Uk Property Owners In Spain After Brexit

Despite the drop the British people continue to be the top foreign buyers in Spain. Once the transition period ends on 31 December 2020 British property owners in Spain will probably pay slightly higher tax on rental income.

How Would A No Deal Brexit Affect British Owners Of Spanish Property My Lawyer In Spain

How Would A No Deal Brexit Affect British Owners Of Spanish Property My Lawyer In Spain

This therefore accounts for the vast majority of holidays and also a majority of holiday-home owners in Spain who use their property in the sun as a second home.

Uk property owners in spain after brexit. There are no current restrictions nor specific requirements to be a national of one of the EU countries in order to purchase property in Spain. Non-EU citizens such nationalities such as Americans and Swiss have been buying properties in Spain for decades. EU citizens including the Spanish themselves pay 19 while non-EU pay 24.

Whilst a trade deal was eventually finalised in December it seems uncertain as to how Brexit will impact overseas property owners and buyers in 2021. Will Brexit affect my rights as a homeowner. Robert Pullen tax partner at the firm explained.

This however is yet to be clarified. Can I still buy property in Spain. February 26 2021 1643 SPANISH PROPERTY INISGHT After the official Brexit reduction on 01 January 2021 British citizens who wish to acquire legal residence in Spain should go through a different process since the Legal Regime for Foreign people will now apply to them.

After Brexit letting the same apartment would be taxed at 24 on the gross rent of 10800 creating a tax bill of 2592. You will still be able to buy property in Spain after Brexit. Holidays and second-home owners.

Brexit will impact on many aspects of life but one thing we are receiving many questions on is travel restrictions. Assuming that the UK leaves the EU on January 31st under the terms of the Withdrawal Agreement - which is looking the most likely scenario at this point although still not certain - heres a look at what is changing and what stays the same. Brexit bombshell for owners of Spanish homes UK-based landlords of Spanish properties will pay higher income tax after Brexit and may lose the right to an exemption from capital gains tax arising on the sale of a former home.

After Brexit the amount a UK buyer can borrow may decrease from a maximum of 70 to 60 or 65 in line with other non-EU nations. It is a tax on the rateable value of the property and is relatively low as the taxable amount is 11 of the rateable value. Much has been written about the effect of Brexit on Brits who live own property and holiday in Spain and far more will be written and discussed until Article 50 is invoked as those of us who either live or own property on the Spanish mainland or the islands consider our route to safety once we know and understand the terms of the United Kingdoms farewell to what we used to call the continent.

If you become a legal resident of Spain before the end of the transitional period you will be granted the same rights to stay as those already living in Spain prior to Brexit. In 2015 Brits bought 15810 properties in Spain and were the largest group of non- Spanish nationals to invest in Spanish property. All owners of property in Spain have the same rights and obligations regardless of where they are from.

25th Oct 2019 4 comments. During 2020 Brexit trade negotiations were a fiercely contested set of campaigns with plenty of back and forth in addition to brutal disagreements. Non-EU owners cannot deduct expenses from their tax bill either.

As British homeowners will retain all their rights except for the freedom of movement equal to EU citizens they will also be able to rent out their homes in Spain. Holidays to Spain with stays of less than 90 days within any 180-day period will remain unaffected by the UK leaving the EU Woolley points out. Based on this future British investment in Spain should not be affected by the UK leaving the European Union and British nationals would in the current position be able to invest in Spain should they wish to do so.

Getting a mortgage in Spain as a UK citizen Non-Spanish residents are usually able to get a mortgage on a property in Spain provided they can prove they have a good credit score. Rules about property ownership rent taxation and shared ownership have not changed. The number one priority for Brits buying a property in Spain is to be officially registered before the end of December 2020.

To ensure that British citizens to obtain The spanish language residency. Britons with Spanish holiday homes dealt unexpected tax bill BRITONS with holiday homes in Spain now face higher tax bills after the UK left the European Union EU according to. Foreign Spanish property purchases after Brexit Foreign buyers make up 16 of the Spanish property market with UK buyers traditionally making up the largest proportion of overseas property buyers in Spain.

