Property Tax Rate Round Rock Texas

If you live in a different school district your tax rate may be different. We are looking at homes in the 400000 to 500000 price range.

2624 Eastwood Ln Round Rock Tx 78664 Realtor Com

2624 Eastwood Ln Round Rock Tx 78664 Realtor Com

As indicated by the map below Travis County had one of the lowest county.

Property tax rate round rock texas. When using the online property tax payment option there is a 150 fee for all e-checks and a 215 fee for all credit card transactions. You must apply with the WCAD for any exemptions which you may be eligible for. 1959 The property tax rate shown here is the rate per 1000 of home value.

The Williamson County property tax rates for each tax jurisdiction for 2020 2019 2018 2017 and 2016 are presented here in an alphabetical list click here for a categorized listProperty tax rates are generally set by each taxing entity around September of each year. 2020 property taxes must be paid in full on or before unday January 31 2021 to avoid penalty and interest. The following table provides 2017 the property tax rates for 5 Austin area counties that are included in the Austin-Round Rock-San Marcos metropolitan area.

Tax amount varies by county The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. How much is the property tax in Round Rock Texas. News from Round Rock.

Property taxes are billed in October of each year but they do not become delinquent until Feb. The tax rate for FY 2020-2021 is 439000 cents per 100 assessed value. Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program.

In Austin the tax rate is 21558 and on a 157000 tax appraisal not purchase price house the taxes would add 240month to your payment according to it. If you live in Round Rock ISD your tax rate will be 2355852. 1 of the following year as required.

The new property tax rate is 631 cents per 100 valuation. Austin counties property tax rates. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Median home value on the 2020 property tax rolls is 256147 Estimated City tax bill for median home. This is the effective tax rate. Property Tax Rate The tax rate approved by City Council Sept.

The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located and by the name of each taxing unit. Texas law provides for certain exemptions and deferrals to help reduce the property tax obligations of qualifying property owners. The delinquency date is Saturday February 1 2021 and 7 penalty and interest.

The average effective property tax rate in the Lone Star State is 169 well above the national average of 107. Property tax tates for all 1018 Texas independent school districts are available by clicking on this Texas school districts property tax rates link. 10 is 43900 cents per 100 of valuation which is the same as the FY 2020 City property tax rate.

These exemptionstax reliefs are administered by the Williamson Central Appraisal District WCAD. The average Round Rock homeowner could see a 9528 increase in their property tax bill next year under a new tax rate receiving initial approval by the City Council. The council Thursday night.

Because Texas has no state property tax tax rate decisions fall under the control of a variety of local entities which we will explain in detail later in this article. The Texas Department of State Health Services held a webinar press. 1 of the next year.

In-depth Williamson County TX Property Tax Information. If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500. So say you home is assessed at 160000 your taxes for the year will be 376936.

The Comptrollers Property Tax Assistance Division PTAD publishes this list not later than Jan. The move means property owners who qualify will pay county taxes on a lesser property value amount. Texas has some of the highest property taxes in the US.

I know there is no state income tax in Texas but still the property taxes in Travis County are pretty high. 2020 Property tax statements will be mailed the week of October 12th. Also bianca - the Travis County appraisal district has a website where you can look up the property taxes for any property.

Can anyone tell me what property taxes are in Williamson County. Property Tax Rate. The vendor fees associated with credit card transactions and e-checks are passed along to the credit card or e-check users and are not paid by the Williamson County budget.

I understand Williamson County is less and we are looking to live in Georgetown possibly. Another 17 of your tax rate is a result of county taxes. Voters approved 125 million in bonds in November 2018 for park and road improvements and a new communications facility for police.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

