San Diego Property Tax Rate By Zip Code

San Diego County collects on average 061 of a propertys assessed fair market value as property tax. 858 694-2922 MS O-53.

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Averages for the 2004 tax year for zip code 92103 filed in 2005.

San diego property tax rate by zip code. Most recent San Diego property tax rates by area of San Diego County. Type an address above and click Search to find the sales and use tax rate for that location. Tax rates are provided by Avalara and updated monthly.

The states average effective rate is 242 of a homes value compared to the national average of 107. San Diego County A snapshot of a map showing case rates by municipality in San Diego County as of Nov. The following information is provided to you as a matter of convenience and.

858 694-2901 Fax. The undersigned certify that as of June 28 2019 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 28 2019 published. County of San Diego California Property Valuations Tax Rates Useful Information For Taxpayers Fiscal Year Ending June 30 2011.

Yearly median tax in San Diego County The median property tax in San Diego County California is 2955 per year for a home worth the median value of 486000. The tax code requires ech person owning taxable personal a. The average combined rate of every zip code in San Diego California is 7645 Other 2021 sales tax fact for San Diego There is also 76 out of 83 zip code in San Diego that are required to charge a special sales tax for a ratio of 91566.

Any tax increase by the county would raise the tax rate in all the cities within that county. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes. A map showing colored case rate tiers for each city in San Diego County as of Dec.

Property Tax Calculator - Estimate Any Homes Property Tax. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country. Look up 2021 sales tax rates for the 92110 ZIP Code and surrounding areas.

Average Adjusted Gross Income AGI. Since we know tax rates. However the county of San Bernardino is limited to an additional tax up to 125.

See reviews photos directions phone numbers and more for Sales Tax Rates By Zip Code locations in San Diego CA. Median real estate property taxes paid for housing units with mortgages in 2019. 8778294732 Pay by Phone.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. The median Los Angeles County homeowner pays 3938 annually in property taxes. Center 1600 Pacific Hwy Room 162 San Diego CA 92101.

Unsecured property are the secured tax rates levied for the preceding fiscal year RT 2905. For more information about tax rates visit our California City County Sales Use Tax Rates webpage. Dan McAllister Treasurer-Tax Collector San Diego County Admin.

1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. 92103 Zip Code San Diego CA Detailed Profile. The average effective property tax rate in San Diego County is 073 significantly lower than the national average.

DAN McALLISTER County of San Diego Treasurer-Tax Collector San Diego County Administration Center 1600 Pacific Highway - Room 162 San Diego CA 92101 Questions. Last sales taxes rates update. Any incorporated city within the county of San Bernardino may impose a tax up to 150.

Monday - Friday 800 am. San Diego County CA Property Tax Rates in 2021 Posted by Scott Taylor on Wednesday February 17 2021 at 918 AM By Scott Taylor February 17 2021 Comment When youre a property owner in San Diego County it is worthwhile for you to understand how your property taxes are calculated. Along with the countywide 072 tax rate homeowners in different cities and districts pay local rates.

Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. Jon Baker - Manager Auditor Controller 5530 Overland Avenue Suite 410 San Diego CA 92123 Phone. Find out how much the property tax rate is for each area of San Diego including Proposition 60 vs 90 due dates and fee schedules for paying your property taxes in San Diego County.

Sacramento County Property Tax Records Sacramento County Property Taxes Ca

Sacramento County Property Tax Records Sacramento County Property Taxes Ca

San Diego Property Tax Rate San Diego Real Estate Taxes Welcome To San Diego

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

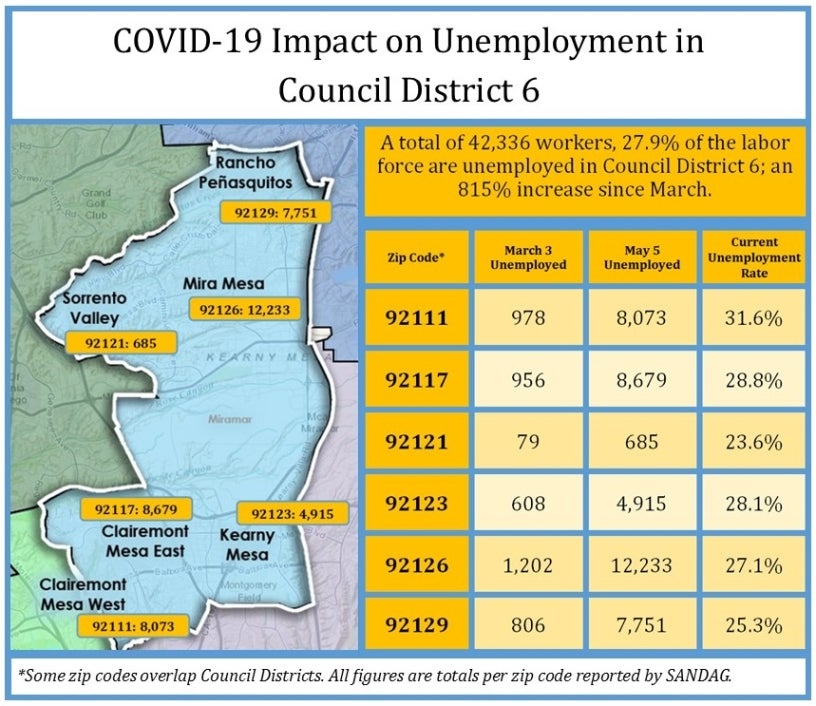

Resource Guide For Businesses Covid 19 Councilmember Chris Cate District 6 City Of San Diego Official Website

Resource Guide For Businesses Covid 19 Councilmember Chris Cate District 6 City Of San Diego Official Website

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

San Diego Zip Codes Map Zip Code Map Map California Map

San Diego Zip Codes Map Zip Code Map Map California Map

Property Taxes By Zip Code No Only By County

Property Taxes By Zip Code No Only By County

San Diego County Ca Property Tax Rates In 2021

San Diego County Ca Property Tax Rates In 2021

2020 Best Houston Area Suburbs To Buy A House Niche

2020 Best Houston Area Suburbs To Buy A House Niche

Study Drivers In Less White Zip Codes Pay More For Auto Insurance Moneygeek Com

Study Drivers In Less White Zip Codes Pay More For Auto Insurance Moneygeek Com

Hawaii Property Tax Calculator Smartasset

Hawaii Property Tax Calculator Smartasset

Sales Tax Calculation Zip Codes Are A Start But Not Enough

Sales Tax Calculation Zip Codes Are A Start But Not Enough

Zip Code Housing Price Index Fastest Housing Price Change Housing Value Appreciation

Most Expensive U S Zip Codes In 2020 Propertyshark

Most Expensive U S Zip Codes In 2020 Propertyshark

County Of San Diego Treasurer Tax Collector

County Of San Diego Treasurer Tax Collector

Most Expensive U S Zip Codes In 2020 Propertyshark

Most Expensive U S Zip Codes In 2020 Propertyshark