Property rights are never linked to residency status or nationality. This is because buying property is not confined to European citizens. Britons Renting Out Their Homes in Spain.

There are currently no restrictions that homeowners in Spain need to be an EU national. Using an exchange rate of say 1 1 Gemma will pay UK income tax at 40 on 3600 1440 less Spanish tax paid of 684 leaving 756 to pay in the UK reduced to only 36 if she is a basic rate. Elsewhere leading tax advisory firm Blick Rothenberg has warned that UK owners of Spanish holiday homes face significantly higher tax bills following Brexit.

Brexit short for British exit as we know now will affect many but one main concern is what will be different with buying property in Spain after Brexit. The rateable value or valor catastral is almost always far lower than the market value. From 1 January 2021 UK based owners of Spanish real estate will suffer a 24 tax rate on income after the previous 19 tax rate expired when the transition period ended on December 31.

As Gemma is a UK resident she will also pay UK income tax at her marginal rate on the net income from the apartment but with a credit for the Spanish tax paid. This is a tax that is paid by property owners in Spain who are not resident in Spain. The purchase process for Britons in Spain remains the same after Brexit as before.

How Will Brexit Affect British Property Owners In Spain Solicitors In Spain

How Will Brexit Affect British Property Owners In Spain Solicitors In Spain

What British Owners Of Spanish Property Need To Know About Brexit Costaluz Lawyers

What British Owners Of Spanish Property Need To Know About Brexit Costaluz Lawyers

