What Is The Property Tax Rate In Queens Ny

The current total local sales tax rate in Queens County NY is 8875The December 2020 total local sales tax rate was also 8875. Simply fill in the exact address of the property in the search form below.

Professional Tax Services In Ny Tax Services Tax Preparation Tax Preparation Services

Professional Tax Services In Ny Tax Services Tax Preparation Tax Preparation Services

When taking those exemptions into account effective property tax rates in New York City are around 088.

What is the property tax rate in queens ny. Or log in to Online Assessment Community. The median property tax in Queens County New York is 291400 All of the Queens County information on this page has been verified and checked for accuracy. Settled in 1683 Queens has long been an ideal living destination for those working in New York City and searching for a little piece of the Big Apple.

Property Tax Rates for Tax Year 2020. The property value is an essential component in computing the property tax bills. Queens New York is a borough of New York City with a population of well over 2 million residents.

The Queens county NY tax assessor office provides the necessary services to estimate the real property value within its jurisdiction. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year. The statewide New York average is 168.

In order to determine the tax bill your local tax assessors office takes into. The median property tax also known as real estate tax in Queens County is 291400 per year based on a median home value of 47930000 and a median effective property tax rate of 061 of property value. In Queens the rate is 088.

While New York City famously under-taxes single-family homes it is well known for overtaxing large residential buildings. To break it down further in Brooklyn Kings County the rate is just 066 less than half the state average. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

But dont rest too easily. Visit Website 212-759-0097 Contact Us. The median property tax in Queens County New York is 2914 per year for a home worth the median value of 479300.

Queens County NY Sales Tax Rate. City State or Zip. The assessed value is determined by an independent organization the Property Valuation Services Corporation a company that performs the valuation services for all properties in Nova Scotia.

Your search for Queens NY property taxes is now as easy as typing an address into a search bar. Queens County collects on average 061 of a propertys assessed fair market value as property tax. In Manhattan New York County the rate is 095.

That Queens single-family homeowner gets a break but the owner of a 750000 condo in Manhattan could be shelling out as much as 19000 in property taxes. Property tax paid is 1917 and in New York it is 375596 percent higher than the national median. The Queens tax assessor office is also tasked to provide supplemental bills business property taxes and other vital information.

The median property tax in New York is 375500 per year for a home worth the median value of 30600000. Moreover New York has the highest local taxes in America as a percentage of personal income79 percent above the national average. Class 3 - 12536.

Bradford Randolph Esq PLLC can help. 025 discount on the last three quarters if you wait until October to pay the entire amount due for the year. Often property values do not coincide with property taxes because tax assessments are usually not done every year and cannot keep pace with the marketplace such as.

New York property taxes are out of control. 05 on the full amount of your yearly property tax if you pay the full years worth of tax shown on your bill by the July due date or grace period due date. See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff.

Class 1 - 21167. New York has one of the highest average property tax rates in the country with only three states levying higher property taxes. Property taxes in the Region of Queens are calculated by applying the applicable tax rate to every 100 in assessed property value.

In-depth Queens NY Property Tax Information. There are public meetings you can attend and voice your opinion and you also have the opportunity to vote on your school budget. If you are concerned with the amount of property taxes being collected in your community you may wish to be involved with the local budgeting processes.

Class 2 - 12473. Get assistance for your Property Tax issue in the Queens New York area. Class 4 - 10537.

But You Don T Look Sick Tax Time Filing Taxes Income Tax

But You Don T Look Sick Tax Time Filing Taxes Income Tax

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Queens Residential Real Estate Market Update March 2019 Luxury Marketing Residential Real Estate Real Estate Marketing

Queens Residential Real Estate Market Update March 2019 Luxury Marketing Residential Real Estate Real Estate Marketing

Map Find The Best Loops And Trails For Running In Central Park 6sqft Central Park Nyc Central Park Map Central Park

Map Find The Best Loops And Trails For Running In Central Park 6sqft Central Park Nyc Central Park Map Central Park

Income Tax Form Ay 3 3 3 Brilliant Ways To Advertise Income Tax Form Ay 3 3 Income Tax Income Tax Return Tax Forms

Income Tax Form Ay 3 3 3 Brilliant Ways To Advertise Income Tax Form Ay 3 3 Income Tax Income Tax Return Tax Forms

Ace Tax Services Deals In Tax Filing In Queens Ny And We Have Countless Numbers Of Happy Clients With Us In The Regio Tax Services Tax Preparation Filing Taxes

Ace Tax Services Deals In Tax Filing In Queens Ny And We Have Countless Numbers Of Happy Clients With Us In The Regio Tax Services Tax Preparation Filing Taxes

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

How To Earn 30000 A Year And Get Ahead Budgeting Financial Tips Federal Income Tax

