Recognition Of Impairment For Property Plant And Equipment

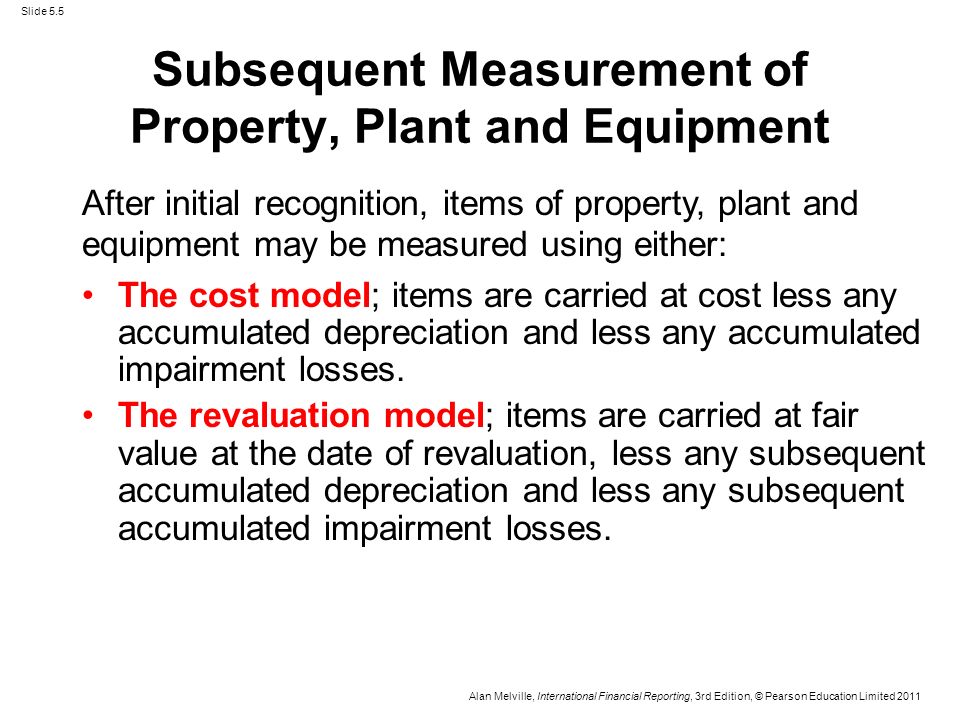

Asset on the balance sheet after accumulated depreciation and accumulated impairment losses are. An item of property plant or equipment shall not be carried at more than recoverable amount.

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower value.

Recognition of impairment for property plant and equipment. In testing for recoverability of property plant and equipment an impairment loss is required if the. Impairment is accounted for according to the principles set out in IAS 36. Recoverable amount is the higher of an assets fair value less costs to sell and its value in use.