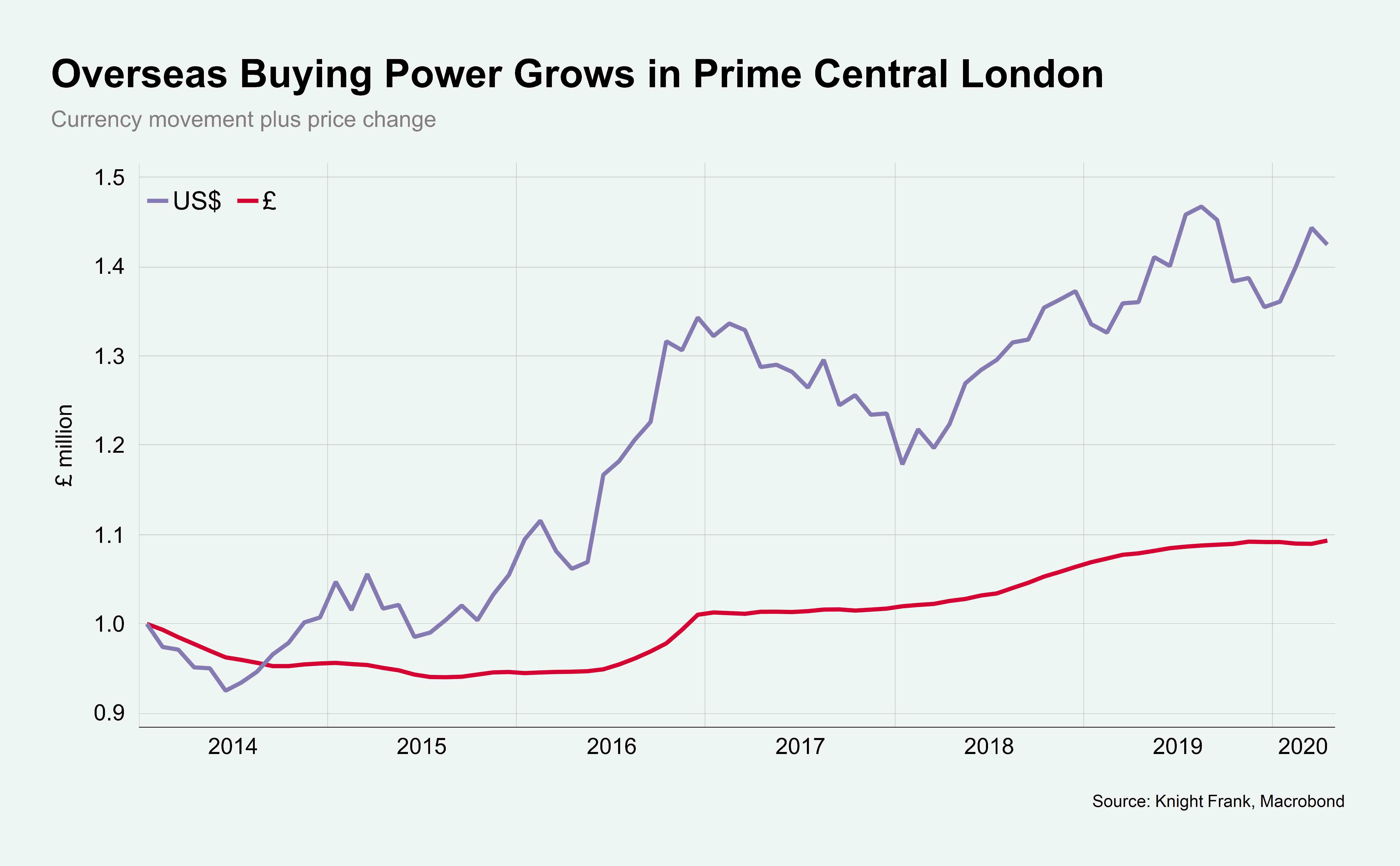

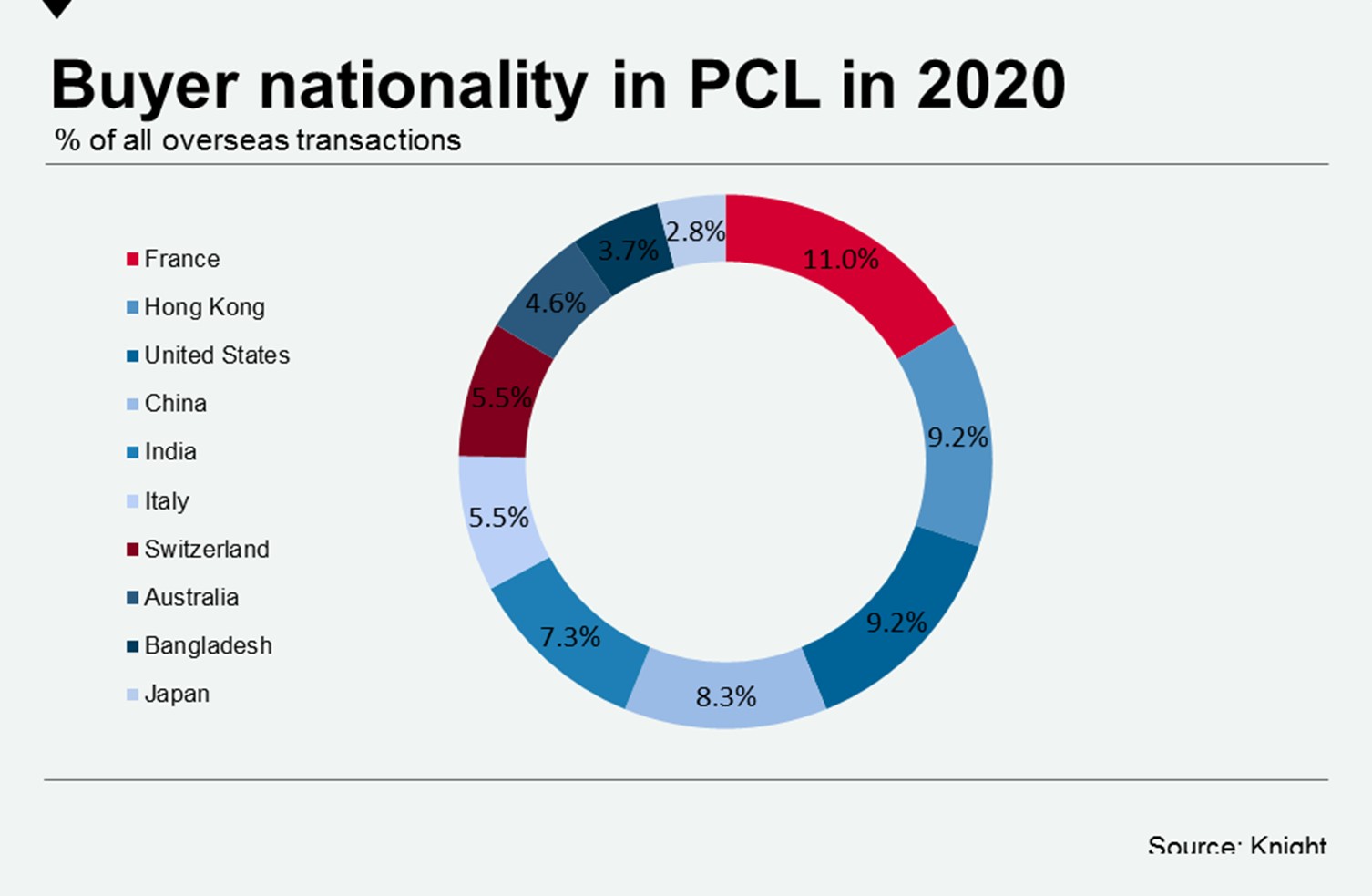

Global Demand For Uk Property Grows As The Pound Comes Under Pressure

Global Demand For Uk Property Grows As The Pound Comes Under Pressure

A Tale Of Two Kensingtons In Palace Gardens London The Average House Price Is 19m In Liverpool Homes Are On Sale For 1 Each But Behind This Shocking Dis Expensive Houses

A Tale Of Two Kensingtons In Palace Gardens London The Average House Price Is 19m In Liverpool Homes Are On Sale For 1 Each But Behind This Shocking Dis Expensive Houses

Brexit Q A What British Second Home Owners In Spain Need To Know The Local

Brexit Q A What British Second Home Owners In Spain Need To Know The Local

British People Could Have To Pay More Tax On Properties They Rent Out On The Costa Sur In English

Uk Property Market Outlook Week Beginning 19 October

Uk Property Market Outlook Week Beginning 19 October

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/ZXIPGKO7XBCKZDJ7VW4VNQDCCQ.jpg) Properties In Spain In Spain Old Franco Law Hampers Post Brexit House Sales To Britons Brexit El Pais In English

Properties In Spain In Spain Old Franco Law Hampers Post Brexit House Sales To Britons Brexit El Pais In English

