What Is Immovable Property Tax In Cyprus

The tax is imposed according to the Capital Gains Tax Laws 1980-2002. Immovable Property Tax IPT was reduced in 2016 to approximately a quarter of that in the previous year and is abolished in 2017.

Vat On The Purchase Of Real Estate In Cyprus

Vat On The Purchase Of Real Estate In Cyprus

Its imposed on the market value of the property as of 1st January 1980 sic and youre exempt from tax if this value is below CY170860 so theres often nothing to pay.

What is immovable property tax in cyprus. Cyprus property tax Cyprus Immovable property tax is calculated on the market value of the Cyprus property as was on the 1 st of January 1980 and applies to immovable property owned by taxpayers on the 1 st of January each year and is payable on the 30 th of September of the same year. Cyprus Immovable Property Tax law. Receipts of payment for all the above taxes and duties may be obtained from the InternalRevenue Department.

Capital gains tax is levied at a fixed rate of 20 on both individuals and companies on gains arising from the sale of immovable property situated in Cyprus and sale of shares in a company not listed on a recognized Stock Exchange which owns immovable property in Cyprus. Receipt obtained from the municipality in whose boundaries the property is situated. Immovable property tax 48 Trusts 50 Transfer fees by the department of land and surveys 52 Social insurance 54 National health system 56 Stamp duty 57 Capital duty 58 Tax treaties and withholding tax WHT tables 59 2019 Tax diary 69 PwC in Cyprus 72 PwC offices in Cyprus 74 Your contacts in PwC 76 Table of contents.

All property owners in Cyprus are liable to pay an annual tax levied on the value of the real estate they own in their name as of January 1 every year. There is no inheritance tax on property in Cyprus and the Immovable Property Tax payable to the Tax Department was axed in 2017. The immovable property tax payment deadline is 30 November 2014.

This tax is paid through the income tax office. The capital gains tax in Cyprus is imposed on earnings on immovable properties shares on companies with immovable properties included. Immovable property is real estate including a house barn shed pool deck and any real estate that cannot be picked up and moved.

Cyprus property tax is calculated on the market value of the property as at 1st January 1980 and is paid annually the Inland Revenue Department. Immovable Property definition used in Immovable Property Tax Law which defines which property is subject to immovable property tax is widened to include land created after backfilling of the sea and marine areas as defined in the Regulation of Marinas Law of 1977. What is Immovable Property Tax IPT.

Until the end of 2016 the registered owner of the property was liable to an annual Immovable Property Ownership tax calculated on the market value of the property as at 1st of January 1980 paid by the 30th of September in the year. For more information our Cypriot lawyers will remain at your disposal. Immovable property tax is payable annually on 30th September.

My wife died in November of last year and probate is still ongoing. Above that value the tax rates are as follows. The vision of the Tax Department is to become a modern tax administration.

This rate is set at 20 percent. Previous article Aristodimou favours full investigation. Property Tax payable to Communities and Municipalities This local property tax has not been abolished and those with property on the island will continue to pay this local tax which is calculated on the Land Registrys assessment of the 1980 value of the property.

Where these definitions become important is a tax time. Immovable Property Tax was payable to the Inland Revenue Department of the Republic of Cyprus. If you own a property with only a contract of sale since 2014 you are responsible for immovable property tax and should be registered.

Immovable Property Tax Rates in Cyprus Cyprus Estate agents Under the Cyprus Immovable. Nevertheless it is one of the hidden fees that is forgotten about by purchasers when they get the property in their name. Inheritance and Immovable Property Taxes.

On May 23 this year I was advised by the lawyer involved that they had received a demand for the payment of IPT owed by my wife. Under the Cyprus Immovable Property Tax laws 1980-2004 all property owners regardless of whether theyre resident in Cyprus or not are liable to pay an annual tax based on the total value of all the immovable property registered in their name. If you want credit from a Cypriot bank you will need to obtain property insurance.

Receipt obtained from the Sewerage Board. Big changes in Immovable Property Tax IMPT on Cyprus Property mean that tax savings are available for Expats owning Cyprus Property. Cyprus Immovable Property Tax Law Amendments 2014 note the first 8 pages contain the Greek text the remaining 3 an approximate English translation.