How To Earn 30000 A Year And Get Ahead Budgeting Financial Tips Federal Income Tax

Irs Income Tax Preparation Offices And Services Near Me Income Tax Preparation Tax Preparation Income Tax

Irs Income Tax Preparation Offices And Services Near Me Income Tax Preparation Tax Preparation Income Tax

Reliable Local Lock Repair Service In Brooklyn Queens Jbm Locksmith Tax Write Offs Home Ownership Things To Sell

Reliable Local Lock Repair Service In Brooklyn Queens Jbm Locksmith Tax Write Offs Home Ownership Things To Sell

Is It Really Worth It To Buy A House House Worth Mortgage Payoff Closing Costs

Is It Really Worth It To Buy A House House Worth Mortgage Payoff Closing Costs

Are You Looking For Someone Who Have A Experience In Tax Related Work And The One You Can Trust Then Cont Tax Services Tax Preparation Services Tax Preparation

Are You Looking For Someone Who Have A Experience In Tax Related Work And The One You Can Trust Then Cont Tax Services Tax Preparation Services Tax Preparation

Income Tax Preparation And Filing Of The Returns Is Just Like The Foundation Of The Entire Taxa Tax Preparation Services Tax Preparation Income Tax Preparation

Income Tax Preparation And Filing Of The Returns Is Just Like The Foundation Of The Entire Taxa Tax Preparation Services Tax Preparation Income Tax Preparation

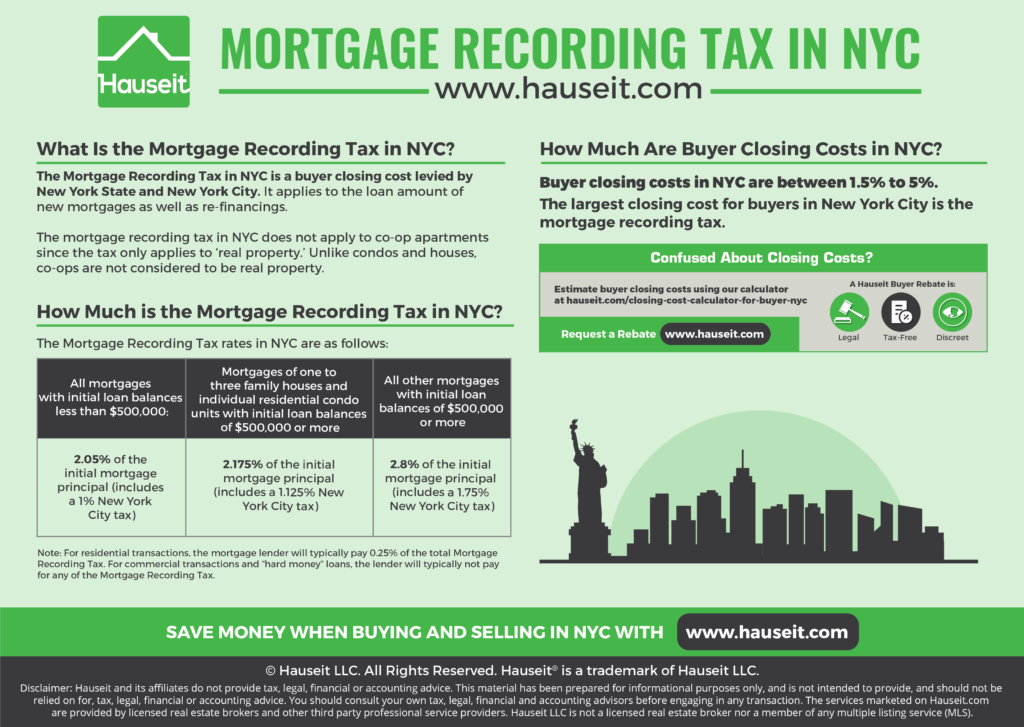

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Family Dollar 112 05 Sutphin Blvd Jamaica Queens Ny 11435 Income Tax Preparation Tax Preparation Family Dollar

Family Dollar 112 05 Sutphin Blvd Jamaica Queens Ny 11435 Income Tax Preparation Tax Preparation Family Dollar

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

Looking For The Professional Tax Services In Queens Ny By Which You Can Easily Prepare Your Tax Forms Fi Tax Services Tax Preparation Tax Preparation Services

Looking For The Professional Tax Services In Queens Ny By Which You Can Easily Prepare Your Tax Forms Fi Tax Services Tax Preparation Tax Preparation Services

Tax Preparation Services 4 Mistakes In Wealth Planning Hit The Like Repin Button If You Don T Mind Income Tax Return Income Tax Income Tax Preparation

Tax Preparation Services 4 Mistakes In Wealth Planning Hit The Like Repin Button If You Don T Mind Income Tax Return Income Tax Income Tax Preparation