Property Value Calculator Mumbai

FAQ-Property Valuation in Maharashtra. Property Valuation Calculator India - Use Online Property Valuation Calculator to estimate the current value of a property by feeding relevant information such as city location type of house area and bedrooms.

Mortgage Of Immovable Property Stamp Duty On Mortgage Loan

Mortgage Of Immovable Property Stamp Duty On Mortgage Loan

The amount per 1000 of property value used to calculate local property taxes.

Property value calculator mumbai. Buyers sellers agents can compute the current market price of any homeproperty using this calculator. Calculate property valuation online get right price of your property. Firstly apply the depreciation to the Ready Reckoner value.

Calculator is simple to use just you need to select city and village or area then you will get CTS numbers in that particular area with their market values. Ready Reckoner Rate x Depreciation percentage x Raise as per floor 78630 x 70 100 x 105 100 5779305. Calculation of Valuation of the above property will as follows.

This system uses the stamp duty ready-reckoner rate issued by the government to find out the value of the property based on different parameters. The Ratable value and tax are with effect from 01APR2011. We are continuously working to improve the accessibility of our web experience for everyone and we welcome feedback and accommodation requests.

Thereafter calculate Flat Valuation. The buyer as well as the seller of a property will be impacted if the salepurchase consideration as stated in the agreement is lower than the fair market value of the property. After finding out the rent just calculate Price of a Property by simply applying following 2 methods and you will get a Fair Value of Property.

We have online ready reckoner calculator to calculate property ready reckoner value stamp duty value and to find CTS number of a property. Land Unit Residential Unit Office Shop Commercial Unit and Industrial Unit with all portion covered under Municipal Corporation of Greater Mumbai. You can easily search for Ready Reckoner values market values for properties as per property location village CTS No Zone Sub Zone anywhere anytime.

If the rates given in the ASR Annual Statement Rate for assessment of stamp duty are not acceptable the concerned applicant along with necessary papers of proofs can submit the application to the following officers for getting valuation done and exercises his right to present the case for adjudication under section 31 of. Estimate Property market value for investment. You can do calculations for Residential Flat Bungalow Duplex Row House Commercial Office Shop and Industrial Unit on the click of your mouse or even on your mobile.

Disclaimer I Site Map. Since this rate is revised annually the Brihanmumbai Municipal Corporation the civic body of Mumbai can arrive at a more realistic property value based tax amount than before. The government is proposing on the changes in Stamp Duty charges.

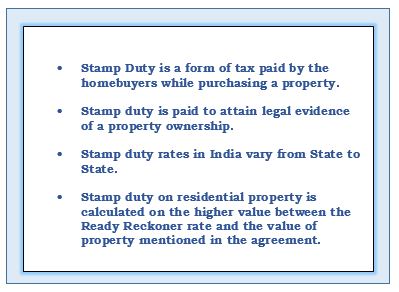

Property Rates Price Trends in Mumbai - 2020 The financial capital of India Mumbai is an investment hotspot that boasts end-user interest throughout the year. The stamp duty in Maharashtra as of 2015 September is 5. Stamp Duty Calculator for Property in Maharashtra.

The concept of fair market value is very important under the income tax laws. Consideration value is the total amount involved in any purchasesale transaction agreed between two parties. This is a well known international method to arrive at the fair value of property and is adopted by well known real estate firms.

A stamp duty of 1 is proposed to be levied on a property that measures 269 square feet in carpet area if purchased by individuals who fall under the EWS category. NAVI MUMBAI MUNICIPAL CORPORATION. Ground Floor Sector-15 A Palm Beach Junction CBD Belapur Navi Mumbai Maharashtra-400614.

For example if the agreement value of a property is Rs 50 lakhs and the value according to the ready reckoner rate is Rs 40 lakhs then the stamp duty would be calculated on the. Capital value Market value of the property x total carpet area x weight for construction type x weight for age of the building. Online Ready Reckoner Calculator.

Coupled by the employment opportunities Mumbai also presents investment options in all price ranges although prospective buyers must be ready to look in the peripheries if they are in. The capital value of your property is obtained as follows. Stamp duty is charged on the ready reckoner rate market valuecircle rate or the consideration value of the property whichever is higher.

Estimate the value of any property anytime anywhere. It is free quick and effortless. We have got 5779305- per Square Metre value for Flat.

In cases where the transaction is valued higher than the circle rate value the fee will be charged according to the deal value and not at the circle rate value. Real Estate Calculator will help you to buy sale property. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities.

Property Tax Base Value Built-Up Area Age Factor Type of Building Category of Use Floor Factor. Assessors calculate that value using the mill levyalso called the millage taxand the assessed property value.

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

How To Estimate Or Evaluate The Proper Value Of A Property Housing In India Quora

How To Estimate Or Evaluate The Proper Value Of A Property Housing In India Quora

How To Calculate Property Depreciation

How To Calculate Property Depreciation

Home Loan Eligibility Housing Loan Eligibility Calculator Eligibility Criteria

Home Loan Eligibility Housing Loan Eligibility Calculator Eligibility Criteria

Land Tax Meaning Charge Calculation Online And Offline Payment

Land Tax Meaning Charge Calculation Online And Offline Payment

Stamp Duty Calculator Calculate Stamp Duty Online

Stamp Duty Calculator Calculate Stamp Duty Online

State Wise Stamp Duty In India

State Wise Stamp Duty In India

Charges For Stamp Duty Registration Mumbai

Charges For Stamp Duty Registration Mumbai

Fair Market Value Calculating Capital Gain For Property Purchased Before 2001

Fair Market Value Calculating Capital Gain For Property Purchased Before 2001

Rent Vs Buy House Decision Explained With An Online Calculator Getmoneyrich

Rent Vs Buy House Decision Explained With An Online Calculator Getmoneyrich

Stamp Duty Calculator Online House Stamp Duty Calculator Indiabulls Home Loan

Stamp Duty Calculator Online House Stamp Duty Calculator Indiabulls Home Loan

Methods To Calculate Land And Property Value Housing News

Methods To Calculate Land And Property Value Housing News

What Are The Stamp Duty Registration Charges In Mumbai

What Are The Stamp Duty Registration Charges In Mumbai

Current Circle Rate In Mumbai Bajaj Finserv

Current Circle Rate In Mumbai Bajaj Finserv

How To Calculate The True Value Of The Property What Are The Methods To Realestate Valuations Am I Paying The Right Price Invest In Real Estate Real Estate Tips Real

How To Calculate The True Value Of The Property What Are The Methods To Realestate Valuations Am I Paying The Right Price Invest In Real Estate Real Estate Tips Real

How To Find Fair Market Value Of Property As Per Income Tax Laws

How To Find Fair Market Value Of Property As Per Income Tax Laws

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Valuation Of The Property As Per The Government Rules Property Registration

How To Calculate Valuation Of The Property As Per The Government Rules Property Registration

Capital Gain Calculator On Sale On Property Mutual Funds Gold Stocks

Capital Gain Calculator On Sale On Property Mutual Funds Gold Stocks