The Intellectual Property Ip Tax Regime In Cyprus Fsmo

The Intellectual Property Ip Tax Regime In Cyprus Fsmo

Offshore Bank For Sale Middle Sized Offshore Bank For Sale Unique Opportunity To Own Your Bank Offshorebankingbusiness Offshore Bank Banking Offshore

Offshore Bank For Sale Middle Sized Offshore Bank For Sale Unique Opportunity To Own Your Bank Offshorebankingbusiness Offshore Bank Banking Offshore

Keep Going On Purpose Keep Going Purpose Business Networking

Keep Going On Purpose Keep Going Purpose Business Networking

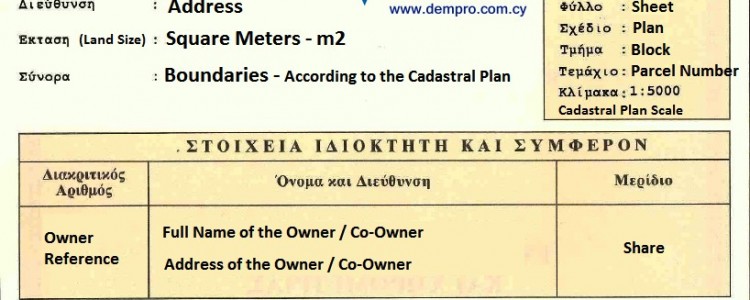

Title Deeds Properties In Cyprus

Title Deeds Properties In Cyprus

Why You Should And Shouldn T Sell Your Home In 2020 Buying Property Real Estate Things To Sell

Why You Should And Shouldn T Sell Your Home In 2020 Buying Property Real Estate Things To Sell

Quick Overview Of Cypriot Real Estate Rsm Cyprus

Quick Overview Of Cypriot Real Estate Rsm Cyprus

20 Up And Comers To Watch In The Property Limassol Cyprus

20 Up And Comers To Watch In The Property Limassol Cyprus

Benefits Of Property Structures Using Cyprus Tax Cyprus

Benefits Of Property Structures Using Cyprus Tax Cyprus

Tiea What Are Tax Information Agreements Offshore Bank Banking Offshore

Tiea What Are Tax Information Agreements Offshore Bank Banking Offshore

Cyprus Property Taxes In 2017 Cyprus Property News

Cyprus Property Taxes In 2017 Cyprus Property News

Immovable Property Tax Rates In Cyprus Cyprus Estate Agents

Immovable Property Tax Rates In Cyprus Cyprus Estate Agents

Corporate Tax Cyprus Andreas Neocleous Co

Corporate Tax Cyprus Andreas Neocleous Co

Property For Sale In Limassol Cyprus Direct From Owners With Title De

Property For Sale In Limassol Cyprus Direct From Owners With Title De

Uk Company With Hsbc Or Barclay Bank Account Opened At Distance Offshore Offshore Bank Banking

Uk Company With Hsbc Or Barclay Bank Account Opened At Distance Offshore Offshore Bank Banking

Pin On Offshore Banking Business

Pin On Offshore Banking Business

Property Tax In Cyprus Chetcuti Cauchi Cyprus

How Much Does A Cyprus Property Really Cost

How Much Does A Cyprus Property Really Cost

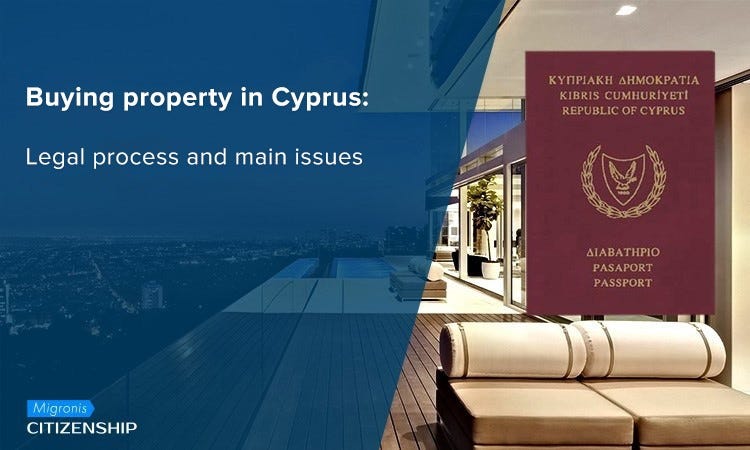

Buying Property In Cyprus Legal Process And Main Issues By Migronis Citizenship Medium

Buying Property In Cyprus Legal Process And Main Issues By Migronis Citizenship Medium