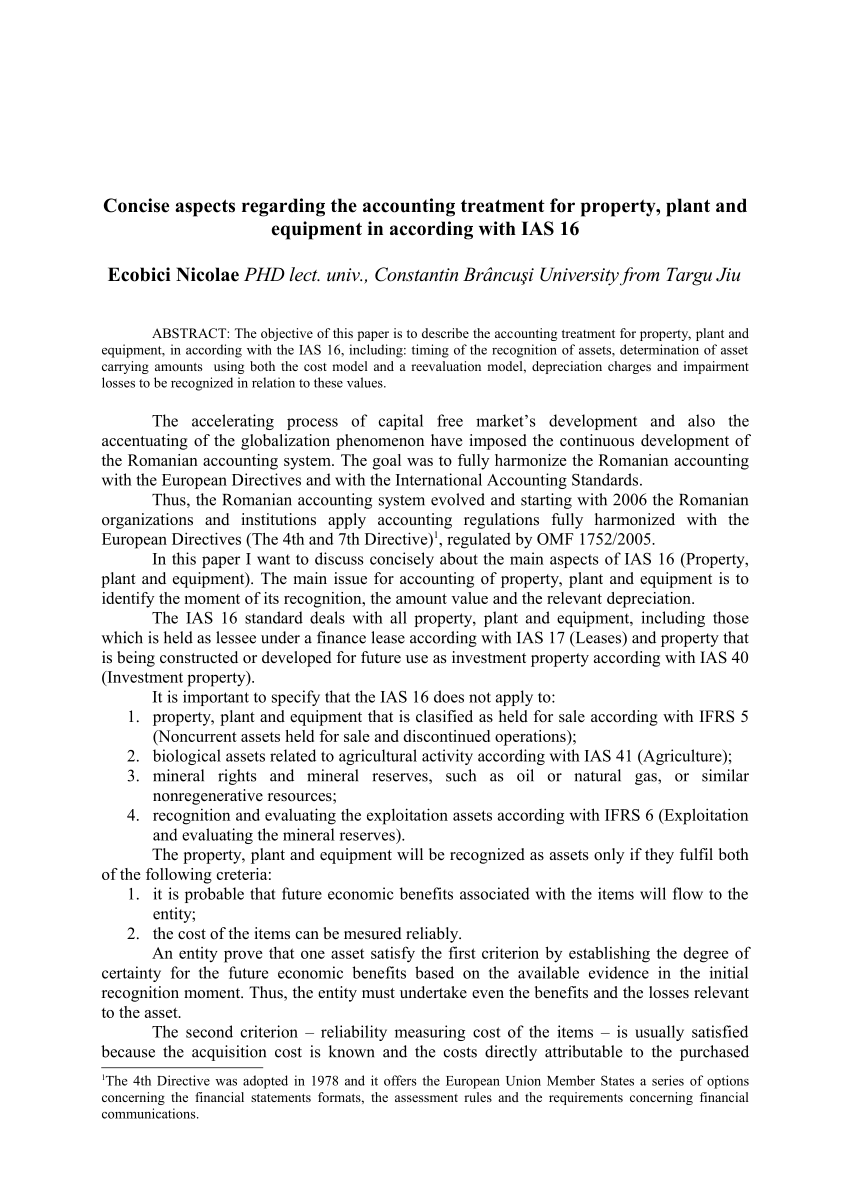

Standard IAS 16 prescribes the accounting treatment for property plant and equipment and therefore it is one of the most important and commonly applied standards. The impairment loss should be recognised in the profit or loss immediately unless the revaluation decrease treatment is prescribed in another accounting standard. Impairment loss is recognised in the income statement for assets carried on a depreciated historical cost basis or treated as a revaluation decrease for assets that are carried at revalued amount.

The carrying amount is the recognised value of the. To be added as increase profit or damage especially as the produce of money lent. The impairment revaluation and derecognition of a companys property plant and equipment as well as its intangible assets can significantly affect the companys financial statements and the financial ratios derived from them.

Effective 1 January 2008. An item may be an asset but if it fails the recognition criteria it will not be recorded as entitys asset in its statement of financial position. Recoverable amount is the higher of an assets fair value less costs to sell and its value in use.

Determining the depreciation charges and impairment losses in respect of property plant and equipment vc_column_text. Property plant and equipment should not be valued higher than its the recoverable amount. For an item of PPE to be recognized recorded in financial statements it has to first meet the definition of asset and then the recognition criteria.

Initial recognition An item of property plant and equipment should be recognised as an asset when. The General Subsections address the accounting and reporting for property plant and equipment including guidance for accumulated depreciation. To come to by way of increase.

The Impairment or Disposal of Long-Lived Assets Subsections retain the pervasive guidance for recognizing and measuring the impairment of long-lived assets and for long-lived assets to be. Ascertaining the carrying amounts of the assets. Based on my experience most of the companies use Cost Model to subsequently measure its fixed assets.

