What Is The Property Tax Rate In Maine

Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. Mil rate x your propertys value Example.

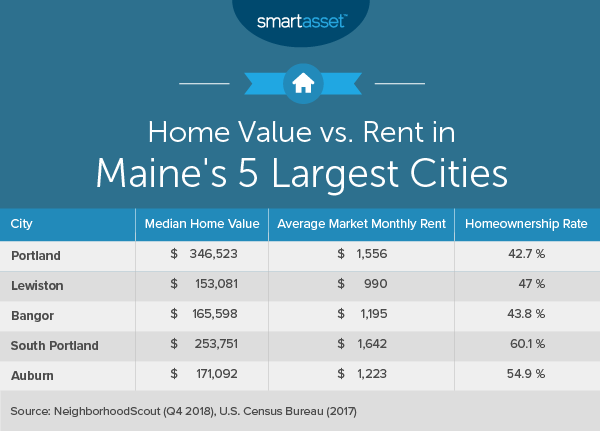

What Is The Cost Of Living In Maine Smartasset

What Is The Cost Of Living In Maine Smartasset

This map shows effective 2013 property tax rates for 488 Maine cities and towns.

What is the property tax rate in maine. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. Counties and cities are not allowed to collect local sales taxes. I created this page after constantly Googling the rates.

Below we have highlighted a number of tax rates ranks and measures detailing Maines income tax business tax sales tax and property tax systems. The states average effective property tax rate is 130 while the national average is currently around 107. Much like a municipal assessors office the division maintains records of all property ownership in the UT and has over 700 UT tax maps.

Waldo County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Property taxes have been with us since colonial times when a persons wealth could be measured in the amount of property a person owned. Resources for Financial Planning Estate planning or any type of financial planning is hard work.

The current tax rate is 2025 per 1000. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55. The income taxes corporate and personal generate 31 and the sales tax generates 23 of the total.

The median property tax also known as real estate tax in Waldo County is 158000 per year based on a median home value of 15030000 and a median effective property tax rate of 105 of property value. If your propertys value less any exemption you may have is. The statewide median rate is 1430 for every 1000 of assessed value.

The Property Tax Division is responsible for annually assessing and collecting property taxes in the UT. Box 1060 Augusta ME 04332-1060. 100000 then your tax bill would be 2025.

Cumberland County collects the highest property tax in Maine levying an average of 297300 12 of median home value yearly in property taxes while Washington County has the lowest property tax in the state collecting an average tax of 106500 104 of median home value per year. The state has an average effective property tax rate of 130. At the median rate the tax bill on a.

Each states tax code is a multifaceted system with many moving parts and Maine is no exception. The Maine taxable estate is equal to the federal taxable estate plus taxable gifts made during the one-year period ending on the date of the decedents death and the value of Maine elective property and for estates of decedents dying before January 1 2016 and after December 31 2017 decreased by any Maine QTIP property. The typical Maine resident will pay 2597 a year in property taxes.

The average effective property tax rate in Maine is 123 just about the national average. How does Maine rank. Groceries and prescription drugs are exempt from the Maine sales tax.

There are 23769 real estate tax accounts and 814 personal property tax accounts maintained by the. Municipal Services and the Unorganized Territory. The property tax rate also known as a mil rate is the amount per 1000 dollars of property value which is used to calculate your tax bill.

The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. These rates apply to the tax bills that were mailed in August 2020 and due October 1 2020. The first step towards understanding Maines tax code is knowing the basics.

In 1953 the sales tax on retail transactions was enacted and in 1969 the states personal income tax was adopted. The exact property tax levied depends on the county in Maine the property is located in. Property taxes currently account for 45 of the revenues in Maine generated by the three major taxes.

Are you looking to move to a town or city in Maine but also want to get a sense of what the property tax or mil rate isYouve come to the right place. Maine Relocation Services Local Tax Rates. The general sales tax is 55 and there are no local sales taxes meaning 55 is the highest sales tax rate youll encounter.

That means that on average Mainers pay 130 of their homes value in property taxes. The state of Maine publishes this information in a PDF but wanted to be able to sort by mil rate county growth rate and current mil rate. Local government in Maine is primarily supported by local property taxes.

Until the early 1950s the property tax was the only major tax in Maine. The Property Tax Division is divided into two units. Maine has no special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Tax Rates The following is a list of individual tax rates applied to property located in the unorganized territory. Maine Property Tax Property taxes in Maine are an important source of revenue for local governments and school districts. Overview of Maine Taxes Property tax rates in Maine are well above the US.

Are You A Number Cruncher Free Mortgage Calculator Mortgage Calculator Number Cruncher

Are You A Number Cruncher Free Mortgage Calculator Mortgage Calculator Number Cruncher

Here Are The Best And Worst States For Taxes What Is Credit Score Healthcare Costs Income Tax

Here Are The Best And Worst States For Taxes What Is Credit Score Healthcare Costs Income Tax

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Rental Property Tax Deductions Rental Property Management Real Estate Investing Rental Property House Rental

Rental Property Tax Deductions Rental Property Management Real Estate Investing Rental Property House Rental

Maine Property Tax Calculator Smartasset

Maine Property Tax Calculator Smartasset

Unorganized Territory Tax Acquired Property List Property Tax Mrs Property Tax Tax Property

Unorganized Territory Tax Acquired Property List Property Tax Mrs Property Tax Tax Property

Https Www Maine Gov Revenue Sites Maine Gov Revenue Files Inline Files Betr Book Pdf

How To Become A Real Estate Appraiser In Maine Work Experience How To Become Real Estate

How To Become A Real Estate Appraiser In Maine Work Experience How To Become Real Estate

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Most Frequent Cause Of Weather Fatalities In The Us Deaths Maps States United Weather The Weather Channel Map Weather

Most Frequent Cause Of Weather Fatalities In The Us Deaths Maps States United Weather The Weather Channel Map Weather

Report Maine Losing 52 Million Annually To Corporations Using Offshore Tax Havens Beacon Tax Haven Tax Offshore

Report Maine Losing 52 Million Annually To Corporations Using Offshore Tax Havens Beacon Tax Haven Tax Offshore

Pin On 867 875 Ludlow Road Ludlow Maine 04730

Pin On 867 875 Ludlow Road Ludlow Maine 04730

Maine Property Tax Rates By Town The Master List

U S Cities With The Longest Names University Of Rhode Island City Names

U S Cities With The Longest Names University Of Rhode Island City Names

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Pin On Maine Is Lighthouses Lobsters Blueberries Lots More To Collect Enjoy

Pin On Maine Is Lighthouses Lobsters Blueberries Lots More To Collect Enjoy

Pin On Www Seanrizor Danberry Com

Pin On Www Seanrizor Danberry Com

Tax Maps And Valuation Listings Maine Revenue Services

Tax Maps And Valuation Listings Maine Revenue Services