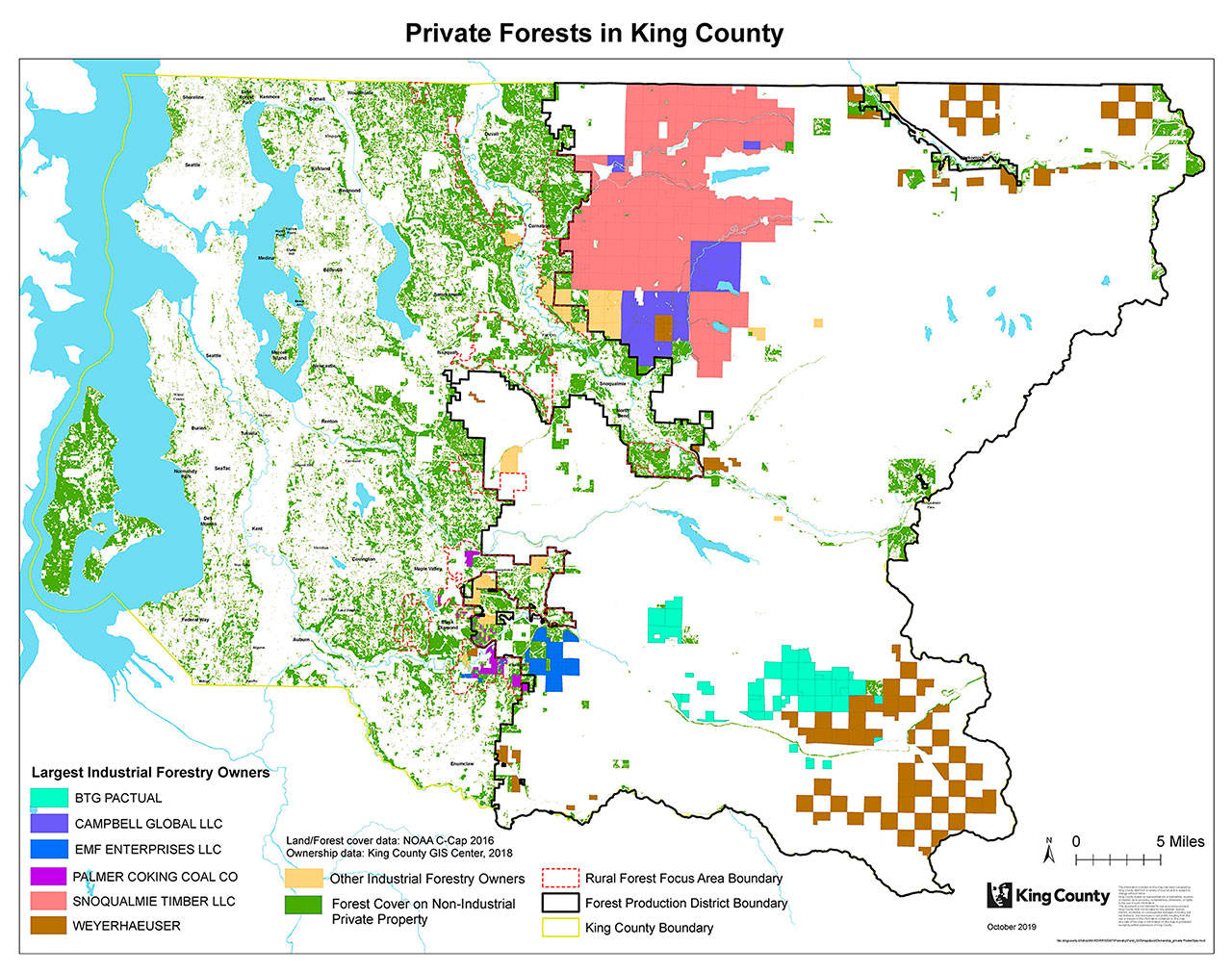

Who Owns King County Forestlands Seattle Weekly

Who Owns King County Forestlands Seattle Weekly

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Washington State Introducing New Real Estate Excise Tax Rates On Property Sales Will Springer

Washington State Introducing New Real Estate Excise Tax Rates On Property Sales Will Springer

Home Prices Bounce Back By 2 8 In Seattle I M Not Happy About This I Won T Be Ready To Buy For At Least A Couple Mor House Prices King County South

Home Prices Bounce Back By 2 8 In Seattle I M Not Happy About This I Won T Be Ready To Buy For At Least A Couple Mor House Prices King County South

The Boeing Boom Elevated The Seattle Area S Black Homeowners The Tech Boom Just The Opposite As The Region S Rate Of Ho Homeowner Home Ownership King County

The Boeing Boom Elevated The Seattle Area S Black Homeowners The Tech Boom Just The Opposite As The Region S Rate Of Ho Homeowner Home Ownership King County

March 14 2018 King Pierce County Real Estate Market Update Planning For Nearly 6 Million New Residents By 2050 Real Estate Marketing How To Plan Marketing

March 14 2018 King Pierce County Real Estate Market Update Planning For Nearly 6 Million New Residents By 2050 Real Estate Marketing How To Plan Marketing

Property Tax Cycle King County Wa Property Tax Tax Property

Property Tax Cycle King County Wa Property Tax Tax Property

Https Www Kirklandwa Gov Files Sharedassets Public Finance And Administration Pdfs Understanding Property Taxes Pdf

An Average Increase Of 17 Than Last Year S Https Inbest Us 2e8kjdw Real Estate Investing Property Tax City

An Average Increase Of 17 Than Last Year S Https Inbest Us 2e8kjdw Real Estate Investing Property Tax City

Area Trends Seattle King County Area Agency On Aging Health Trends Older Adults How To Plan

Area Trends Seattle King County Area Agency On Aging Health Trends Older Adults How To Plan

2020 Is Set To Become A Record Breaking Year For The Housing Market Thanks To The Culmination Of 3 Factor Housing Market Income Producing Lowest Mortgage Rates

2020 Is Set To Become A Record Breaking Year For The Housing Market Thanks To The Culmination Of 3 Factor Housing Market Income Producing Lowest Mortgage Rates