1000 Ledbetter St Round Rock Tx 78681 Realtor Com

1000 Ledbetter St Round Rock Tx 78681 Realtor Com

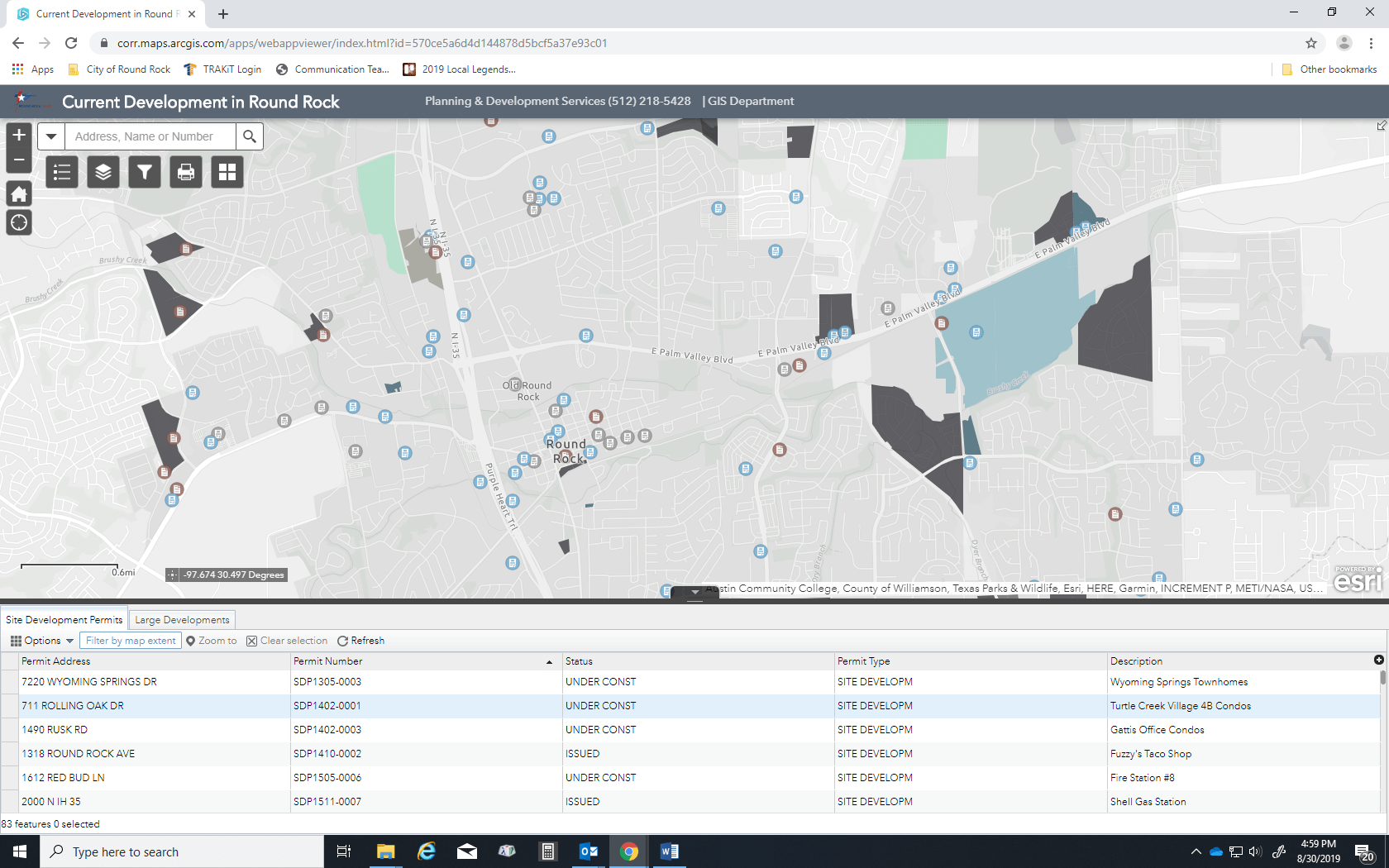

City Introduces New Current Development Map City Of Round Rock

City Introduces New Current Development Map City Of Round Rock

Https Www Roundrocktexas Gov Departments Finance Tax Information

Round Rock Named One Of Coolest Suburbs In America City Of Round Rock

Round Rock Named One Of Coolest Suburbs In America City Of Round Rock

About Round Rock City Of Round Rock

About Round Rock City Of Round Rock

Round Rock Texas Tx 78664 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Residents City Of Round Rock

New Residents City Of Round Rock

2315 Windsong Trl Round Rock Tx 78664 Realtor Com

2315 Windsong Trl Round Rock Tx 78664 Realtor Com

706 Tom Kite Dr Round Rock Tx 78664 Home For Rent Realtor Com

706 Tom Kite Dr Round Rock Tx 78664 Home For Rent Realtor Com

17411 Toyahville Trl Round Rock Tx 78664 Realtor Com

17411 Toyahville Trl Round Rock Tx 78664 Realtor Com

3631 Walleye Cv Round Rock Tx 78665 Realtor Com

3631 Walleye Cv Round Rock Tx 78665 Realtor Com

5745 Porano Cir Round Rock Tx 78665 Home For Rent Realtor Com

5745 Porano Cir Round Rock Tx 78665 Home For Rent Realtor Com

2808 Forest Green Dr Round Rock Tx 78665 Realtor Com

2808 Forest Green Dr Round Rock Tx 78665 Realtor Com

Utility Billing City Of Round Rock

Utility Billing City Of Round Rock

17412 Toyahville Round Rock Tx 78664 Realtor Com

17412 Toyahville Round Rock Tx 78664 Realtor Com

The Story Of Old Town City Of Round Rock

The Story Of Old Town City Of Round Rock

3702 Hawk Ridge St Round Rock Tx 78665 Realtor Com

3702 Hawk Ridge St Round Rock Tx 78665 Realtor Com

1930 Mulligan Dr Round Rock Tx 78664 Realtor Com

1930 Mulligan Dr Round Rock Tx 78664 Realtor Com

4133 Haight St Round Rock Tx 78681 Realtor Com

4133 Haight St Round Rock Tx 78681 Realtor Com