Brexit 90 Day Limit Will Hit British Demand

Brexit 90 Day Limit Will Hit British Demand

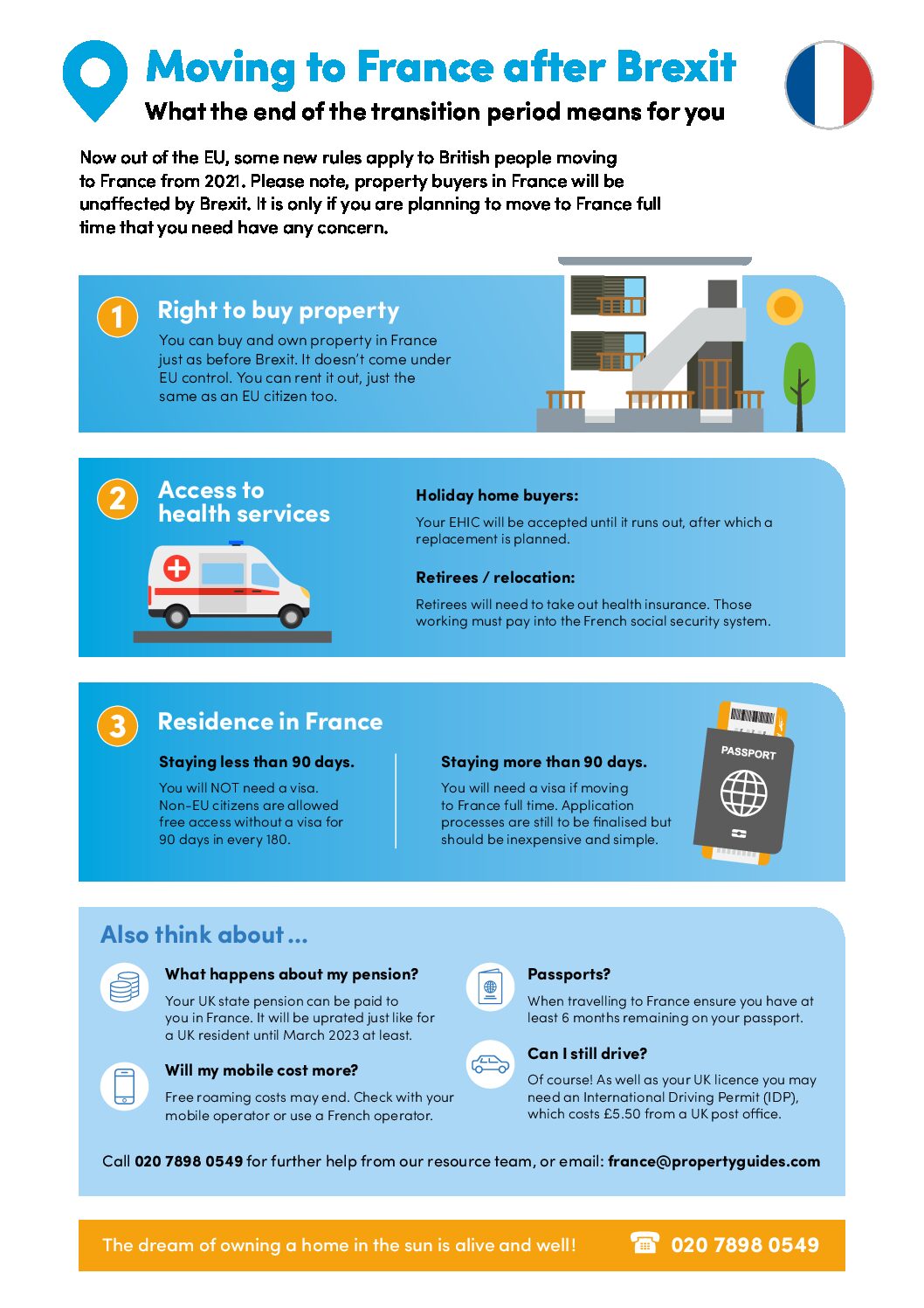

Buying Property In France After Brexit France Property Guides

Buying Property In France After Brexit France Property Guides

Gilts Among Best Shorts As U K Reflation Trade Alive And Well Nice Shorts Wellness Best

Gilts Among Best Shorts As U K Reflation Trade Alive And Well Nice Shorts Wellness Best

Buying Property In Spain After Brexit Covid Update Houses In Spain

Buying Property In Spain After Brexit Covid Update Houses In Spain

Spain Assures The British Of A Continued Warm Post Brexit Welcome With Or Without A Deal

Spain Assures The British Of A Continued Warm Post Brexit Welcome With Or Without A Deal

What Worries British Second Home Owners In Spain Most About Brexit The Local

What Worries British Second Home Owners In Spain Most About Brexit The Local

The Main Effects Of Brexit On Uk Property Owners In France France Property Guides

The Main Effects Of Brexit On Uk Property Owners In France France Property Guides

Living In Spain After Brexit What You Need To Know Right Casa Estates Calahonda Spain

Living In Spain After Brexit What You Need To Know Right Casa Estates Calahonda Spain

Avoid Spanish Taxes On Your Uk Property Are You Moving To Spain

Avoid Spanish Taxes On Your Uk Property Are You Moving To Spain