View Property Tax Bill Nyc

Whereas villages and the City of Rochester receive their total allocation of sales tax in cash property owners in towns receive a portion of their sales tax as a credit which reduces their property tax bill. The median property tax in New York is 375500 per year for a home worth the median value of 30600000.

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments Nyc

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments Nyc

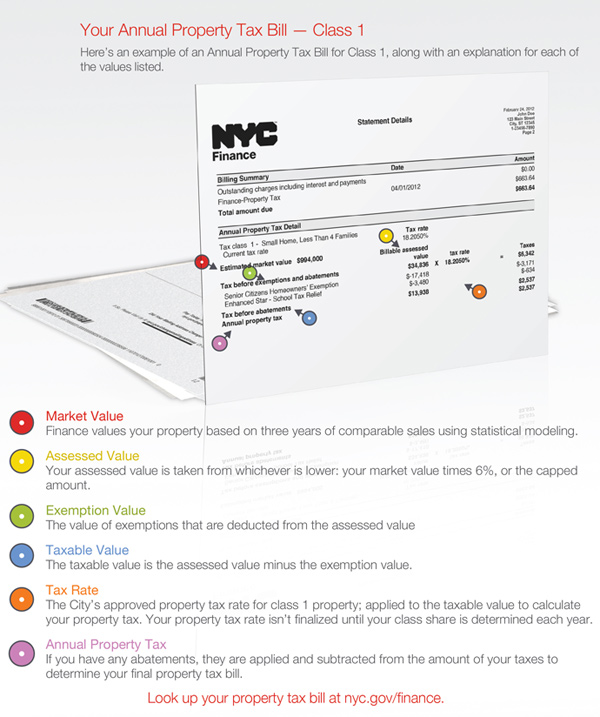

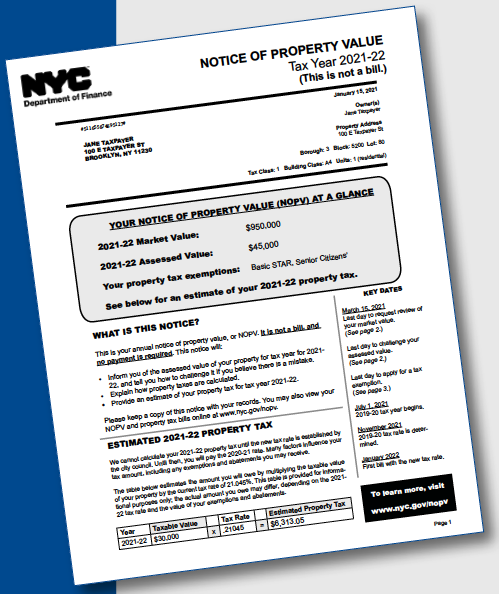

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due.

View property tax bill nyc. Or log in to Online Assessment Community. Property Taxes Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF Information for Property Owners. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

Permits Apply for various permits. In Public Access you can. IF YOU WANT TO PAY A PARTICULAR BILL ALSO CLICK THE VIEW BILL TAB NEXT TO THE DESIRED BILL.

Directions to find your tax bill. One Niskayuna Circle Niskayuna NY 12309 P. Tax Map Enter your section block and lot as it appears in the description of property on your tax bill.

General and School Tax Bills may be viewed online in the Receiver of Taxes Payment CenterUsing your Parcel ID school district section block and lot numbers or tax bill number you may search for your current General and School Tax Bills. See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff. If you do not receive your City tax bill by July or your County bill by April please call the Tax Office.

Report Submit Track and View Service Requests. The City of Yonkers mails one 1 City tax bill and one 1 County tax bill per year. If you own a co-op your co-ops managing agent or board of directors gets the property tax bill for the entire building.

Recreation Learn more about programs parks community centers pools and more. In most communities the second bill arrives in early January and is for. 518 386-4592 Monday - Friday.

You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. School tax bills are generally the first to arrive after assessments are finalized. After clicking the above link to access eGov you do not need to fill out all the requested info select the year and type of bill you want to see and then enter your last name in the owner name box and run a search.

518 386-4560 Monday - Friday. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year. Bills are generally mailed and posted on our website about a month before your taxes are due.

The eGov site allows you to view print andor pay your Town tax bills. Minimum fee of 175 Visa Debit card 395 flat fee will apply or by Electronic Check 175 flat fee will apply. Access Your Property Tax Bill.

Address Enter a house number and street name excluding the street type Rd Ln. Peekskill City Hall 840 Main Street Peekskill NY 10566 914 737-3400 Peekskill Police Department 2 Nelson Avenue Peekskill NY 10566 914 737-8000 Regular Office Hours. 311 Request Report submit track and view service request.

View Tax Bills Online. In-depth Queens NY Property Tax Information. Police Find information about Clarkstown Police services.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Most taxpayers in New York State receive two tax bills each year.