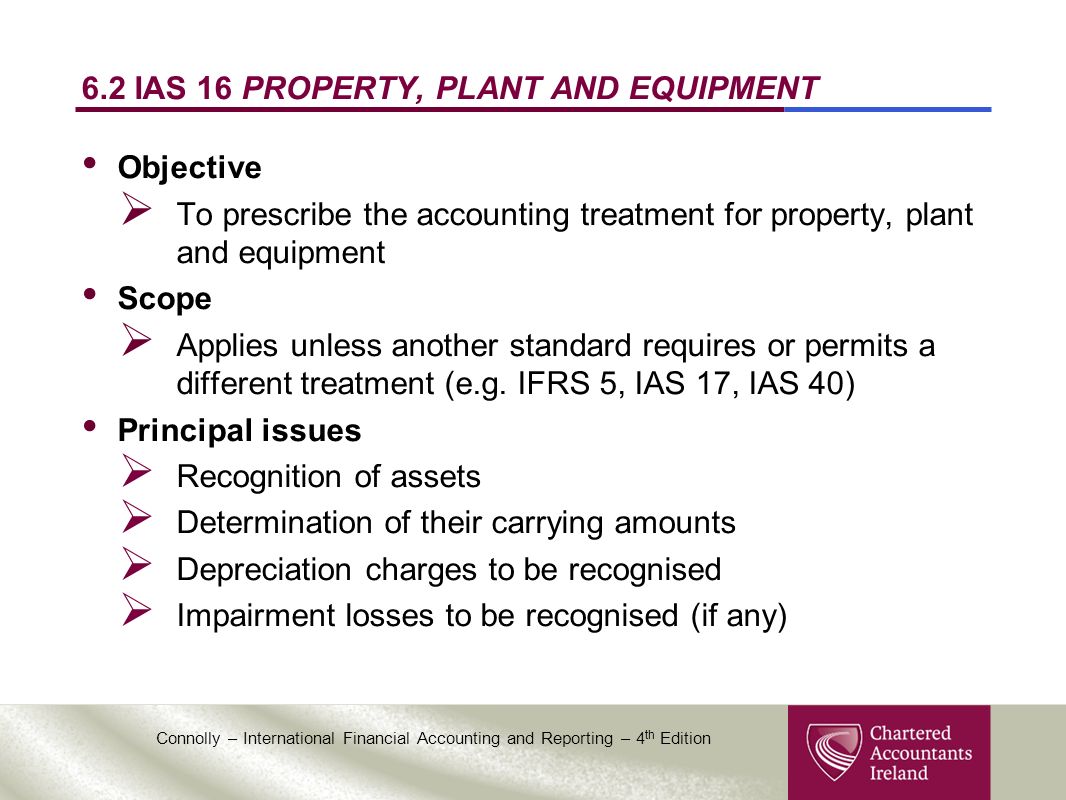

IAS 16 Property Plant and Equipment sets out the requirements for the recognition of the assets the determination of their carrying amounts and the depreciation charges and impairment losses in relation to them. This Standard deals with the accounting treatment of Property Plant Equipment including the guidance for the main issues related to the recognition measurement determination of carrying value depreciation charges any impairment loss and de-recognition aspects for the property plant equipment in the financial statements of an entity. The fundamental challenges while accounting for property plant and equipment include.

The main issues dealt in IAS 16 are recognition of property plant and equipment measurement at and after recognition impairment of property plant and equipment although IAS 36 deals with impairment in more detail and derecognition. Compensation from the third party for PPE impairment shall be included in PL when compensation is receivable. Property plant and equipment should initially be measured at its cost.

Key Terms accrue. The PPE asset exceeds its recoverable amount. The definition of the cost model is after recognition as an asset an item of property plant and equipment shall be carried at its cost less any accumulated depreciation and any accumulated impairment losses.

The manufacturing facility is. Assets book value exceeds the undiscounted sum of expected future cash flows. This might occur say if the asset was revalued upwards in accordance with IAS 16 Property Plant and Equipment in the past and theres a revaluation surplus to assign the current impairment against.

1 Recognition of property plant and equipment. Recoverable amount is higher of an assets fair value reduced by its selling cost and its utility. IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment.

Impaired because its book value exceeds undiscounted future cash flows. To increase to augment. Are held for use in the production or supply of goods or services for rental to others or for administrative purposes are expected to be used during more than one period IAS.

To arise or spring as a growth or result. According to IAS 16 this comprises. An item of property plant or equipment shall not be carried at more than recoverable amount.

IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment.

Https Www Aer Gov Au System Files Pn 201 20property 20plant 20and 20equipment Pdf

5 1 Part C Financial Statement 1 Tangible Non Current Assets 2 Intangible Assets 3 Impairment Of Assets 4 Inventory And Biological Assets 5 Financial Ppt Download

5 1 Part C Financial Statement 1 Tangible Non Current Assets 2 Intangible Assets 3 Impairment Of Assets 4 Inventory And Biological Assets 5 Financial Ppt Download

Property Plant And Equipment Ppt Video Online Download

Property Plant And Equipment Ppt Video Online Download

Impairment Of Tangible And Intangible Assets Cfa Level 1 Analystprep

Impairment Of Tangible And Intangible Assets Cfa Level 1 Analystprep

Financial Accounting Icab Chapter 5 Property Plant And Equipment

Financial Accounting Icab Chapter 5 Property Plant And Equipment

Property Plant And Equipment Ias Ppt Video Online Download

Property Plant And Equipment Ias Ppt Video Online Download

Ias 16 Property Plant Equipment Ppe

Ias 16 Property Plant Equipment Ppe

Pdf Concise Aspects Regarding The Accounting Treatment For Property Plant And Equipment In According With Ias 16

Pdf Concise Aspects Regarding The Accounting Treatment For Property Plant And Equipment In According With Ias 16

Questions And Answers Review Of Financial Accounting Theory And Practice Property Plant And Equip By Browsegrades Com Issuu

Questions And Answers Review Of Financial Accounting Theory And Practice Property Plant And Equip By Browsegrades Com Issuu

Http Uir Unisa Ac Za Bitstream Handle 10500 19405 Hemus C 086981950x Section3 Pdf Sequence 3 Isallowed Y

Property Plant And Equipment Accounting Definition Journal Entries Depreciation

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Property Plant And Equipment Net Financial Edge Training

Property Plant And Equipment Net Financial Edge Training

Chapter 5 Property Plant And Equipment Ias16 Ias23 Ias20 Ias40 Ppt Download

Chapter 5 Property Plant And Equipment Ias16 Ias23 Ias20 Ias40 Ppt Download

Ias 16 Property Plant And Equipment Ppt Download

Ias 16 Property Plant And Equipment Ppt Download

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Ppt Property Plant And Equiptment Ppe Powerpoint Presentation Free Download Id 5756873

Ppt Property Plant And Equiptment Ppe Powerpoint Presentation Free Download Id 5756873