Tax Collector 87 Barger Road Medusa NY 12120 You may pay your taxes online 24 hours a day 7 days a week by using your Visa MasterCard American Express or Discover credit card 245 convenience fee will apply. Apply for Various Permits CLERK. In most communities school tax bills arrive in early September and may also include library taxes.

Monday Friday 900 am to 500 pm. Nassau County Tax Lien Sale Annual Tax Lien Sale Public Notice. Sales Tax CreditTown represents the share of total sales tax collections credited to towns outside of villages.

For questions contact Tax Collection Inquiries at 914-377-6138 6141 6146 and 6137 Monday through Friday from 830am - 430pm. Animal Care. If you signed up for automatic payment you will continue to receive property tax bills in the mail.

Look up information about a property including its tax class and market value. About a month before your taxes are due you can also view your bill online. IF YOUR PROPERTY HAS TAX LIENS YOU CAN SEE WHAT THE ORIGINAL BILL WAS BEFORE IT BECAME A LIEN BY CLICKING VIEW BILL YOU MUST CLICK VIEW LIEN TO CHECK WHICH LIENS STILL HAVE BALANCES DUE.

Etc This system allows you to view print or pay your tax bill in a secure and convenient environment. 9 - 5 Justice Court P. Welcome to the NYC Department of Finances Property Tax Public Access web portal your resource for information about New York City property taxes.

Cuyahoga County Home Has A 211 584 Property Tax Bill See Top Taxed Home In Each Town Cuyahoga County Property Tax County

Cuyahoga County Home Has A 211 584 Property Tax Bill See Top Taxed Home In Each Town Cuyahoga County Property Tax County

Can I Change My Mind If I Put An Offer On A House Purchase Contract Withdrawn Offer

Can I Change My Mind If I Put An Offer On A House Purchase Contract Withdrawn Offer

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Brooklyn Bridge

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Brooklyn Bridge

Map Find The Best Loops And Trails For Running In Central Park 6sqft Central Park Nyc Central Park Map Central Park

Map Find The Best Loops And Trails For Running In Central Park 6sqft Central Park Nyc Central Park Map Central Park

All Cash Offer In Nyc Hauseit Nyc Offer Cash Buyers

All Cash Offer In Nyc Hauseit Nyc Offer Cash Buyers

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa Income Tax Return Accounting Services Income Tax

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa Income Tax Return Accounting Services Income Tax

Condo Co Op Building Management Duties Nyc Hauseit Building Management Paying Bills Regulatory Compliance

Condo Co Op Building Management Duties Nyc Hauseit Building Management Paying Bills Regulatory Compliance

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

How Much Is The Coop Condo Tax Abatement In Nyc Hauseit

How Much Is The Coop Condo Tax Abatement In Nyc Hauseit

Co Op Tax Deduction Letter Hauseit Tax Deductions Deduction Income Tax Return

Co Op Tax Deduction Letter Hauseit Tax Deductions Deduction Income Tax Return

See How To Appeal High Property Taxes At Maximum Real Estate Exposure Learn The Process For Challenging Your Tax Bill In 2021 Property Tax Real Estate Challenges

See How To Appeal High Property Taxes At Maximum Real Estate Exposure Learn The Process For Challenging Your Tax Bill In 2021 Property Tax Real Estate Challenges

Property Tax Assessment See If You Re Paying Too Much

What Is The Nyc Senior Citizen Homeowners Exemption Sche Property Tax Senior Citizen Nyc

What Is The Nyc Senior Citizen Homeowners Exemption Sche Property Tax Senior Citizen Nyc

Nyc Real Estate Buyers Agent Duties Hauseit Real Estate Buyers Agent Real Estate Buyers Buyers Agent

Nyc Real Estate Buyers Agent Duties Hauseit Real Estate Buyers Agent Real Estate Buyers Buyers Agent

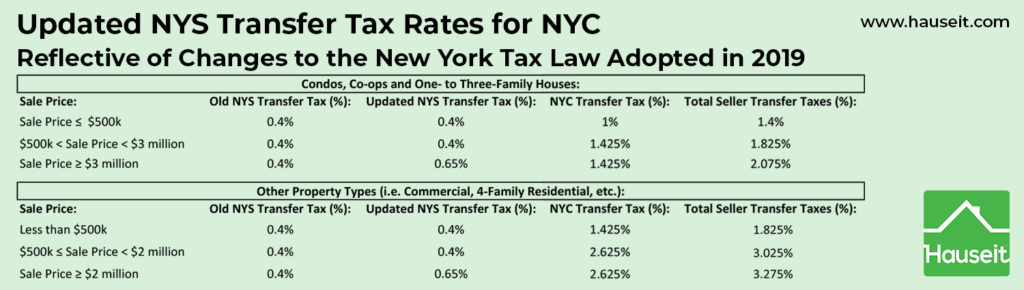

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

Monthly Property Tax Payments Dof

Monthly Property Tax Payments Dof

Nyc Finance Nycfinance Twitter

Nyc Finance Nycfinance Twitter